Skift Take

Where online travel agencies make it easy for guests to book hotel rooms from their smartphones, hotels need to do a much better job if they want more direct bookings. And they need to make better apps while they're at it.

J.D. Power and Associates has released its annual North America Hotel Guest Satisfaction Index Study and the biggest takeaway for hoteliers is this: pay more attention to mobile. Hotels that incorporate mobile apps and functionality into a hotel stay have higher guest satisfaction. And they are more likely to increase their number of direct bookings if they focus on mobile.

The catch, however, is that hotels also need to encourage more guests to download their mobile apps, as well as add more loyalty members to their respective programs.

“As mobile usage becomes increasingly ubiquitous for guests, the challenge for hotels becomes twofold: First, they must persuade guests to book directly with them, and second, they must encourage easy utilization of this technology,” Rick Garlick, practice lead, travel and hospitality at J.D. Power said. “By forging direct relationships, hotels can become guardians of the guest experience, but at the center of these relationships is an establishment’s mobile strategy.”

The study collected the responses of 63,866 adult hotel guests who stayed at a hotel between May 2016 and May 2017 and was conducted via an online survey.

Some key takeaways for hoteliers:

J.D. Power found that guests who’ve booked through an online travel agency or a mobile app not directly associated with the hotel are more likely to experience a problem, and to be less satisfied with their stay.

However, the number of consumers booking through an online travel agency (19 percent in 2017 versus 16 percent in 2013) is rising, despite major hotel chains’ efforts to push more direct bookings with large campaigns and discounted rates for loyalty members.

And the number of guests booking a hotel room using a smartphone or tablet is also rising. In 2014, 14 percent of online reservations were made on mobile; now it’s 25 percent and the majority of those booking via mobile tend to be younger or business travelers.

Hotel loyalty members were more likely to book direct with a hotel or on a loyalty member site than non-members (75 percent to 47 percent), and they also have higher levels of guest satisfaction.

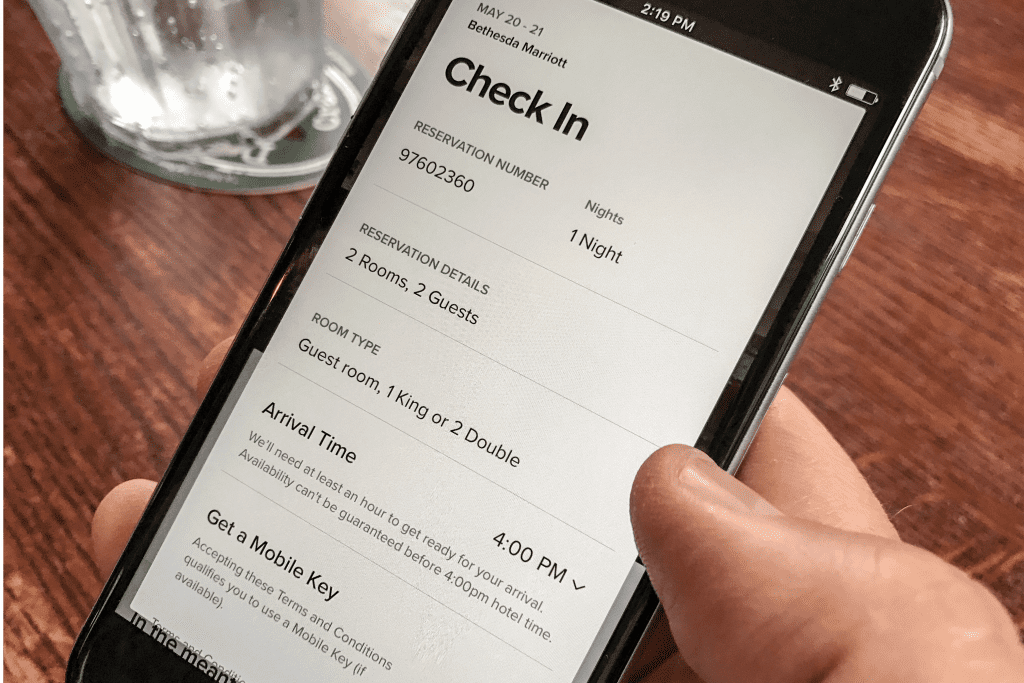

Although hotels have made efforts to invest in their own proprietary mobile apps, the J.D. Power survey found that a significant number of guests (38 percent) don’t even use the apps during their hotel stays, which seems to suggest there could be room for improvement in how hotels develop their mobile apps. Only 4 percent have used those apps to check in and only 1 percent have used them to check out.

Many hotels are experimenting with adding messaging functionality to their proprietary apps in an effort to make the apps more useful and functional for their guests. Some hotel companies, including Marriott and Hilton, are also developing their apps in ways that allow them to gather more personalized information on their guests that can be used to customize their stays.

When guests do use the hotels’ mobile apps, however, they reported higher guest satisfaction and were more loyal. Only 19 percent of all guest respondents have downloaded a hotel app, but 70 percent of rewards members have downloaded a hotel’s mobile app.

Social media isn’t just a channel through which guests will complain about their experiences, but if a guest does experience a problem during his or her stay, 86 percent are extremely likely to post to social media.

Facebook’s head of travel, Christine Warner, told Skift that hotel companies, especially, can’t afford to miss out on the marketing opportunities afforded via mobile platforms as well, especially social media.

Guest who read and/or write hotel reviews on sites like TripAdvisor are also more likely to have higher guest satisfaction, but only slightly more than half (52 percent) have read a review of a hotel, industry news, or an online forum in the past month. And only 46 percent of respondents had written a review in the past six months.

Guest Satisfaction Rankings

To measure guest satisfaction on a 1,000-point scale, J.D. Power looked at eight different hotel segments: luxury; upper upscale; upscale; upper midscale; midscale; economy; upper extended stay; and extended stay. Factors that determined satisfaction included reservation; check-in/check-out; guest room; food & beverage; hotel services; hotel facilities; and cost & fees.

“While The Ritz-Carlton and JW Marriott rank highest in the luxury segment, both of these Marriott-affiliated brands appeal to different types of customers,” Garlick said. “It’s important to remember that this study measures guest satisfaction among a hotel brand’s own customers and doesn’t directly compare hotel brands to one another. Often, the type of guest becomes an important element in determining satisfaction rankings.”

The following hotel brands ranked highest in guest satisfaction in their respective segments:

- Luxury: JW Marriott and The Ritz-Carlton (tied; Ritz-Carlton ranked highest for the third consecutive year)

- Upper Upscale: Hyatt

- Upscale: Hilton Garden Inn (for a second consecutive year)

- Upper Midscale: Drury Hotels (for a 12th consecutive year)

- Midscale: Wingate by Wyndham (for a third consecutive year)

- Economy: Americas Best Value Inn

- Upper Extended Stay: Staybridge Suites

- Extended Stay: Candlewood Suites

Have a confidential tip for Skift? Get in touch

Tags: jd power, mobile, mobile apps, mobile booking

Photo credit: The newest J.D. Power and Associates study on hotel guest satisfaction in North America suggests hotels should be paying more attention to mobile apps, bookings, marketing, and loyalty. Pictured is Marriott's app on iOS. Skift