Skift Take

Expedia Inc. is following the TripAdvisor playbook on Trivago, which could go the spinoff/IPO route one day. The Priceline Group, meanwhile, is focusing on Booking.com and new-prize OpenTable as priorities while being measured about Kayak's international expansion.

When the Priceline Group acquired Kayak in 2013 the smart money viewed the transaction as finally spearheading Kayak’s international growth, and that still may happen, but Priceline CEO Darren Huston made it clear this week that Kayak’s growth will take place at a deliberate pace.

If you are immediately thinking that it was inevitable that Kayak would would fade somewhat within the Priceline Group brand portfolio then just consider how fellow metasearch player Trivago is soaring within the Expedia Inc. panalopy of brands.

Priceline’s and Expedia’s strategies for their metasearch prizes, Kayak and Trivago, respectively, are a study in contrasts.

During the Priceline Group earnings call earlier this week, CEO Darren Huston said Kayak is doing additional marketing in Europe and is operating “beyond our expectations,” but that its growth would have to be “in a very sustained fashion.”

Taking Things Slow With Kayak

“I would say that Kayak, since the day we acquired it, has exceeded our expectations from a profit standpoint,” Huston said. “And I’m really proud of the work that Steve [Hafner] and his teams have done. I would say we are not as aggressively investing. We certainly don’t want to invest at a loss to build the Kayak business, so we have done a lot of experimentation and we feel pretty good about the results in particular in Europe.”

“The other area that I’m really proud of at Kayak is the product continues to improve. We get great accolades from the customers who use Kayak and the investments that we’re making there seem to be at least from the data seem to be paying off very well and we’re still very optimistic that there is more that we can do at the Kayak investment over time but to-date, I would say [we’re] overall quite pleased and beyond our expectations but look to see the effect of the various experiments that are going on and our ability to profitably roll this business out to more parts of the world.”

So the Priceline Group plans to invest in Kayak’s growth as it helps sister brands such as Booking.com, Agoda and Priceline.com market themselves, but Huston won’t pour money into Kayak’s expansion at the expense of profits.

In other words, nice and easy does it.

Kayak CEO Hafner declined to comment on the Priceline Group’s go-slow approach with Kayak.

Apart from king-of-the-hill Booking.com, Kayak was the cool kid in the Priceline Group’s portfolio in the months immediately following the Kayak acquisition.

OpenTable’s Here, Kayak Move Over

But restaurant reservations platform OpenTable, acquired by the Priceline Group for $2.6 billion in July, may be getting more of the Priceline Group’s focus on international growth than Kayak is attracting now.

Priceline Group CFO Dan Finnegan said the company plans “to increase investment in OpenTable from an advertising and OpEx (operating expenses) perspective in Q4 and coming quarters to position the business for future growth.”

And much of that investment will be on the business-to-business side of the equation, improving OpenTable’s platform for restaurants, including mobile payments.

Expedia Goes All-In for Trivago

In contrast to Kayak’s prospects within the Priceline Group, Trivago is leading the charge within Expedia Inc., which is “aggressively” investing in the hotel metasearch company’s expansion.

One of the benefits for Expedia Inc. is that it is losing marketing clout within hotel-metasearcher TripAdvisor because Expedia refuses to participate in TripAdvisor’s book-on-TripAdvisor feature, and Trivago is helping Expedia make up for the lost clicks it needs for brands such as Expedia.com, Hotels.com and Venere.

Speaking during Expedia’s third quarter earnings call last week, CEO Dara Khosrowshahi said: “We continue to invest aggressively in expanding our Trivago brand worldwide and are very encouraged with the scale and growth that we’re seeing in the U.S., Canada, Australia and certain Asia Pacific markets, such as Hong Kong, Taiwan and Singapore. Trivago’s growth also helps our core OTA (online travel agency) growth.”

In fact, Expedia reported that Trivago’s revenue grew 50% year over year in the third quarter, and that Expedia Inc.’s advertising and media business — the heart of which is Trivago — has notched $450 million in revenue over the 12 months ending September 30, 2014.

“And then the Trivago team has been very aggressively investing in marketing and building that brand on a global basis and doing it successfully,” Khosrowshahi said. “And I think, at this point, they have moved from … their European core, nicely into North America and are now experimenting in markets in Asia Pacific, markets in Latin America etc. that are pretty interesting markets and we’re starting to see some pretty good trends in.”

In the U.S. sometimes it seems as though you can’t avoid Trivago’s advertisements on TV and similar campaigns are taking place in other markets around the world.

Khosrowshahi doesn’t expect Trivago to continue growing its revenue at a 50% clip, but added “we do anticipate that Trivago is going to be a nice growth driver for us over the next couple of years.”

Profits Versus the Long-Term View

While the Priceline Group is only willing to invest in Kayak’s growth in a sustainable way that doesn’t cut too deeply into profits, Expedia is taking a longer-term strategic view about Trivago.

Expedia Inc. CFO Okerstrom said the company’s looming fourth quarter investments in Germany’s Trivago and China’s eLong will be “more significant” than Expedia anticipated during the summer. In fact, Okerstrom expects the adjusted EBITDA contribution of eLong and Trivago to be down $15-$20 million in the fourth quarter.

“Given the huge opportunity in front of us, the dynamic and highly competitive nature of the industry and the clear long-term benefits of size and global scale, we believe that we are effectively balancing the delivery of near-term profits against the strategic objective of investing in the business to fuel long-term growth,” Okerstrom said.

It appears to be a laid-back and prudent Priceline Group when it comes to its priorities and investing in the once-rising star Kayak while Expedia Inc. is jamming the pedal to the metal with Trivago.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: expedia, kayak, metasearch, otas, priceline, trivago

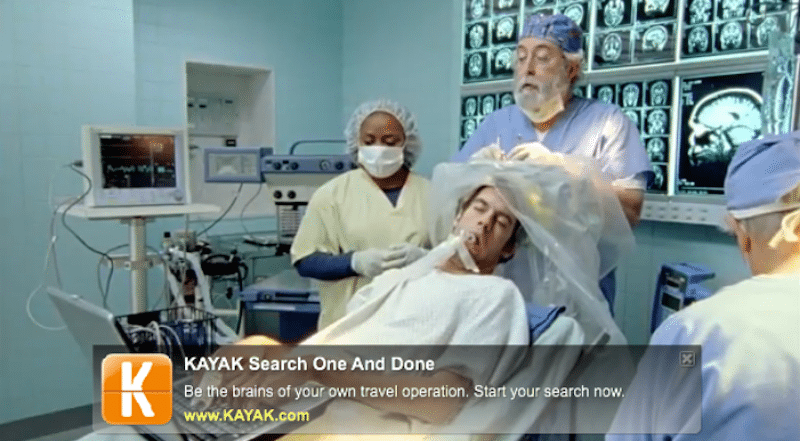

Photo credit: It doesn't take brain surgery to figure out that Kayak has been a nice addition to the Priceline Group's portfolio. Pictured is a Kayak commercial where searching for a deal is discussed during the middle of brain surgery. Kayak