Skift Take

Suddenly former Expedia CEO Dara Khosrowshahi walks away from substantial unvested compensation. Becoming CEO of Uber may have been a once in a lifetime opportunity for Khosrowshahi, but we expect that Uber had to compensate him for his treasure trove of unvested options to pry him away.

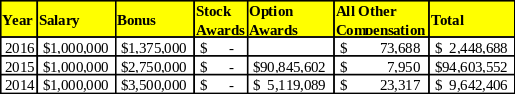

Like others, we can only speculate how much Uber is paying its new CEO. Looking at past salary, bonus, and stock compensation at Expedia helps shed light on what Dara Khosrowshahi may be looking at from Uber.

Khosrowshahi’s salary as Expedia CEO was $1 million per year for the past three years. Base salary would likely be comparable at Uber, but that is far less important than incentive compensation, including stock options. This would be the case for most CEOs at large companies, including Uber, which has a private valuation of nearly $70 billion.

What was left behind

The glaring number in the chart below is $90.8 million in options granted in 2015.

Source: Company Filings, Skift Estimates

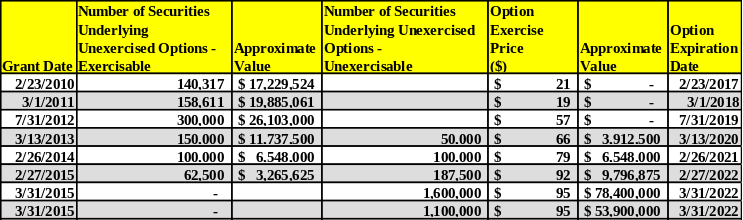

Within the 2015 option package, Khosrowshahi received the equivalent of 1.6 million shares that was to vest equally on two dates, March 31, 2018 and March 31, 2020. His second award was for 1.1 million shares. This would have vested in one tranche on September 30, 2020 if Expedia’s stock price hit $170; this is 18 percent above yesterday’s closing price and 50 percent above the 2016 year-end close.

Additionally, there are another 337,500 unvested underlying shares in previous awards.

Consensus seems to be that Khosrowshahi leaves behind something in the neighborhood of $160 million to $200 million in unvested compensation. Without busting out a Black-Scholes analysis or performing Monte Carlo simulations, we can see that even at the low end, simply assuming yesterday’s EXPE closing price of $144 without volatility and time considered, the options are worth more than $152 million. At a $170 level, these options would likely be worth more than $200 million.

Our simple approximation is done as follows:

(Underlying Securities * August 29 EXPE Closing Price) – (Underlying Securities * Option Strike Price)

We emphasize that this is not a true option valuation method where we would need to consider interest rates, volatility, and time, but is meant to give a rough sense of the options he leaves behind.

Source: Company Filings, Skift Estimates

What comes with Khosrowshahi

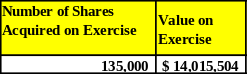

Filings show that Khosrowshahi has already exercised $14 million worth of his options. Additionally, he has 152,000 shares of exercisable (vested) stock that would roughly be worth around $85 million.

Source: Company Filings, Skift Estimates

What might uber be paying

To entice Khosrowshahi to leave a company he loved and helped build into a global leader in travel, we guess that the pay package has the potential to hit well over $200 million, with compensation heavily weighted toward incentive compensation. We believe that hiring Khosrowshahi was a smart choice for Uber, but he has a lot to clean up before the company can IPO at an acceptable valuation to its investors.

Impact on Expedia shareholders

If Expedia’s CEO was also its founder, there could have been an overhang for existing investors fearing that a large shareholder would immediately sell a large block of shares, placing downward pressure on the value of the stock. Because Barry Diller holds around 20 percent of shares and Liberty holds 16 percent (in addition to each owning all of the 12.8 million supervoting Class B shares) and Khosrowshahi only owning around 1 percent, there will not be a large liquidity event nor a change in voting control.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: dara khosrowshahi, expedia, uber

Photo credit: Dara Khosrowshahi at the Skift Global Forum 2016 in New York City. Skift