Skift Take

In the beginnings of travel metasearch there were rumblings that it was going to be an outlet that favored suppliers such as airlines and hotels. In the hotel sphere, it has all turned out to be the opposite with online travel agencies dominating the scene.

Online travel agencies such as Booking.com and Expedia dominate hotel metasearch in the U.S. and a new report from digital researcher L2 Inc. quantifies just how one-sided the competition is with hotels.

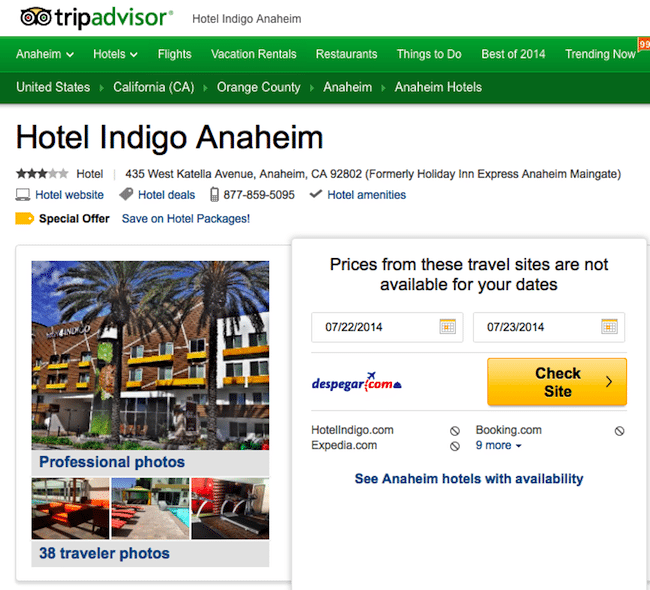

Consider TripAdvisor’s property pages, which are the source of much of its traffic from travelers seeking to do comparison shopping for hotel rates.

In the study, Insight Report Metasearch: Prestige Hotels, L2 found that among the 66 luxury hotel brands listed in an earlier study, just 6% appeared in the all-important top three booking options shown within TripAdvisor’s property pages in May 2014.

The following screenshot, showing the TripAdvisor property page for Hotel Indigo Anaheim, is actually the exception to the rule. Hotel Indigo is the #2 booking option displayed behind online travel agency Despegar and ahead of Booking.com and Expedia. (When L2 did the study in May, TripAdvisor was apparently displaying three booking options on property pages, but now it is showing four.)

“While 42 percent of brands appear as the featured provider on at least one property page, Index brands [66 luxury brands considered in L2’s June 2014 Digital IQ Index] control just six percent of the top three positions, ceding visibility and revenues to OTAs,” L2 found.

The following table shows the Top 11 Luxury Hotel Brands in TripAdvisor Property Page Results, with Hotel Indigo and MGM Resorts International topping the list, appearing in the cost-per-click-driven top three booking options on TripAdvisor for their properties 24% of the time.

Top 11 Luxury Hotel Brands in TripAdvisor Property Page Results

| Hotel | Percentage in Top 3 Results | Average Top 3 Rank |

|---|---|---|

| Hotel Indigo | 24% | Second |

| MGM Resorts | 24% | Second |

| InterContinental Hotels | 22% | Second |

| Mandarin Oriental | 20% | Third |

| St. Regis Hotels | 19% | Second |

| Sheraton Hotels | 18% | Second |

| Le Meridien | 17% | Second |

| Renaissance Hotels | 15% | Third |

| JW Marriott | 14% | Third |

| Hilton Hotels | 13% | Third |

| Marriott Hotels | 13% | Second |

Source: L2 Inc., Metasearch Insight Report

Marriott appeared among the top three booking options on its TripAdvisor property pages just 13% of the time, but mostly hotels get totally shut out on TripAdvisor.

