Skift Take

Blackstone had a superb 2013 with several high-profile hotel and other IPOs, but the stock markets are more dicey so far in 2014. Still, Blackstone has shown that it is a highly skilled hotel-chain owner, and this IPO will attract great interest.

After confidentially filing its IPO papers with the Securities and Exchange Commission in late December, Blackstone-owned La Quinta publicly filed its registration statement in a bid to take the midscale brand public.

Blackstone would retain control of La Quinta after the IPO and net proceeds would be used to pay down debt and for general corporate purposes, La Quinta says.

The placeholder amount, used to calculate fees, but it could change is for a $100 million IPO. La Quinta didn’t reveal the number of shares it would sell or the price range of the offering.

La Quinta revealed that it notched net income of $17.1 million from continuing operations in 2012 on $818 million in revenue.

La Quinta claims to be the fastest-growing midscale owner, operator and franchisor in the U.S., outpacing Comfort, Holiday Inn Express and Hampton. La Quinta currently has 836 properties in its portfolio, up from 362 in 2003.

Blackstone acquired La Quinta in 2006, and the turnaround plan emphasized bringing in new management, consolidating operations around the La Quinta brand, increasing operating efficiency, enhancing revenue management, and upping marketing spend to grow the chain’s loyalty program.

Blackstone has been on roll, executing a $565 million IPO of Extended Stay America in November and the record $2.35 billion Hilton IPO in December.

Have a confidential tip for Skift? Get in touch

Tags: blackstone, ipo, la quinta

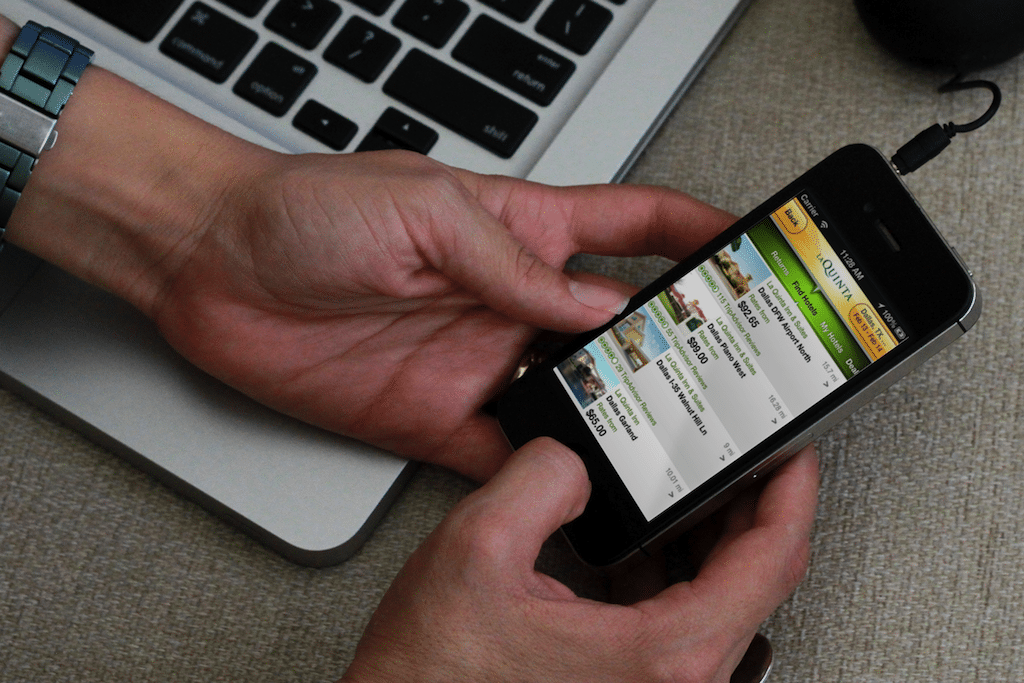

Photo credit: The La Quinta hotel app. Blackstone is trying to take the mid-scale brand public. PlaceIt by Breezi