Skift Take

If some of the well-intentioned founders of travel inspiration startups might be accused of creating pie-in-the-sky business plans, investors are pouring their money into more grounded enterprises, with lots of sharing economy ground transportation startups attracting the highest funding on average.

In some respects, the last few years have been a Golden Age for travel startup funding even when the company is not named Uber or Airbnb.

PhoCusWright tracked 743 digitally oriented travel startups from 2005 to 2013 that were funded or had substantial products, and found that they attracted $4.8 billion in funding from angels, venture capitalists and strategic acquisitions (but excluding acquisitions by public companies and IPOs.)

That funding has accelerated over the last few years.

Of that $4.8 billion, travel startups raised 68% of it, or $3.3 billion, from 2011 to 2013.

The $3.3 billion figure includes funding deals for the likes of Trivago, Airbnb, Lyft, Uber, Qunar, eHi Car Rental, Kuaidadi, and numerous others, writes PhoCusWright’s Douglas Quinby, research vice president, in a post, but it excludes mega funding rounds generated in 2014 for Airbnb and Uber.

Depending on the travel startup’s vertical and the specific company, the venture money may or may not be pouring in, and any talk of a Golden Age for travel startup funding has to be tempered by the 2012 onset of the Series A crunch, which finds many travel startups stymied as they are prodded to prove substantial revenue and scale before investors are willing to sign on for larger rounds beyond seed or angel funding.

Funding Versus Success

Series A crunch aside, the more or less fruitful environment for travel startup funding, doesn’t necessarily correlate with travel startup success.

Tracking the fates of the 743 digitally oriented travel startups founded from 2005 to 2013, PhoCusWright found that fewer than 10%, or perhaps 70, have been acquired.

If that number seems high, it can indeed be misleading because some of these startups were acquired in asset sales or brought investors a fraction of the money they had funneled into the startups.

“And many of those acquisitions were not the big exits their founders (and investors) likely hoped for, but [were] distressed asset sales or ‘acqui-hires’ for developer talent,” Quinby writes.

It is difficult to get a statistical handle on the extent of these “soft landings” because large public companies such as Google, TripAdvisor, the Priceline Group, and Expedia Inc. don’t generally have to disclose details about individual acquisitions if they are relatively small.

Shutting Down

In a surprising data point, PhoCusWright found that only about 20%, or 148, of the 743 travel startups that started operating from 2005 to 2013 have officially closed their doors.

However, Quinby says he suspects that a substantial number of the survivors may be in “maintenance” mode, meaning they are inactive, so the failure rate would be much higher when considering startups in limbo.

Follow the Money

So where exactly are the investors placing their bets?

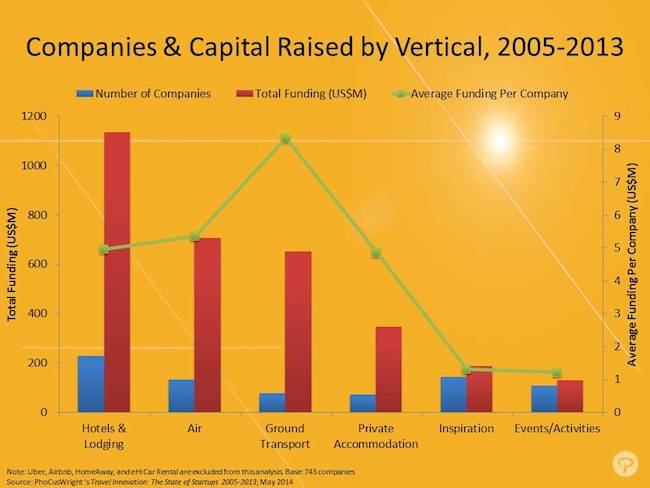

The following chart shows that while the 243 lodging startups over the nine-year period attracted the most funding, $1.2 billion as a group, the highest average funding per company went to ground transport startups (more than $8 million); followed in descending order by airline startups; hotel and lodging startups; private accommodation startups, trip-planning/inspiration startups, and then events/activities startups.

The more than $8 million in funding on average for ground-transport startups, ranging from ride-sharing to e-hail newbies and traditional fleets, is even more impressive because PhoCusWright excluded Uber and eHi Car Rental from the analysis because their inclusion and outsized funding would have skewed the numbers.

Quinby points out that the “inspiration” startup sector is likely the second-largest category in terms of number of startups after lodging with nearly 200 startups, including those falling into the social travel, trip-planning, discovery and guidebook arenas.

But, these inspiration-oriented startups were near the bottom of the heap — just slightly above the average funding for events and tours and activities startups — as inspirations startups attracted just more than $1 million in funding on average.

“While a lot of entrepreneurs see opportunity in the inspiration and travel-planning phase of travel, investors aren’t buying in,” Quinby writes.

The Regional Picture

In the 2011 to 2013 period, 30% of travel startups sprang from emerging markets, PhoCusWright found, with startups in China at the forefront.

And that momentum has been building over the last decade.

In fact, Asia Pacific saw a 285% increase in travel startups in the 2011 to 2013 period versus 2008-2010, while North America and Europe experienced jumps of 21% and 6%, respectively, PhoCusWright found.

Startup acquisitions in 2014, meanwhile, have been off the charts in girth, with the Priceline Group’s OpenTable acquisition ($2.6 billion at a 46% premium over the stock’s prior closing price), and TripAdvisor’s Viator acquisition ($200 million, much more than anyone would have guessed), being prime examples.

Then again, neither of them could be considered travel startups: OpenTable was founded in 1998 and Viator had its beginnings in 1995, nearly 20 years ago.

There are a lot of travel startups hanging around, salivating about the prospects of such paydays, although they are undoubtedly seeking faster exits.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: cars, hotels, travel inspiration, venture capital

Photo credit: Asia Pacific saw a 285% increase in travel startups in the 2011 to 2013 period versus 2008-2010, while North America and Europe experienced jumps of 21% and 6%, respectively, PhoCusWright found. Skift