Skift Take

The websites that have the most comprehensive set of lodging choices, whether they are hotels, vacation rentals, apartments or igloos, will dominate. Expedia, through its HomeAway acquisition and intent to develop apartment rentals in cities, knows this and is getting ready for the future of travel in lodging.

The online accommodations business will undoubtedly be transformed over the next few years and Expedia CFO Mark Okerstrom said his company should take seriously the prospect that Airbnb might enter the hotel-booking business.

“So I think it’s a threat that we look at it,” Okerstrom said, referring to the possibility that Airbnb could evolve into a distribution platform for hotels. “We should take it seriously and I think that at the same time we look what Airbnb is doing and we look at that as a potentially attractive opportunity for us.”

Speaking at the Credit Suisse Technology, Media and Telecom Conference in Phoenix December 1, Okerstrom said, however, that Airbnb wouldn’t find entering the hotel-booking arena an easy thing to do — especially since Airbnb would have to face competition from established players such as Expedia and Booking.com.

“… I think the issue is that the hotel business is a very different business than renting out primary homes for the weekend,” Okerstrom said. “The industry structure is different. The business practices of the existing hoteliers are different. Connectivity is built between the OTAs already and the hotels there are established relationships and patterns of behavior and though I think that it’s certainly open for Airbnb to try to enter the hotel market. I think they are entering the market that has a couple of very large and established players who have a pretty amazing consumer value proposition and a pretty amazing supplier value proposition. And I think that like many before them have found, it’s not as easy as coming up with a website, it’s different.”

Okerstrom’s latter comment about entering the hotel business not being “as easy as coming up with a website,” might have been a reference to Amazon, which abruptly exited its fledgling hotel-booking business without much explanation in October.

Business and Revenue Models Will Be Mixed

Looking into his crystal ball about the future of alternative lodging revenue models, Okerstrom predicted that when sites such as HomeAway or Airbnb have unique inventory they might be able to charge consumers a booking fee but when they are handling standard rental units from professional managers, for example, that consumer booking fee may be difficult to sustain.

Airbnb currently charges guests a booking fee, HomeAway plans on introducing one next year, and Booking.com officials are adamant that they won’t charge travelers a fee.

“… There are situations such as the big professionally managed multi-unit properties, the type of stuff that where you’ll see on, for example, Booking.com, and in that case the model has generally been the supplier will pay and I think in their case its 15% commission,” Okerstrom said. “I suspect if we look forward five years from now and we think about what the industry is going to look like what HomeAway will look like. I actually expect there will be a hybrid of different monetization models depending on what type property [it] is, whether it’s unique, whether it’s professionally managed.”

“And we’re not exactly sure what that mix will be but we do know a couple of things. One is that this is a highly fragmented, high-value marketplace and in the travel industry where those conditions generally exist, intermediaries can absolutely charge 10% to 20% margins. Where they come from we don’t know. But the second thing we do know is that we are very good at testing. And it’s in our DNA. And we can help HomeAway test their way into the right outcome.”

Returning to the issue of whether alternative lodging will become a threat to Expedia’s core hotel business, Okerstrom feels like Expedia now has an insurance policy.

Said Okerstrom: “I think also to the extent that, that Airbnb type inventory becomes a true substitute for the mainstream lodging product, I think, for us the HomeAway acquisition provides not only a perfect hedge, but a perfect opportunity to actually go after that new market.”

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, booking.com, expedia, homeaway

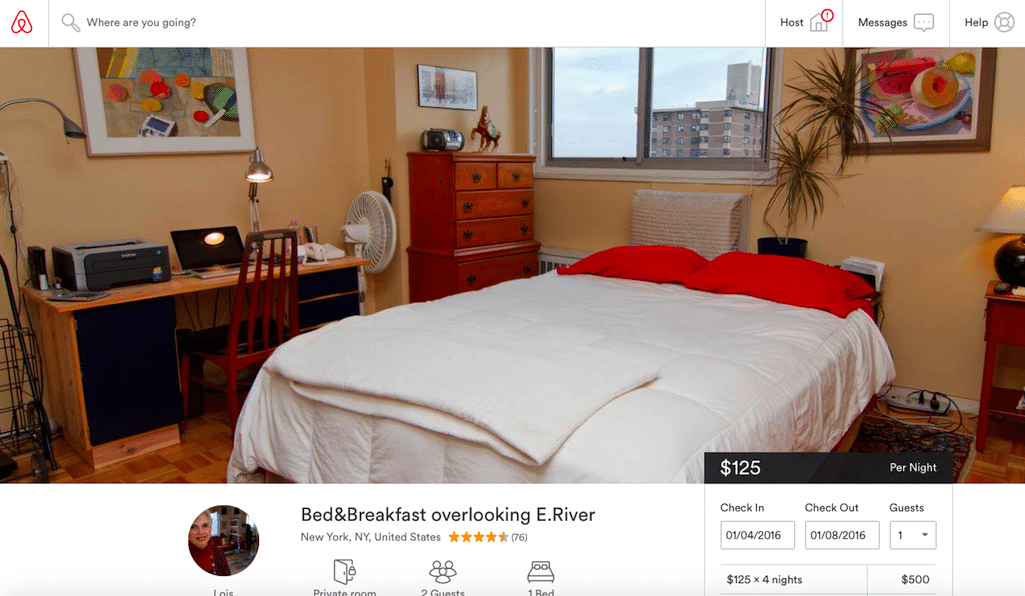

Photo credit: A bed and breakfast in New York City for rent on Airbnb. Airbnb