Skift Take

The kind of curation the One Night app provides its users really does set it apart from other booking channels. The bigger question, though, is how many people actually know about it?

It’s been just a little more than a year since Standard International debuted its One Night same-day booking app for independent hotels and CEO and managing partner Amar Lalvani is more convinced than ever that the same-day booking model is one with staying power.

This, despite the fact that same-day booking pioneer HotelTonight recently announced its pivot to becoming more like a “Hotel Whenever,” as it opened its booking window to 100 days. “I think the premise for hotel companies is less valuable for HotelTonight now,” Lalvani told Skift.

The One Night app allows users to book a stay at more than 130 independent and boutique hotels in 11 cities beginning at 3 p.m. local time. Those hotels include such properties as all of The Standard Hotels, as well as the Gramercy Park Hotel in New York, the Thompson Chicago, and The Line in Los Angeles. Although Lalvani said the app was primarily designed for boutique, independent, and lifestyle hotels, a quick glance at the hotels listed on the app also found properties like the Rosewood London and The Langham, London, both of which are part of larger hotel companies.

The model One Night uses is commission-based, similar to how an online travel agency such as Expedia or Booking.com would have with their hotel partners, but the Standard, unlike most of those companies, will share guest information with its hotel partners.

“It’s essentially a commission, the same way an OTA would do, but we have a friendlier approach as it relates to what our commission is and how we structure the contracts,” Lalvani said.

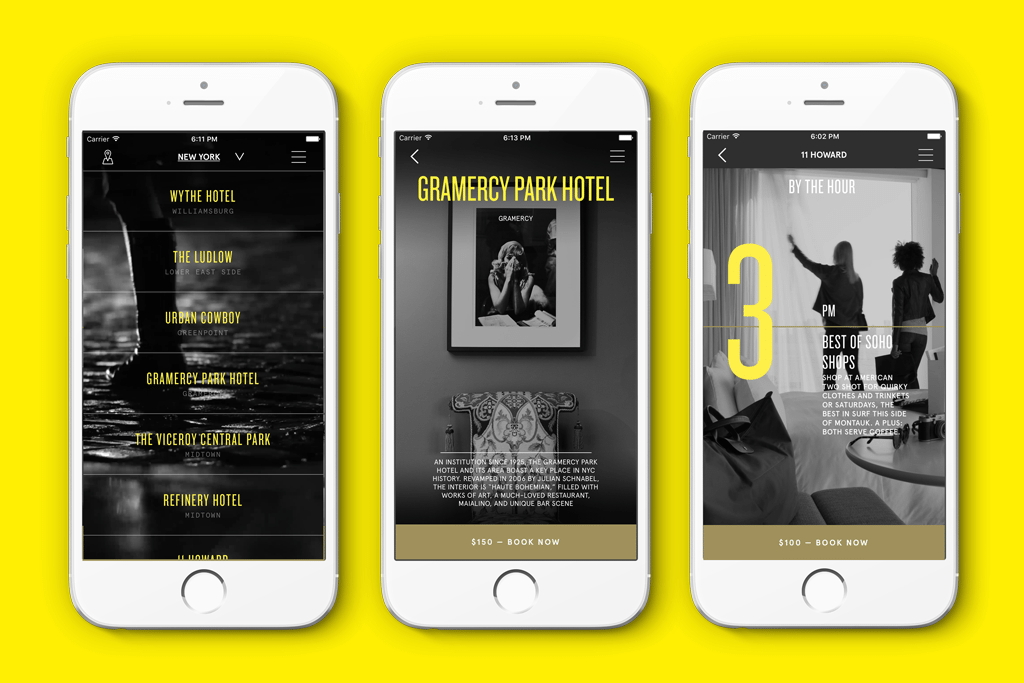

Lalvani said the company also pays close attention to curation — which hotel partners are allowed to be a part of the app — and includes additional experience-related, in-destination information on the One Night app for its users. The app also doesn’t make price a focal point.

“We also don’t rank hotels based on the price of the hotel,” he said. “In fact, we think that comes secondary to the experience of the hotel, so if you look at the home screen, it’s very different, again, from any other booking channels. In fact, on our home screen the price is hidden; it’s certainly available, but you know with One Night you’re automatically getting the best deal out there.”

