Skift Take

What would you pay for extra legroom? Seriously. Be Honest. Airlines are standing by to take your calls.

How much would it cost to get an extra inch of legroom and an extra degree of recline?

@designerjet Has anyone ever costed how a comfortable flight would cost? eg with hypothesis of 2 extra inches at knee or 1° extra recline?

— Amelie A Gagnon (@AmelieAGagnon) December 29, 2015

Good question.

We couldn’t write the math equation, let alone fit the answer in 140 characters. Even the controversial ten thousand character limit might not be enough, but we decided to try.

First, let’s look at the costs to airlines of that extra room.

Show Me the Money

Before we can understand the cost of space for airlines, we have to ask: Are they making the right kind of money on the space they have now? Even profitable airlines, could be flying unprofitable cabins.

They make up the difference with ancillaries, extras, low fuel, consolidation, favorable labor contracts, efficient aircraft, strong network partnerships, and other ways. Basically, there is lots of padding.

Think of that padded revenue as a delicious soufflé, which, when, a cold wind blows, becomes a sub-par pancake. Revenue buffers can change overnight. Cabins do not.

Airlines are transport businesses. Like hotels, airlines are also in the real estate business. Except their real estate flies. To make money, every square foot of that real estate has to return the right kind of revenue. You’ve got to have the right product mix.

Full-service airlines can make a quick buck with discounted Economy revenue to pump-up load factors, but the big money is in Premium real estate. Stable money is in a proper balance between the front and the back.

Airlines face the added burden of regulated, high-cost products. Each element of airlines’ “rooms” must be certified and approved. It’s time consuming and expensive and once an aircraft’s interior is finished it flies, while changes mean grounding aircraft. Nobody wants that.

In aviation, hardware is forever—even if forever only lasts 10 years. If the market suddenly changes, getting the cabin mix wrong can be catastrophic and to win the long-game, you need to earn the highest possible sustainable revenue, per square foot.

The Concept

For purposes of this exercise, we present a concept for Fantastic Air’s 777-300s cabin review.

The Fantastic Air concept considers various cabin mix options for revenue balance. Optimal interiors balance the product range with real load factors (percentage of seats sold) and market fares. They protect an airline’s revenues during sudden market fluctuations, and recover top dollar from every inch of cabin real estate when times are good.

