Skift Take

Messaging was once the darling of the travel industry and for some brands it still is. But video continues to be what many brands are focusing on and monetizing that trend is a priority for Facebook.

Travelers are watching more videos on mobile devices than ever before and Facebook is seizing that trend to help grow its business and introduce more mobile video ads into news feeds.

But its Facebook Messenger and WhatsApp platforms, while an important part of its business, won’t be one of the biggest drivers of the company’s growth during the next few years.

Rather, artificial intelligence, or machine-learning technology, will play an increasingly critical role on Facebook platforms and will also be key to making mobile video ads more relevant – eventually, said Facebook co-founder and CEO Mark Zuckerberg, speaking to investors and analysts on the company’s second quarter 2017 earnings call earlier this week.

Zuckerberg told analysts and investors this week that he’s seeing a shift in the way that brands market their products to consumers because of artificial intelligence. “Now you can put a creative message out there, and AI can help you figure out who will be most interested,” he said. “A lot of the time you don’t even need to target now because AI can do it more precisely and better than we can manually.”

Facebook’s second quarter revenue was $9.3 billion, up 45 percent year-over-year. Of that, second quarter ad revenue was $9.2 billion, up 47 percent year-over-year and mobile ad revenue accounted for $8 billion of the total ad revenue, up 53 percent year-over-year.

Desktop ad revenue grew 17 percent despite an ongoing decline in desktop usage on Facebook and also benefited from efforts to limit the impact of ad blocking technologies, said CFO David M. Wehner, also speaking during the call.

The average price per ad increased 24 percent year-over-year on Facebook and Instagram in the second quarter and the number of ad impressions increased 19 percent, primarily driven by mobile feed ads on Facebook and Instagram, said Wehner.

Facebook had five million advertisers using the Facebook platform and one million using Instagram at the end of the second quarter, said COO Sheryl Sandberg during the July 26 call.

Travel brands, particularly hotels and tourism boards, have been saturating many travelers’ Facebook and Instagram news feeds with ads during the past year.

Sandberg mentioned Delta Air Lines’ Dynamic Ads during the call as an example of how native mobile ads are outperforming more traditional ads.

Delta is one of the first airlines to use Facebook’s new Dynamic Ads for airlines, which rolled out in April. Last year, Facebook launched Dynamic Ads for Travel, which target travelers with ads and creative content based on browsing history and was initially geared towards hospitality brands.

Sandberg said Delta ran Dynamic Ads based on the routes people viewed on its site and they linked to Delta’s booking page. The airline had a 12.7 times return on ad spend, said Sandberg.

But beyond Dynamic Ads, Facebook and investors are working on ads for Instagram Stories, or video stories a few seconds long that disappear after a certain timeframe and quickly became one of Instagram’s most popular features when it rolled out last year.

While it’s still early for Instagram Stories ads and Facebook hasn’t seen many examples of brands in and outside the travel industry using them, the company sees a lot of potential in this ad format.

Many brands are likely aware of Instagram Stories ads, said Sandberg. “We also have a huge opportunity within Instagram,” she said. “And obviously, the use of ads in Instagram is much, much bigger than the use of ads in Stories.”

During the company’s fourth quarter 2016 earnings call in February, Zuckerberg also said that Instagram advertising looks promising in 2017.

Growing Mobile Video

As Facebook becomes more bullish on its mobile ad growth Wehner said that ad load – the ratio of ads to organic posts in news feeds – won’t be a significant factor in driving ad revenue growth in the future.

Desktop ad revenue growth rates will slow in the second half of 2017 when Facebook begins to ramp up efforts to limit the impact of ad blockers, said Wehner.

“In addition, we expect that our strategic focus on driving engagement with mobile video may slow advertising impression growth, given the relatively fewer ad impressions in video relative to News Feed,” said Wehner. “I would also note that we do not see our early efforts in Messenger monetization offsetting the factors that I just mentioned.”

