Skift Take

In Mexico, Latin America's largest hotel market is expected to keep on growing, thanks in part to the country being boosted by the U.S. economy.

Last week we launched the latest report in our Skift Trends Reports service, A Strategic Deep Dive Into Latin America’s 20 Largest Hotel Chains.

Below is an excerpt from our Skift Trends Report. Get the full report here to stay ahead of this trend.

The report is a comprehensive look at both markets in Latin America and the hotel brands that are investing in new and existing properties from Mexico south to Chile. The report highlights the 20 largest brands operating in the region, from AccorHotels at the top by number of rooms (47,000) to smaller yet still quite large brands including Spain’s NH Hotel Group and Bahia Principe (both at 10,000 rooms).

Preview and Buy the Full Report

Among Latin American countries, Mexico leads its peers as the largest hotel market in terms of inventory, beating out Brazil. Much of the demand comes from international visitors but the country’s domestic travel market has also begun to pick up steam in recent years.

The overall economy relies heavily on trade ties with the U.S., hence the relative health of the U.S. economy has helped Mexico weather an otherwise unfavorable global landscape for oil producing nations. Foreign investment continues to flow into Mexico’s industrial base particularly in advanced manufacturing, as wages in China have edged upward.

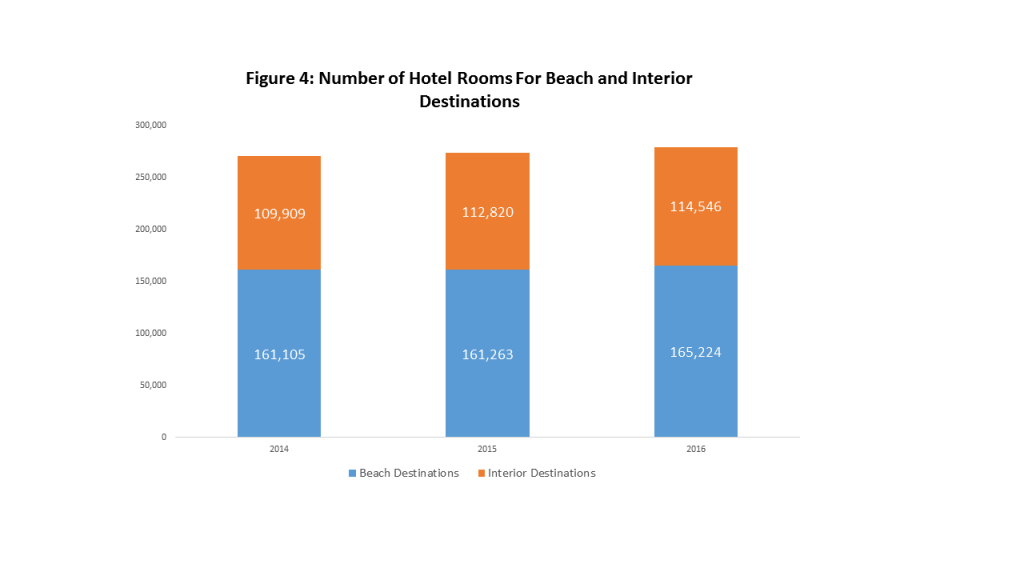

These and other factors have led to a more favorable climate for hotel operators and mainstream beach destinations, but also the cities and zones within the heart of Mexico. About 40% of Mexico’s total hotel inventory is located in non-beach destinations.

Certain industrial hubs in Mexico have grown their hotel room inventory by as much as 20 percent since 2014, as economic activity in sectors such as automotive manufacturing and knowledge services outsourcing continue to gain momentum.

Data show that places like Puebla, Queretaro, and Villahermosa – cities at the heart of the Mexican industry – have expanded in room size by 20 percent in some cases. Looking beyond the maturing and intensely competitive beach resort market, global chains are keeping a close eye on these hubs as Mexican industry, particularly the automotive sector, shows signs of strength.

Pent-up demand, improved connectivity and tourism product, are expected to drive record visitation, particularly in established destinations such as Cancun and Riviera Maya. Interior city hotel supply has also expanded in certain secondary cities such as Puebla and Queretaro.

Preview and Buy the Full Report

Subscribe now to Skift Trends Reports

This is the latest in a series of twice-monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Have a confidential tip for Skift? Get in touch

Tags: hotels, latin america

Photo credit: The lobby of the Courtyard Marriott in Mexico City. Mexico is Marriott's largest market in Latin America and Courtyard is its most populous brand. Marriott International