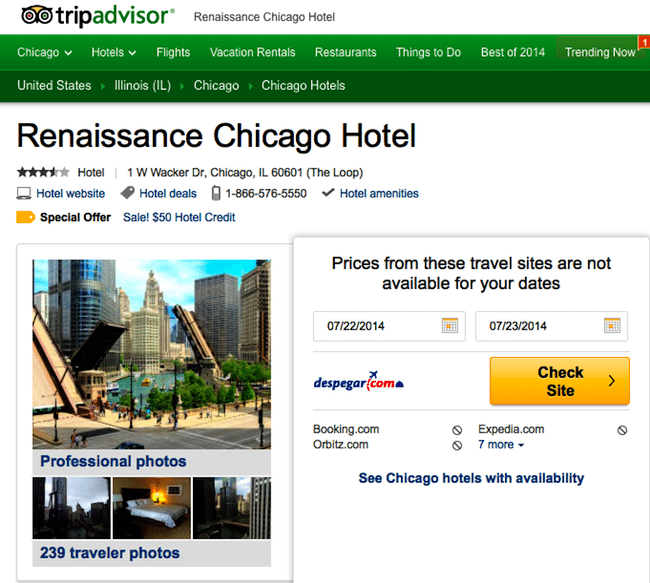

A typical example is the TripAdvisor property page for the Renaissance Chicago hotel, where the top four bidders yesterday were Despegar, Booking.com, Orbitz.com and Expedia. The Renaissance Chicago hotel doesn’t show up as a booking option for its own property page on TripAdvisor because the property either didn’t submit a bid, or didn’t submit a bid high enough to appear among the 11 booking options shown among the expanded booking choices.

Hotel properties generally don’t have the resources to compete with the online travel agencies, which are essentially huge marketing organizations, in metasearch.

In fact, while hotels only appeared 6% of the time among the top booking options on TripAdvisor property pages, Booking.com was displayed 27% of the time, followed by Expedia 21% of the time.

So at least for the luxury brands that L2 considered, Booking.com is pouring more money into TripAdvisor than Expedia is, and may be winning the OTA versus OTA battle.

The situation appears to be even worse for hotels on Kayak than at TripAdvisor. Or at least the situation points to the fact that hotels likely consider TripAdvisor a more fruitful focus for their marketing dollars than Kayak.

While L2’s luxury hotel brands appeared as booking options on 6% of their property pages on TripAdvisor, they appeared as booking options on merely 1.3% of Kayak’s listings.

At the same time, online travel agencies were booking options on Kayak in 96.4% of the listings for luxury hotels, L2 found.

And, even if hotel properties were content to cede control to the online travel agencies on Kayak as booking options, L2 found that a brand only appeared on the first page of Kayak listings in markets that they have properties only 64% of the time.

Kayak and metasearch companies don’t generally publicize how they order properties in their listings pages, but it is likely a combination of economics/advertising and popularity.

“We display hotels by what we believe is the most relevant sort order for the query,” says Robert Birge, Kayak’s chief marketing officer. “We use anything we know about the query to improve relevance.”

“As a travel search engine, we have to strive to provide the most comprehensive, accurate and relevant search results,” Birge adds. “If they don’t have to filter we’ve nailed it. If people find the hotel that’s right for them easily, they’re far more likely to return to Kayak, and that’s preeminent in our goals.”

Properties in the upper reaches of displays get the lion’s share of bookings so a property’s being relegated to the second page of Kayak listings is akin to being exiled.

The following two charts show the brands with the lowest visibility on Kayak’s first page of listings (Jumeirah appears only 40% of the time on the first page in markets where it has properties), and brands with the highest visibility (Hilton, Steinberger, and Wyndham appear 100% of the time).

Bottom 10 Luxury Hotel Brands’ Visibility on Kayak

| Hotel | Percent of Markets |

|---|---|

| Jumeirah | 40% |

| Four Seasons | 40% |

| Belmond | 38% |

| Waldorf-Astoria | 35% |

| Relais & Chateaux | 32% |

| Small Luxury Hotels of the World | 32% |

| MGallery | 31% |

| Rosewood Hotels | 30% |

| Hotel Indigo | 27% |

| Okura Hotels | 0% |

Source: L2 Inc., Metasearch Insight Report

Top 10 Luxury Hotel Brands’ Visibility on Kayak

| Hotel | Percent of Markets |

|---|---|

| Hilton | 100% |

| Steigenberger Hotels | 100% |

| Wyndham Hotels | 100% |

| Swissotel Hotels | 90% |

| Pan Pacific Hotels | 90% |

| Kimpton Hotels | 89% |

| Radisson Hotels | 89% |

| Shangri-La Hotels | 87% |

| InterContinental Hotels | 86% |

| Loews Hotels | 86% |

Source: L2 Inc., Metasearch Insight Report

Hotels’ lack of clout in TripAdvisor and Kayak isn’t necessarily the fault of these two travel metasearch companies, but punctuates how the majority of brands don’t have the resources, acumen or will to stand up to the online travel agencies in this channel.

For hotels seeking to drive more bookings to their brand websites, these L2 numbers are sobering.

Have a confidential tip for Skift? Get in touch

Tags: kayak, metasearch, tripadvisor

Photo credit: In May 2014, Marriott properties appeared as a booking option among the top three choices on its TripAdvisor property pages just 13% of the time, according to an L2 Inc. study. Pictured is a Marriott hotel in Cranberry Township, Pennsylvania. Associated Press