In recent months Facebook has also rolled out Ad Breaks, or ads that play in between videos in the Facebook mobile news feed, which the company views as one of the next steps to attract more advertisers to its platform.

Wehner said Facebook is still in beta with Ad Breaks and is currently testing the ability to put short Ad Breaks in uploaded videos. “We do it if a video is longer than 90 seconds or live videos are longer than four minutes,” he said. “We’re just in the process right now of expanding to more publishers in the United States, so it’s really early.”

Facebook is keen to show that these and other ads lead travelers to make purchases but it isn’t rushing anything, said Wehner. “And obviously, we care that people view the ads, but the most important thing is tying those ads impressions, even if they’re short views, all the way through to that same purchase data that we keep talking about,” he said.

“And so as we work on rolling out more Ad Breaks, and we are rolling out slowly, we’re really focused on finding ways to help marketers measure the right things, and that’s a very important focus for the company going forward,” said Wehner.

Slow-Going With Messenger

Facebook views messaging as a long-term investment that will take years to monetize effectively, said Wehner and Zuckerberg during the call.

Skift reported earlier this year that travel brands are still learning how to communicate with consumers on messaging platforms and many haven’t struck the right tone or balance or haven’t learned what consumers want from these platforms.

Wehner said that monetizing messaging has been deliberately slow but Facebook Messenger is further along in that process than WhatsApp.

Sandberg also said the company has a lot of work to do with its messaging platforms. “This is not a feed-based product, and this is a messaging product,” she said. “So it’s a different consumer format, and we believe that the ad format should follow the consumer format, so it’s really integrated as part of the experience. And that’s where we have a lot of work to do.”

Facebook realizes that the messaging experience is often perceived by consumers as more intimate and the company doesn’t want to diminish the messaging experience with too many ads, for example.

Mobile video ads in news feeds, however, seem like a more natural fit with consumer behavior and how they view content. “I actually think over the next couple of years or few years, the much bigger driver of the business and determinant of how we do is going to be video, not Messenger,” said Zuckerberg.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: advertising, earnings, facebook, instagram

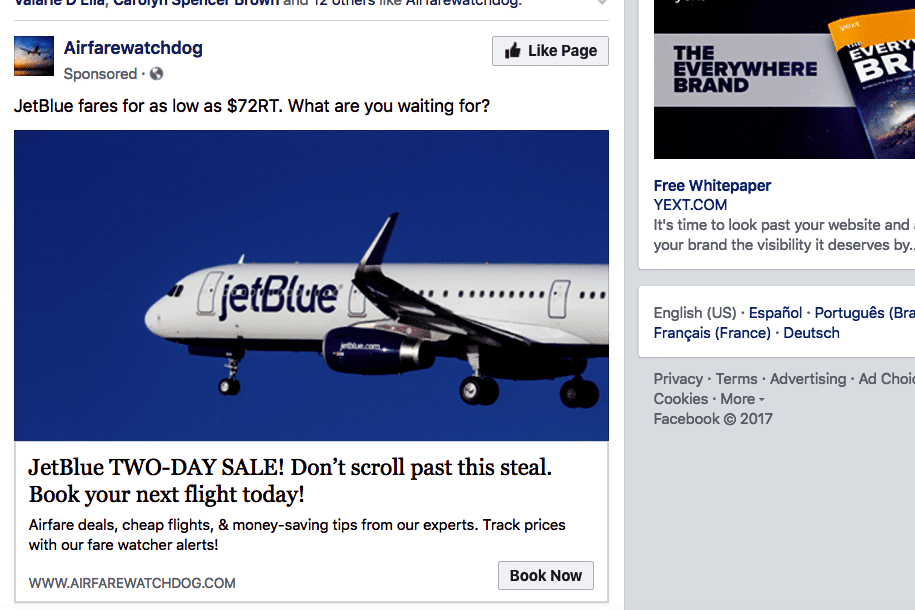

Photo credit: An Airfarewatchdog advertisement in a Facebook news feed touting a JetBlue fare sale. Facebook