He also said that from June to August of this year, sales on the app grew 152 percent, and average daily bookings grew by 331 percent. Downloads also grew 53 percent, and active users grew to 48 percent of downloads, representing a growth of 97 percent versus the prior period.

Standard Hotels would not disclose exactly how many downloads of the app have been made since its debut, or exactly how many users it has, or how many bookings have been made. However, given the fact that it has only been on the market for about a year, it’s likely that its user base is smaller than that of a competitor like HotelTonight.

A majority of users of the One Night app are locals — 65 percent, according to Lalvani — and of those who book Standard Hotels properties through the app, Lalvani said they are spending, on average, $55 per person on food-and-beverage-related experiences at their hotels.

Skift spoke to Lalvani about the company’s progress with the One Night app, which recently expanded its bookings to hotels in London, as well as the company’s larger plans for further growth and expansion.

What follows is an edited version of that conversation, which took place on October 5.

Skift: It’s been a year since One Night launched. Can you give us an update?

Amar Lalvani: It’s been a very exciting year for us at One Night. One year in, we’re about to launch our first international city, which is London, which obviously has all the dynamics that we look for in a 24/7, compelling, interesting city with a great stock of independent hotels that we have a great deal of respect for. So, it’s nice to mark the one-year anniversary with our first international opening.

Skift: Why pick London as the first international city to expand to and what other international destinations are on the horizon for One Night?

Lalvani: London is a natural extension for what we do. The first two markets we launched were New York and LA. The most crossover traffic of any international city we find in our hotels to both of those cities is London. So, it’s a very natural extension.

I would say we are as a team spending a lot of time in London as well, because we will be opening the Standard London about a year from now, and so we’re very familiar with the market. I would also say the dynamics of London are exciting for One Night because it’s a 24-hour city. People interact and behave on a very spontaneous basis because of the nightlife that exists there, because of the culture that exists there, because of the transportation in and out of London from people arriving at all times of the day into the airports, because of the Eurostar going back and forth. It’s got the dynamic lifestyle and social aspect, and it’s also got the travel patterns that make it conducive to what we would think about as a One Night city. It’s also got a great group of independent, boutique, lifestyle, fun, differentiated, experiential hotels, so there’s a good stock of hotels that we’d be proud to put on One Night.

I think from there, London will be the hub of the expansion of One Night. I think you can imagine the usual suspects. I think the obvious candidates coming out of London as a hub are places that resonate with that kind of lifestyle, whether it’s Paris or Berlin, or Amsterdam or Milan. I think you can imagine London being the hub and then the spokes out of that from a use perspective are quite logical — places that have the type of guests that appreciate these hotels and the types of guests that have the dynamic lifestyle that would use it.

Skift: What are your thoughts on HotelTonight’s pivot to “Hotel Whenever,” and would you ever do that with One Night?

Lalvani: Obviously, when people see what we do, their first thought is to compare us to HotelTonight. I think from the beginning we’ve been quite different in a couple ways.

One is we’ve been exclusively after 3 p.m., so while that may seem the same or similar even when they had a 24-hour booking window or a seven-day booking window, or now a 100-day booking window, we’ve always been after 3 p.m. [on the same day.] And the reason we did that, from a hotel partners’ perspective, is that after 3 p.m. there’s very little booking that happens on your direct channels, so it really is excess inventory. So, it was very important for us not to be cannibalizing the hotel direct booking channels, so we were very conscious of that, and we learned that through our own data. We’ve been very tight and focused on that.

I can say, definitively, we won’t move in that direction because our premise is to make sure that it relates to the spontaneity of travel, that it’s a new way of booking, that the immediacy is very, very important to us. Now I can’t speak, obviously, for HotelTonight, but I think from a hotel company’s perspective looking at it, the value of utilizing HotelTonight for the excess inventory does get diminished in some fashion because now it’s similar to the other OTAs.

Where they had a tighter premise, that really worked for the hotels. It’s diluted in some standpoint because it really does compete with other OTAs, it competes with their existing channels. As I say, since we’re formed out of a hotel company, so we’re very conscious of what works for hotels companies and brands on an incremental basis. That’s been a very important premise to us, and I don’t think we will deviate from that.