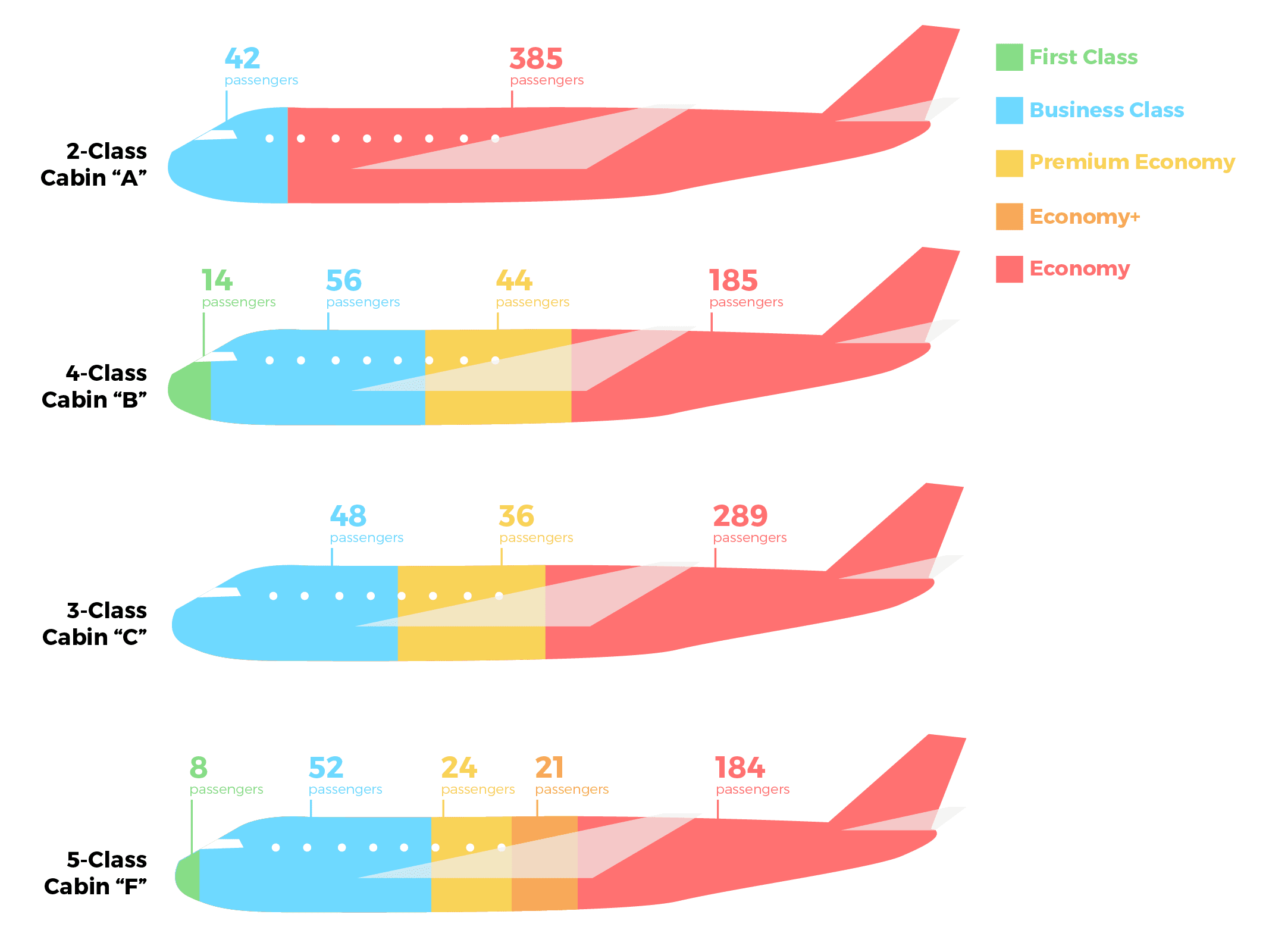

We look at eight alternate configurations, modeled on 777-300 aircraft flying today.

- One 2-Class (Business/Economy) option

- Four 3-Class configurations

- Two 4-Class configurations

- One 5-Class configuration

We use traditional cabin Class labels. Airlines call their cabins all sorts of things, but we wanted to compare like-to-like.

- First class gets space-friendly suites.

- Business class features lay-flat beds.

- Premium Economy is separate with recliner chair seats.

- Economy+ is just like Economy, but with 6″ extra legroom.

- Economy seating is 9-across.

We could fit more passengers in the same area, with 3D design and slimline seats, but our product cabin footprint compares to popular seat models in the market.

Fare Measures and Filling Seats

We use fixed fares for like-to-like comparison, with market-based fare differentials for each class.

- Economy $1,100

- Economy+ $1,300

- Premium Economy $2,500

- Business $4,500

- First $9,000

These are markers, based on median fares in the North Atlantic Market—the highest volume and most competitive routes.

Fantastic Air fares don’t reflect dynamic pricing. Sophisticated revenue management programs, used by airlines, handle a mix of fares in the same cabin class to optimize revenue. We didn’t because there’s a reason that software costs a bundle. Fantastic Air doesn’t have the budget for it.

We used four load factor (seats sold) scenarios.

Theoretical (100%): Airlines can’t sell 100% of seats on every flight. But, by comparing full occupancy to variable load-factors, we get a better look at how dramatically revenue shifts for each cabin lay-out.

Break Even (61.7%): Recent global break-even as reported by IATA. At break-even, airlines cover the cost operations, but don’t make a profit.

Market Average (80.6%): Recent global market average reported by IATA. A fair (not exact) view of today’s market conditions.

Hybrid: In real life, some cabins have higher demand than others. The problem is guessing what variable load factors to plug in for Fantastic Air. It’s a very changeable dynamic. We didn’t guess blindly. We used figures from the filings of airlines which are doing well financially.

To the original question: It’s not how much extra legroom and recline costs, but how it affects overall airline revenue that matters.

Fantastic Air charges $200 for extra legroom Economy+ over a $1,100 base fare. That’s an 18% fare differential. It makes Fantastic Air a quick buck because it’s relatively affordable. It’s a nice way for our customers to get better cabin conditions. But does that quick buck help us or hurt us in the long-game? Will that differential cover the real costs and opportunity costs of that space?

