Skift Take

Travel metasearch in the U.S. is already a crowded field with Kayak, Room 77, and Hipmunk vying for eyeballs, and recently TripAdvisor got into the game, too. Don't be surprised if there are mergers/consolidation over the next few years, although nothing appears imminent.

Drew Patterson, who recently became Room 77’s first CEO, does a perceptible double take at the seeming absurdity of the question.

“How is Room 77 going to meet the challenge of being relatively late to the party?” he’s asked.

After all, the first crop of travel metasearch sites, including FareChase, SideStep and Qixo, are now distant memories of a bygone Travel 1.0 era, and notable players such as Skyscanner and Kayak have each been refining their products and building traffic for about a decade already.

How, then, are travel startups such as Room 77, which only debuted its hotel-metasearch business about a year ago, and Hipmunk, founded in 2010, going to compete against the bigger and and more-established players?

It may be late, but it’s still early

Patterson believes it’s actually early rather than late.

“It’s the very early innings of the shift to mobile,” Patterson says, noting that a massive shift in consumer behavior is under way as travelers reach for their smartphones and tablets, often even when the desktop is within easy reach.

“Mobile is the catalyst,” Patterson adds.

Patterson argues that travel search is a great fit for mobile as travelers won’t need a plethora of apps, they may be on-the-go searching for a hotel, and can benefit from streamlined side-by-side comparisons “when there’s no keyboard and screen real estate” is scant.

In some ways, as relatively new and funded travel startups, Room 77 ($43.8 million) and Hipmunk ($20.2 million) find themselves in similar situations. How are they going to break out of the pack in the battle for global traction, and site and mobile visitors?

“It all starts with the right product,” Patterson says.

Is Room 77 different enough?

In that regard, one can make an argument that Room 77 currently has a more differentiated product than Hipmunk’s.

Sure, Hipmunk has its much-touted and attractive user interface and Agony index, and can adeptly enable users to search for hotels based on the location of their business meetings, too.

But, consider some of Room 77’s differentiators:

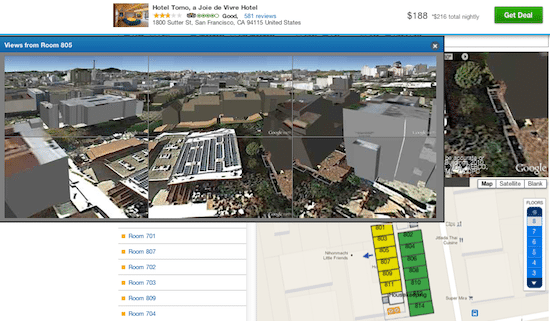

- Room 77 offers simulated room views for around 1 million rooms at hotels that are three stars and above, and also features insider tips for choosing specific rooms, hotel floors, or vantages (pick a room facing E. 33rd Street) at around 16,000 hotels.

- You can book about 200,000 hotels on Room 77 without having to navigate to another hotel or online travel agency website, and many of these properties enable guests to delay payment until hotel checkout, a spokesperson says. Customers can also book hotel stays from the Expedia Affiliate Network and Getaroom.com without leaving Room 77.

- In addition to displaying rates from various online travel agency and hotel websites, Room 77 also shows AAA, senior, government and military rates.

- At four- and five-star hotels booked on Room 77, you can indicate your room preferences and Room 77’s Room Concierge service will attempt to get you a specific room type or location to match your likes and dislikes. During the booking process, guests can also give hotels special requests such as putting flowers in the room for an anniversary etc.

The tortoise and the cheetah?

Patterson argues that Room 77’s site speed is a differentiator, too. Around the Skift office, we informally gauged the pace of Room 77’s loading of hotel search results against those of Hipmunk and Kayak. Room 77 may have been a tad quicker, although this was far from a scientific study, and the contest was close.

However, the speed of TripAdvisor’s hotel metasearch results seemed like a tortoise compared to Room 77’s cheetah.

Breaking into seeming talking points mode, Patterson says Room 77’s “speed, intelligence and relevance is second to none.”