The second thing is that I think HotelTonight started with a premise of curation and certainly, there’s still some element of that, but we’re very fixated on that curation. It’s done by The Standard team and, this is no disrespect to hotels that I mentioned, but you know you may find yourself on HotelTonight next to a limited-service hotel of a more generic brand. We will not do that because it comes from The Standard, it comes from our philosophy that we will always maintain the tight curation and the tight time period.

I think the premise for hotel companies is less valuable for HotelTonight now. But that does not mean it’s a bad decision for HotelTonight, from a business perspective. It can certainly allow them to have more bookings and certainly allow them to grow. I know they’re venture-capital backed and that growth is important, but I think those are business reasons for them, which may be very valid, but I think the premise for a hotel company working with them has changed.

Skift: Do you think another online travel agency will want to acquire HotelTonight soon?

Lalvani: I don’t know. I obviously can’t say, but I’ve certainly seen, in the past, the OTAs being highly acquisitive, there’s no question about it. So, who knows if they will or not, but they’re big boys and they like to buy things.

Skift: It’s also been more than a year since the major hotel chains pushed out massive direct booking campaigns to incentivize consumers to book direct instead of booking on an Expedia or a Priceline. Where do you see the industry at right now in terms of what some people referred to as the “direct booking wars” last year?

Lalvani: I think what happened was, and this is sort of my commentary on the industry, but I think the hotel companies woke up after a period of slumber about this issue, and suddenly realized that the OTAs had grown bigger and they were a marketing partner and they offer a lot of value, but all of a sudden, they looked at it and said, “Wow, such a meaningful portion of my bookings are coming through OTAs,” and “Wow, these guys charge a lot for those commissions.”

And I think there was, in my view, the [fact that the] hotel business tends to move very slowly, and there was a collective wake up and they said, “We gotta do something about this.” And so you had a whole bunch of energy. “Oh my gosh, what happened? How do we do something about this?” And you saw everybody doing it.

Now when they first realized it became part of everything, that they had to talk about everything they had to do, now they’ve put in place strategies and they’ve put in place mission and ideas to do that, and now they’re in kind of implementation phase about that. But I think what you saw was this big energy of a wake up and a push back.

I think you also saw things going on with consolidation in the industry with Marriott buying Starwood, and InterContinental [Hotels Group] buying Kimpton, so I think, in those some of the consolidations, even Marriott-Starwood as you guys have written very well about, was in response to that wake up of how to pull back and push back on the OTAs in terms of their commission structures or the power that they generate. So I think that collective wake up in the industry is what you saw going back a couple of years, and now it’s kind of a fact of life — that you need to do your best to have your channels be the strongest.

I think you see a couple different reactions to it by hotel companies, some of which I think are a little, from my view, misguided. For example, if you book direct, you get certain benefits like free Wi-Fi. To me that’s a very negative marketing strategy because if you’re in the hotel and you happen not to book direct, why would you be offered a second-class experience? So, I think there are some odd marketing strategies that they’ve incurred. It’s almost like you get a slap on the wrist for not booking direct. So, I think it’s interesting to watch how certain companies react to that.

Our approach is obviously very different to that. One is continuing to ramp the experience within our hotels for everybody, making our hotels more intriguing and interesting every day from both an offline and an online perspective. If you look at what we do, there’s a culture that we’ve built, there are relationships that we’ve built, so it’s a very positive reason to be engaged with us and not go through a third-party channel, as opposed to a slap on the wrist for doing so.

And I think we’re the only company out there that said, “You know what? We should create a distribution platform for independent hotels, so let’s understand that model and let’s find a way to actually get into that business and do it on behalf of the independent hotels.”

Skift: As opposed to Room Key?

Lalvani: I would think that’s fair to say. Certainly, we’re the only independent company to have jumped into that space.

And I would say we also … I think [the major hotel companies that got together to form Room Key] did that in a very, sort of, defensive posture of how to take it back. I think we did [One Night] from a very proactive perch, trying to empower the independent hotels really to market themselves, to capitalize on excess inventory.

We’re offering a different product in terms of the curation and the after 3 p.m. booking window. This wasn’t to say, “We need to be an OTA to compete with them.” We said, “No, we need to build a product that is good for the hotels.”

Skift: How are you marketing One Night and are you assuring your hotel partners that they’re getting access to enough users?

