Skift Take

Zozi is more Gilt Groupe than Viator, and it will be interesting to see if its gear-first, tours-and-activities-second model will work.

San Francisco-based Zozi announced a deal for $10 million in financing, and some pundits will herald this as another shot in the arm for the tours and activities sector.

But, taking a closer look, Zozi has transitioned over the years from “local experiences” into more of an e-commerce site for gear and apparel as its financial soul.

The company, which launched in 2010 as a deals site, now offers local activities, getaways and adventures with celebrity/expert “gurus,” plus a heavy dose of retail, including outdoor gear and apparel from well-known brands ranging from Adidas and New Balance to Patagonia.

Zozi states the financing includes “equity on a Series B1 round as well as debt investment from top financial institutions.” Participants included existing investors such as the Pritzker family, Launch Capital, 500 Startups, and Forerunner Ventures, as well as Par Capital Ventures, Silicon Valley Bank and others.

To clarify the numbers, a Zozi spokesperson says the company has raised $17.5 million in equity financing to date, or $20 million when including equity and debt.

Zozi indicated in its announcement today it will use the financing to expand its Zozi Gurus roster, bolster its experiential and retails products, and unveil “new technologies to improve the customer and merchant booking experience.”

“Our customers seek a trusted source to help them with discovery and curation of the most authentic experiences and the latest gear products, while our merchants seek an on-brand channel to find large numbers of targeted new customers who will become repeat buyers and refer their friends,” said TJ Sassani, Zozi’s founder and CEO.

Zozi’s model is different from most tours and activities startups, and it could be breaking new ground if it is able to make and scale a business out of it. When Zozi users search for activities, they also see advertisements to start shopping for backpacks, jackets and sunglasses, and this is where the profits are set to come from. The big bucks would come from the gear sales — and not from the tours and activities themselves.

The profit margins for apparel and gear are likely a lot higher for Zozi than for tour and activities startups struggling to earn commissions from local guides.

In his own words, Sassani, the Zozi founder, explains to Skift how the company changed and what its current strategy is:

“We launched in April of 2010 as a small local experience site focused on just one market, San Francisco. Our mission is to help our customers get out there and live active lifestyles. And, fast-forward to today and local is just one part of that. The core business is built on three pillars – Inspiration, Commerce, and Technology.

“First, our goal is to advance our vision around inspiration. We have built the ZOZI Guru platform beyond our expectations, a team of 13 category leading personalities and athletes. You’ll see in 2013 how we take this incredible asset and integrate it into our business to help inspire our customers.

” Second, and what drives our actual business, is commerce. This pillar connects our customers with three distinct product lines, including local experiences across 21 cities in the U.S. and Canada, getaways, and the gear products customers are likely to use during our experiences.

“It’s worth noting that the vast majority of our inventory is now regular price (not discounted) and over the next few months, you’ll be able to search and book from thousands of unique products on ZOZI. The third pillar is technology. Our tech touches both customers and merchants and we will be making a few exciting announcements about the technology pillar in Q2 2013.

“The new funding is mainly being used to further develop our vision around inspiration and technology. The commerce lines are well developed and easy for us to scale at this point. Our user economics and AOV [average order value] are stronger at this moment than they have ever been and we’ve proven we can scale that part of the business.

“Vertically focused businesses were not popular for awhile. I recall reading quotes from luminaries like Marc Andreessen about how they’d never invest in companies who focused vertically. Today though, even Marc has changed his tune largely because of the adoption of the internet, growth in ecommerce overall, and the explosion of the sharing economy — lots of innovation is happening in the verticals today — some say most.

“Vertical players can now not only succeed at building big businesses, but they can innovate with new models — and that’s what we’re doing here at ZOZI. In a year, my hope is that young entrepreneurs are pitching investors saying, ‘We’re like ZOZI, but for X.’ We’ve made those statements for a long time to get to where we are and I now believe we’re on the cusp of creating an innovative and fully vertically integrated model that can work not only in the activity industry — but in other industries as well. It’s extremely difficult to get all the pieces in place, but I believe once a company does that they can succeed in a big way and will have also created wide moats in the process.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

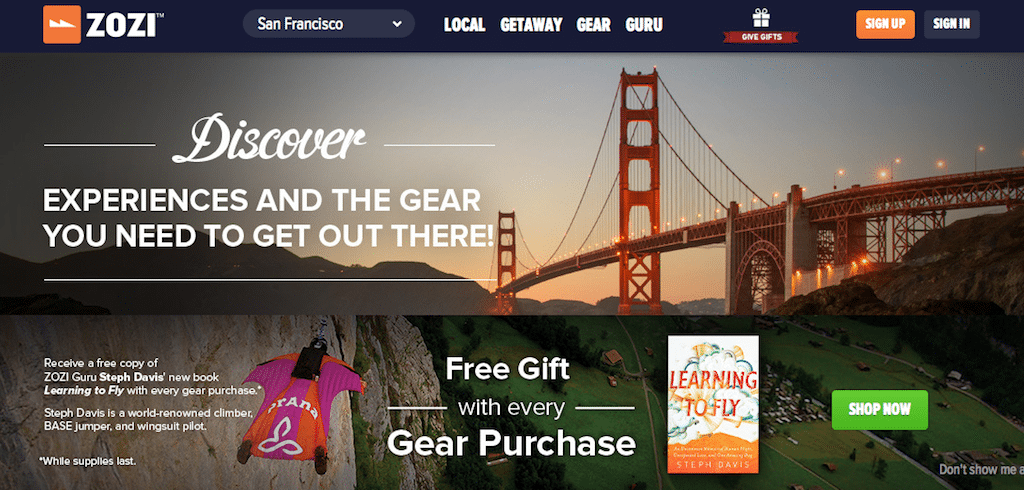

Photo credit: Zozi's business model is heavy on apparel and gear and lighter on tours and activities. Zozi