Readers might ask why the total number of passengers can vary so much (from 289 passengers to 427 passengers) on the same plane. That’s seat cabin footprint for you! The size of seats, galleys, cabin divides, toilets. It all takes up room. Design matters.

So what works best for Fantastic Air? Let’s see.

All Onboard: 100%

The 4-class (First Class, Business Class, Premium Economy, and Economy) cabin scenario “B” wins on revenue: $691,500. It carries a total of 299 passengers, of which 114 passengers (38%) are paying premium fares ($488,000 premium revenue).

This “B” cabin also delivers $2,313 average revenue per passenger (PAX). That’s an important factor to offset administrative costs and the care and maintenance of passengers onboard: food, drink, crew, etc.

If our traffic needs can support a 299 passenger flight, it’s the winner.

Getting By: 61.7%

At break-even, the 4-class “B” cabin wins again. Total revenue ($426,656), per PAX revenue ($2,306).

Notice how important Premium fares become at break-even ($301,096). If variable Economy leisure demand slumps, we’ll need those flyers at the front.

Flying Steady: 80.6%

Cabin class “B” wins again (Total Revenue: $557,349, Premium Revenue $393,328). Notice that $88,660 of premium revenue (16%) comes from persuading productivity Economy flyers to pay reasonably priced Premium Economy fares.

We also get a healthy per PAX revenue of $2,322. Nice.

Different Strokes: First, Business, Premium Economy 57%, Economy+ 36%, Economy 84%

Surprise! 2-class “A” (Business/Economy) cabin takes the lead with total revenue of $556,794. But that per PAX revenue ($1,146) is dismal. If Fantastic Air flies out of major connecting hubs, and Economy class demand is known to be high, this cabin could work. Makes sense that some ultra-long haul airlines have switched to 2-class aircraft on select destinations.

But 4-class “B” (Total Revenue $449,100) performs better per PAX: $2,041. With generally lower Economy demand, it’s a good option.

There’s an extra advantage to good Premium mix and per PAX revenue: We can lower Economy to loss-leader fares (for a limited time) to beat competitors without breaking the bank.

Decision Time

Which cabin mix works for Fantastic Air’s 777-300?

It depends on competition and route, but we’d go for a 4-class “B” or even a 5-class “F” cabin in some circumstances. But the 4-class “B” performs best under pressure and during good times we’d see even higher revenue from more premium seats.

We’d consider 5-class “F” which delivers reasonable total revenue and healthy per PAX revenue in most cases. It also makes us look kind to customers. The problem is that 36% occupancy in Economy+, which we didn’t just make up (remember, we used some real-world stats to get these numbers). Maybe passengers don’t appreciate the product difference enough to pay 18% more.

If we did have some Economy+ seats, it would be to win brownie points with weary passengers, and we could also put our loyalty upgrade passengers in there — they like the Premium cabins. But let’s not get carried away because we’d much rather see revenue from those seats. Mileage revenue counts.

We can also sell last-minute seats forward. As the reality of a long flight in a cramped cabin gets closer, customers might not mind the fare differential. By selling differential separately, we get some customers past their booking-time sticker shock. Some real airlines do that. It’s the type of up-selling we can get behind.

We believe growing the middle class will result in a more attractive bottom line than a discount heavy tail. Reasonably priced, markedly better, it attracts a choice group productivity and leisure customers—who would otherwise be Economy passengers—by offering just what they want, need, and can afford.

The fare differential is high enough to buffer us against sudden or cyclical market fluctuations.

The Final Cost

Airlines have priced extra legroom seats (6″) around 18% over the basic Economy fare.

That’s $100 per knee, $33 per inch, or $13.33 per degree of recline (based on 15º) on Fantastic Air.

But each time we grow the pitch (seat separation), we risk removing a row of Economy passengers, or reducing Premium cabins. Go too far, you lose more than 18% in revenue.

If the 36% load factor for Economy+ seats is anything to go by, passengers don’t value extra room as much as low fares.

We’d be weary, and feel safer with a solid front, ample middle, and optimized Economy—which is why real airlines do too.

How’d we do, Twitter?

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: aircraft interiors

Photo credit: Japan Airlines' Premium Economy Seat reclines forward, to avoid conflicts in the back. Japan Air Lines