Lalvani: I think they are happy with what they’re seeing for sure. And One Night is a startup, and it’s small. It’s incubated by Standard International, but what they like about it, I would say, is not that we’re screaming loud out there and trying to get people onto One Night, but that we’re supporting the marketing efforts that they have.

And so, again, to the point of not trying to compete with them, we’re actually just positioning them in a different way. If you look at our social media following with One Night, how it’s put together, we really feel like we’re augmenting their marketing as opposed to competing with their marketing. And I think to the standpoint of whether they think it’s worthwhile, I think the answer is absolutely yes because, not just because of how we market them, but of who and how people are using it.

Skift: When One Night launched, I asked you about the possibilities of developing the app into a potential platform for data sharing among independents, or for loyalty opportunities, or incorporating messaging or other sorts of mobile services. Have you been working on that and are those features sort on the horizon for One Night?

Lalvani: We’ve definitely been working on it and product development and evolution is going to be a big part of what we do. I think if you look at technology, and I think even if you look at probably things that you have on your phone, simplicity is very difficult to achieve, and so something that’s simply designed and beautiful, especially in a spontaneous area I think is very important. So, we’re very conscious of keeping the beauty and the simplicity of what we do.

We’ve had our hotel partners say, “Hey, can we do this, can we do that?” We’ve had guests say things like that. We are conscious of the simplicity of what we do, but I think going forward you will see some product enhancements.

Skift: A few years back, there was a lot of talk about rapid growth and expansion for Standard Hotels but, with the exception of the upcoming London hotel, there hasn’t been news of any new projects for a while. Are more hotels on the way?

Lalvani: There’s definitely more. You’ll be hearing more in the future, but I will tell you we are entering into a very, very exciting new phase for the company with a lot of really, really interesting projects that we have not announced yet. There will be some announcements in the future and you’ll start to see a lot more. But London is the next one on the way.

London’s going to be an absolutely fantastic hotel, a great representation for Standard and a perfect location for us, so that’s the one that, even if we haven’t formally announced iy, it’s gotten too much coverage and is a building that’s being renovated in too prominent an area to be ignored. So that’s coming. But I promise you you’ll see some really exciting new openings from us in the coming years.

Skift: Has anything changed much since André Balazs [founder and former chairman of Standard International] left the company as chairman in March?

Lalvani: No, you know, I would say a couple of things. I worked with André for a long time and the team that remains here has worked with André for a long time too, so there’s no question that he was the founder and visionary and we’re carrying on that legacy. But the reality is that for the last few years he hasn’t been actively involved day to day, so it’s been a very seamless transition. And so, we’ve got a great team, we’ve got great potential, a great future, but things have been running very well, and it’s a natural transition over the last several years that’s occurred.

Skift: Any other thoughts you’d like to share about where you see the hotel industry headed?

Lalvani: The hotel business moves very slowly and the customers tend to move faster than most hotel companies, and I think hotel operators, over the years, have drawn too many narrow distinctions about what their business is. “We’re a hotel company, we’re not good at restaurants.” “We’re a hotel company, we’re not good at running bars.” “We’re a hotel company, we don’t know what we’re doing in the world of music or fashion.”

We were early days on breaking down those barriers and I think what needs to happen is to realize that guests don’t have those barriers in their mind’ they’re just living their lives. Whether they want to go on a cooking tour or have a massage in their room, or go to a nightclub, or listen to music — whatever those things are — that’s what they’re thinking about. They’re not thinking about I want to go to this hotel to do that, I need to go somewhere else to do this, they don’t care who’s running it. They care about the lifestyle that they’re living and what they’re doing.

I think we woke up to that very early. I think the innovative companies like Airbnb understand that, and I think the bigger companies are playing catch up to that, but it’s really that they’re playing catch up to the customers’, the guests’ lifestyles, where we’ve always been integrated with how they’re living, and have always been bringing those experiences. And of course, with examples like the Trans-Pecos Festival [an annual festival Standard International’s Bunkhouse division helps host in Marfa, Texas], we need to get better and better at that, but I think that’s where the world is headed, only because that’s how people live their lives.

Have a confidential tip for Skift? Get in touch

Tags: direct booking, hoteltonight, standard, standard hotels

Photo credit: Amar Lalvani, CEO of Standard International, thinks the company's same-day hotel booking app has staying power. Standard International