Skift Take

Airlines have found a way to make a profit -- ancillary revenue -- and these fees are likely to be around for an extended period of time.

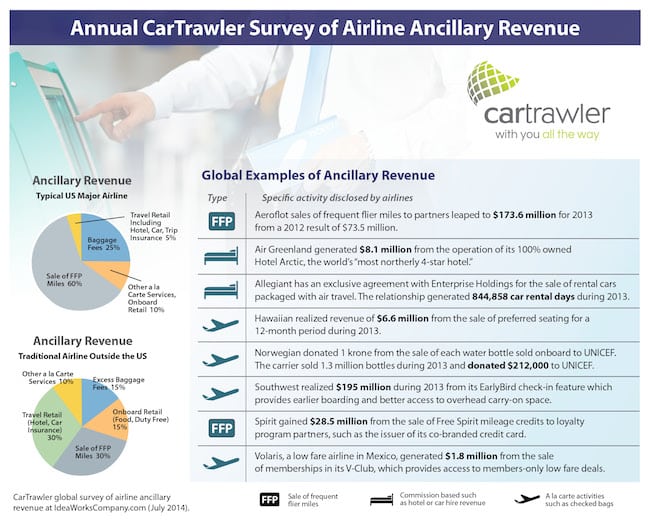

With razor-thin margins on a per-passenger basis, airlines took in some $31.5 billion in ancillary revenue in 2013 to bolster their drive for profits, according to a new IdeaWorks Co. report.

That number came from 59 airlines that disclosed their ancillary revenue, and compares with $27.1 billion generated by 53 carriers in 2012.

The $31.5 billion that IdeaWorks Co. cites, with six additional airlines disclosing ancillary revenue in 2013 versus 2012, begs the question: Did airlines increase their ancillary sales in 2013 versus 2012.

The answer is that they likely did, but the IdeaWorks report doesn’t overtly take up the question. Instead, Jay Sorensen, IdeaWorks Co. president, says the report merely deals with airline disclosures about ancillary revenue, and not necessarily the total reality about airline ancillary revenue.

“I know the numbers reported by many of the carriers are a small portion of their true ancillary revenue sales,” Sorensen says.

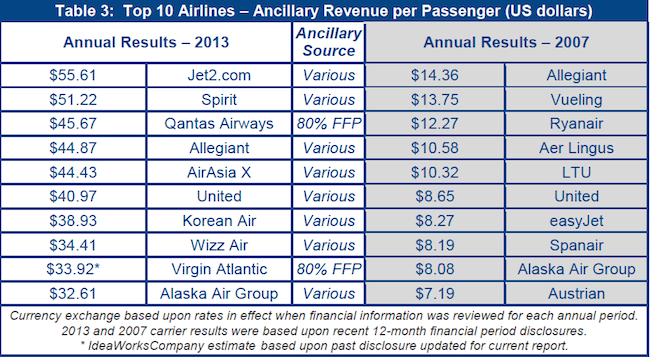

IdeaWorks found the average annual ancillary revenue per passenger reached $16 last year, with Jet2.com taking the number one spot at $55.61 per passenger. In 2007, Allegiant held the top spot, selling with $14.36 in ancillary services per passenger.

Forty-four of the airlines surveyed notched ancillary fees for services such as checked bags, premium seats, early boarding, and food and beverage of more than $6 per passenger.

“Airlines the world over share a common evolutionary pattern: the shift in focus from being a purely aviation-based service to becoming multi-product travel retailers,” says Michael Cunningham, chief commercial officer of CarTrawler, which sponsored the IdeaWorks report. “The shop window for travel is no longer static. It follows the customer across more devices and locations than ever before.”

Budget airlines were still dominated in 2013 in terms of ancillary revenue as a percentage of total revenue, just as they did in the early days of ancillary revenue efforts in 2007.

Spirit led the top 10 list with ancillary revenue accounting for 38.4 percent of its total revenue, according to the report.

Ryanair was number one in 2007 at 16.2 percent, but in 2013 fell to the fifth rung while still increasing ancillary revenue to 24.8 percent of its total revenue. The airline began taking a more liberal approach last year introducing lower bag fees and a free second small carry-on, which is likely a source of the increase.

United, bolstered by its merger with Continental, recorded the most ancillary revenue last year as it did seven years ago, with $5.7 billion in 2013 compared to $600 million in 2007.

The airlines’ argue that unbundling fares and charging fees for service that were previously included in the fare gives passengers more autonomy because they can decide if they want extra services or not.

Some airlines, like British Airways, which weren’t charging for coveted extras are now charging fees for seat assignments. And Singapore Airlines now gives passengers the option to pre-pay baggage fees at home to avoid “hefty baggage fees” at the airport.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Photo credit: Spirit Airlines pushes back at Ronald Reagan Washington National Airport in Arlington, Virginia. Adam Fagen Adam Fagen / flickr.com