Skift Take

The antitrust prospects of Expedia Inc.'s $1.6 billion acquisition of Orbitz Worldwide hinge on which prism competition authorities choose to view the deal. Expedia would have a 75 percent share of the U.S. online travel agency market but consumers have plenty of other ways to book their trips, too.

If antitrust or other legal complications block Expedia Inc.’s acquisition of Orbitz Worldwide, Expedia would have to pay Orbitz a $115 million termination fee.

That detail emerged as Expedia Inc. filed a copy of the merger agreement with the Securities and Exchange Commission.

On the other hand, if Orbitz Worldwide were to accept a proposal superior to Expedia Inc.’s $12 per share, or $1.6 billion cash offer, then Orbitz would have to pay Expedia a $57.5 million termination fee. Orbitz Worldwide is prohibited from soliciting such an offer, but is free to accept one.

In a research note today, UBS pointed out that it is unlikely that a new bid for Orbitz would emerge because Expedia characterized the run-up to the acquisition as a “competitive process,” meaning bids were already solicited, if not submitted.

The potential Expedia payment to Orbitz over potential antitrust complications is notable because the deal will raise competition issues.

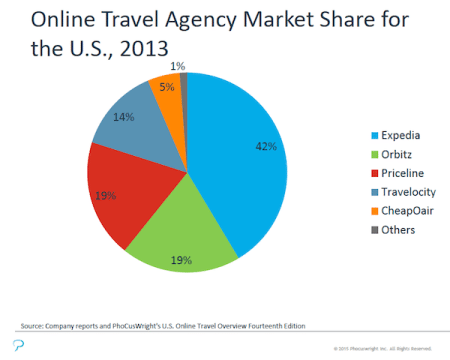

In the U.S., according to PhoCusWright, the new Expedia would wield 75 percent market share among online travel agencies, including Priceline.com, Booking.com, and CheapOair, among others. The numbers are for 2013.

But when all channels are taken into account, online travel agencies, including Expedia.com, Orbitz and their competitors, generate just 16 percent of total U.S. gross bookings, Phocuswright states.

“So the interesting question for regulators will be, how do they define the market?” asks Douglas Quinby, Phocuswright’s vice president of research. “Will they view the market through an online travel agency lens? Through a broader intermediary lens? Or through all of the ways that travelers can discover and book travel (supplier direct, metasearch, etc.)”

Most observers, though, think the merger will win antitrust approvals because Expedia Inc.’s share in the U.S. is relatively small when considered in the context of the entire travel market.

In the total global travel market, Euromonitor estimates that Expedia Inc.’s share is around 6.3 percent while the Priceline Group wields about a 4.9 percent share.

Expedia Inc. CFO Mark Okerstrom said yesterday during a conference call about the merger that Expedia Inc. would still be a small player after the merger with market share in the “single digits.”

That, of course, refers to its global share and not its U.S. market share.

Breakup-fees are fairly standard in merger agreements but the antitrust fees written into the Expedia-Orbitz agreement are noteworthy because this acquisition may get closer scrutiny than others.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: antitrust, expedia, orbitz

Photo credit: Expedia Inc. CEO would rather be writing a $1.6 billion check to Orbitz Worldwide shareholders than paying Orbitz Worldwide a $115 million breakup fee if the deal doesn't pass an antitrust review.