Skift Take

With 1,000 customers signed up for its open-booking platform, and 5,000 new clients enrolled in all its products over the last year, Concur is getting increasingly mainstream in the corporate travel industry. That's a challenge for establishment companies such as American Express, Carlson Wagonlit Travel and BCD, which must pay heed to the insurgent.

Concur Technologies notched strong revenue growth (31%) in its fiscal second quarter, doubled the number of customers signed up for its open booking TripLink platform to 1,000, and continued to pile up losses — namely $56 million.

In some respects, you can think of Concur as an Amazon of the travel industry in the sense that Concur is disrupting business travel, investing millions of dollars in product and marketing to grow its top line and customer base, and perennially delivering red ink.

One of the questions for Concur is when will investors get Amazon-like fatigue and get impatient waiting for the payoff? Concur’s stock price was down nearly 5% to around $79 mid-day on April 30, a day after the company’s Q2 earnings announcement, trading much closer to its 52-week low of $70.71 than the $130.39 high.

Concur officials, though, were very bullish about the quarter and where the company is headed.

“But the most important thing to take away from today’s call and to understand about Concur is that we are reinventing one of the larger industry verticals in the world, corporate travel,” CEO Steve Singh told analysts during the earnings call. “We are, always have been and always will be a product company. Across the technology landscape, history shows that the greatest product companies often get the chance to become platform companies simply by virtue of the pervasive user experience that they enable.

“Those platforms enable healthy, vibrant and large ecosystems that drive value for every participant. Our platform is creating an ecosystem for corporate travel. Hundreds of developers are innovating on our platform. Millions of individual travelers and thousands of customers have accessed to new wildly compelling services via our platform.”

Concur’s main business in corporate travel is travel and expense management, but Singh believes its fledgling open-booking platform, TripLink, in the long term will be “a very material component of revenue comparable to what we see in our core business.”

TripLink is geared to help corporations deal with employees who want to book their travel outside the designated corporate booking tool and on supplier websites, capturing any negotiated rates with suppliers, and enabling the corporations to at least keep track of wayward bookings made outside of corporate travel policies.

Concur launched the TripLink platform in 2013, had signed up 500 customers by the end of the year, and added another 500 in the March 31, 2014 quarter, officials said.

In addition to the 1,000 corporate customers now enrolled in TripLink, Concur has named a handful of suppliers — a key element that could determine its fate — including Avis, InterContinental Hotels, Marriott and La Quinta.

Concur is being very coy about identifying new customers that have signed up for TripLink, preferring to wait to unleash a public relations blitz on the topic at its Fusion customer conference in New Orleans next week.

In other news, Concur reportedly increased its $40 million investment in India online travel agency Cleartrip, according to TechCrunch. Concur declined to comment, and Cleartrip didn’t immediately respond to a request for comment.

Concur has been a very active investor in travel startups through its $150 million Perfect Trip Fund.

Concur has been on a hiring bltiz, adding 1,200 employees over the last year, and now has a workforce of around 4,000.

Concur also disclosed it has 10 federal-government agencies live on its E-Gov Travel Service 2 booking platform for civilian government employees, although it doesn’t expect any material revenue from it in 2014.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: concur, earnings, open booking

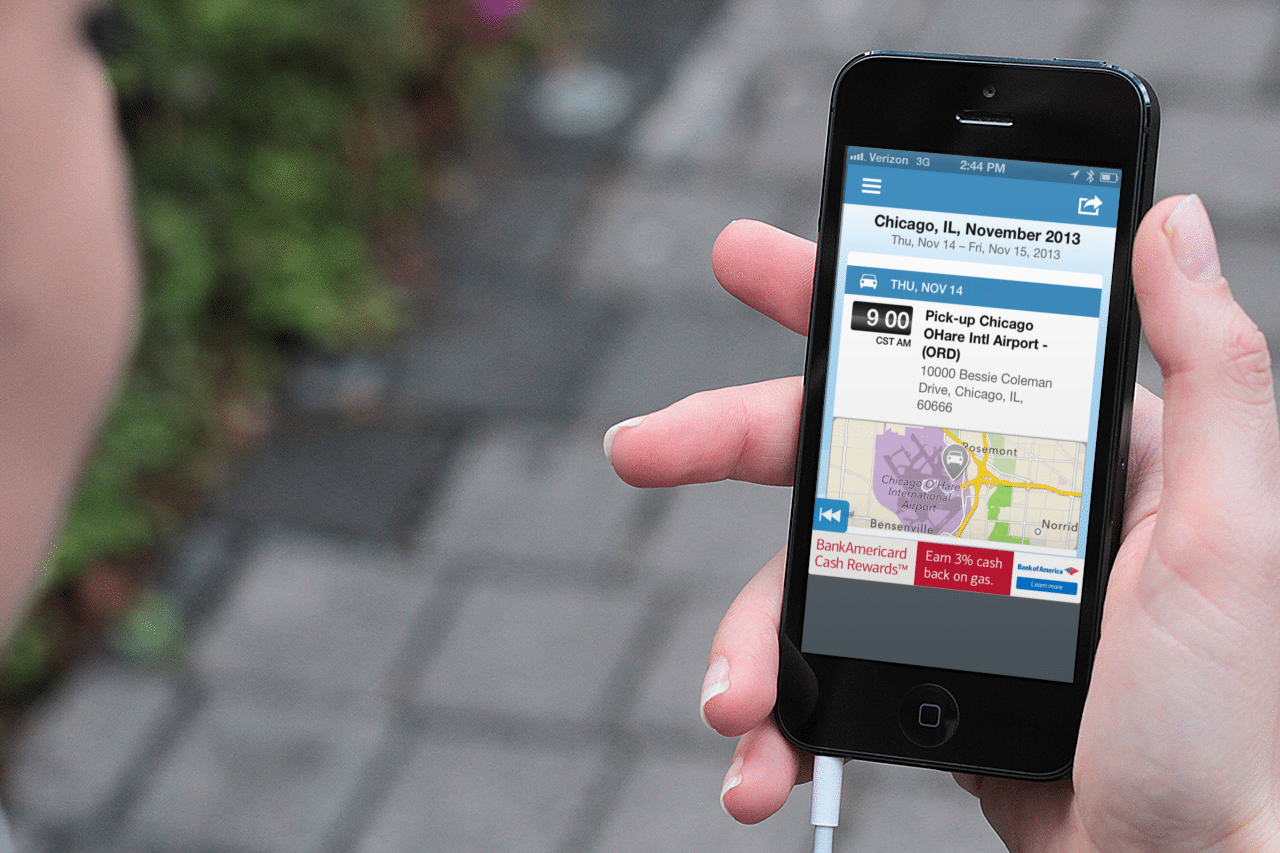

Photo credit: The Concur-owned TripIt app. PlaceIt by Breezi