Skift Take

With American and Delta increasingly matching Spirit's low fares, Southwest will find it difficult to maintain any low-fare advantage that it still has. Still, Southwest has a lot going for it and its growth opportunities both within the U.S. and internationally are abundant.

When it comes to competing against the likes of Spirit and Frontier, is 48-year-old Southwest Airlines like the middle-aged guy who can longer fit into his college jeans?

A financial analyst asked Southwest CEO Gary Kelly precisely that question during a presentation at The Wings Club in Manhattan December 10.

After quipping that the analyst was getting “personal,” Kelly acknowledged that airline bankruptcies (Delta, United and American) and startup competition (Spirit, Frontier and Allegiant) have narrowed Southwest’s traditional cost advantage.

Kelly conceded that Southwest is no longer the carrier with the lowest fares, although it is “close.”

“It is different for us [now] and we need to recognize that,” Kelly said.

Only one airline — presumably Spirit — has a lower cost structure than Southwest’s, Kelly said.

Southwest’s goal is to be the airline with the lowest fares and best service globally, Kelly said, although he acknowledged that this goal is aspirational rather than necessarily being a realistic agenda item.

On the cost side, Southwest’s primary goal is fleet modernization, Kelly said, adding that the airline will have to be creative and imaginative in the future to attain its goals.

Southwest can’t compete on price alone, Kelly said, although “we will do best if we are the lowest price.”

That is becoming increasingly difficult as Kelly pointed to heavier-than-usual discounting by larger airlines in November which prompted Southwest to lower its forecast for revenue per available seat mile in the fourth quarter.

Most of the growth in the U.S. aviation market has been coming from low prices — and not just from the competition but from Southwest’s low fares, too, Kelly said.

Short-haul markets have been really harmed over the last 15 years, Kelly said, pointing to the Dallas-Houston route, which today has about half the airline-passenger traffic than it did in 2000.

Kelly thinks expansion in short-haul markets can be a key growth opportunity for Southwest.

The Southwest CEO mentioned that when several IT projects are finished in the next three to five years, then the airline will have the capability to introduce assigned seating, sell extra legroom and launch a dual-class cabin, although he said Southwest won’t necessarily make these changes.

However, Kelly was adamant about one thing: Southwest doesn’t intend to “nickel and dime” its passengers and won’t levy new checked bag or change fees.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: southwest airlines, spirit airlines

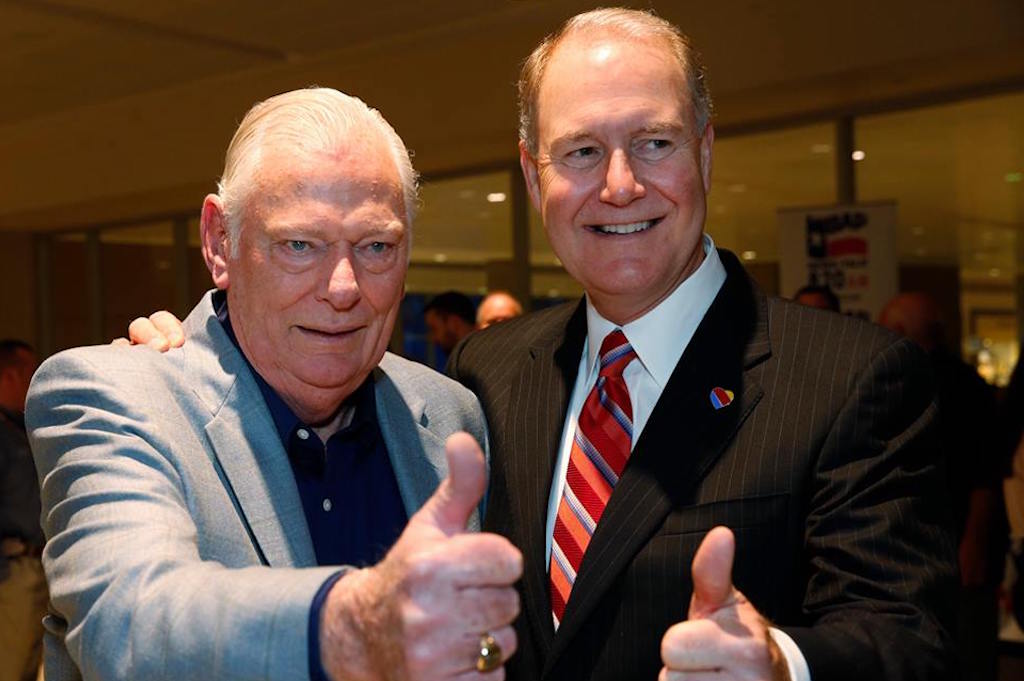

Photo credit: Southwest founder Herb Kelleher (left) and CEO Gary Kelly in March 2015. Southwest Airlines