Founded in 2009 by Brad Gerstner, a former co-CEO of National Leisure Group and avid travel industry angel investor, who serves as Room 77 chairman, the company first focused on its room view technology after having acquired OpTrip and TripKick for their tech and talent.

Changing views about the business direction

Room 77’s room views, created by plotting a room’s latitude, longitude and altitude, and then marrying them with Google Earth, are still part of the site, but they are relegated to the lower portions of the page. Many hotels weren’t exactly enamored with the idea of giving consumers the option to book a specific room, which was Room 77’s ultimate intent, although there is indeed some of that going on in the hotel industry today.

At the time, Room 77 enlisted hotel guests with its iPhone app and spent a lot of energy in the early days collecting hotel floor plans to build the world’s largest database of hotel rooms.

That process may be ongoing, but Room 77 pivoted toward hotel metasearch and got into it in a meaningful way about a year ago.

Independence, with a few dependencies

With 38 employees, Mountain View, California-based Room 77 has implemented a different funding strategy than its Hipmunk competitor and neighbor in nearby San Francisco.

In January 2013, Expedia, Concur, Sutter Hill Ventures, General Catalyst Partners, Felicis Ventures, and a bunch of angels, including Rich Barton, Erik Blachford, and Spencer Rascoff, participated in a $30.3 million Series C round, bringing Room 77’s total funding to $43.8 million.

With its $20.2 million in funding from the likes of Institutional Venture Partners and Ignition Partners, not to mention Ashton Kutcher, Hipmunk doesn’t have Expedia- and Concur-like strategic investors, and Hipmunk CEO Adam Goldstein argues this gives Hipmunk a competitive advantage with potential partners because it is “independent.”

Investments from Expedia and Concur send a signal about Room 77’s direction and strategy, Goldstein argues.

In fact, Goldstein says: Hipmunk is “one of the last independent metasearch companies in the U.S.,” and “one of the fastest growing.”

Patterson of Room 77 isn’t buying Goldstein’s analysis, saying: “I’m not sure they [Hipmunk] could make up more asterisks on what they are number one in.”

Patterson says Expedia and Concur are “passive investors” in Room 77, and they don’t have seats on Room 77’s board.

Still, Patterson says, “we are in active discussions with those guys.”

Expedia, Trivago and Room 77?

It may not be too far-fetched to speculate that one day Expedia, which recently poured $632 million in cash and stock into German hotel metasearch site Trivago, taking a majority stake, could one day consider acquiring Room 77 outright. If it paired Trivago in Europe with a growing Room 77 in the U.S., then Expedia could build a base to begin to challenge Priceline-Kayak in the global online travel battle.

Patterson doesn’t touch that speculation, but says Room 77 is “well-capitalized,” which gives the company “enormous flexibility.”

Room 77 is experimenting with online marketing through different channels, although the key would be to find the right ways to engage consumers, and not just buy traffic, Patterson says.

“Having that kind of dry powder,” Patterson says, referring to Room 77’s funding, “creates flexibility. Do we want to go offline [with advertising]? We have the capital to do that.”

Hotel metasearch is a crowded field with intense competition. Search engine marketing is very expensive, and titans of metasearch, such as Kayak, undoubtedly command better unit economics than startups like Room 77 and Hipmunk because of their much smaller footprints.

And, let’s not overlook TripAdvisor, which will undoubtedly play a huge role in shaping the market.

However, even with those disadvantages, amply funded travel startups such as Room 77 and Hipmunk are currently focusing mostly inward on their products, and aren’t in a huge hurry to play the big, paid-marketing game.

After all, if you believe Room 77’s Patterson, these are the early days.

“The smartest investors in this category see huge growth to come in search,” Patterson says. “We are playing with where the business can be five or six years from now, and not the next quarter.”

This is the second of a three-part series on funded travel startups, looking at where they started and their strategies for breaking out of the pack.

Part 1: The real-world challenge for travel startups, as mirrored in Hipmunk’s story

Have a confidential tip for Skift? Get in touch

Tags: metasearch, room 77

Photo credit: Room 77 employees take a break from "turning hotel search inside out" or whatever else they do at company headquarters. New CEO Drew Patterson (center, on the couch) thinks these are very early days for hotel metasearch. Room 77