Skift Take

The dissident shareholders at United are facing an uphill battle in their proxy fight as CEO Oscar Munoz has garnered a great deal of support from United's unions/employees. The hedge funds claim, though, that they support Munoz and only want to equip him to do a better job by putting in place a more experienced board.

As the United board lines up its unions against a proxy fight, dissident shareholders, who own more than 7 percent of the airline, say the board is misleading stakeholders about their effort to win six seats on the currently 15-member United board.

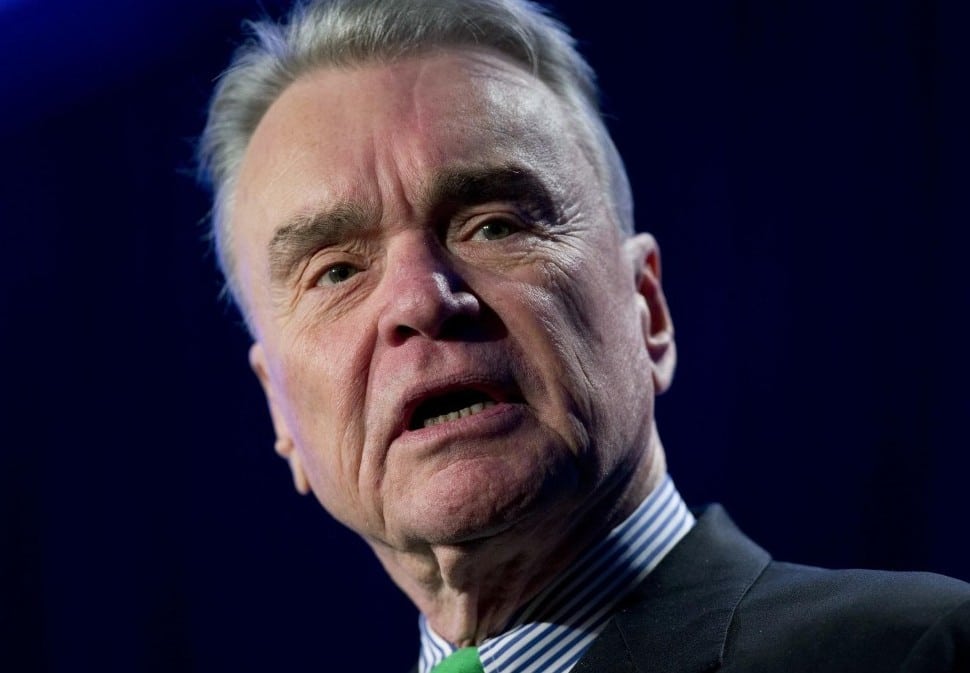

The dissidents, including Altimeter Capital Management, PAR Capital Management and former Continental CEO Gordon Bethune, who hopes to win a seat on the board, and perhaps to become chairman, delivered a letter [embedded below] to the United board seeking to correct the record.

“We have been continuously invested in United for more than six years,” said Brad Gerstner, CEO of Altimeter Capital and a former Orbitz board member. “After years of watching the incumbent Board supervise United’s chronic underperformance, we have stepped forward to nominate six outstanding professionals with deep expertise in airline operations, marketing, technology, revenue management, and major turn-around situations. We believe that replacing six incumbent directors, who have served on United’s Board over the Company’s sustained period of underperformance, with our six highly-qualified nominees will add meaningful long-term value to the Company. We want to see United return to greatness and perform at the top of the industry over the coming years.”

Contrary to the board’s storyline about the dissident effort, the dissident shareholders claim their six nominees, including Bethune, Gerstner, former Orbitz Worldwide CEO Barney Harford, former HomeAway board member Tina Sharkey, former Carnival Cruise Lines VP of revenue management Brenda Yester Baty, and former Delphi Automotive CEO Rodney O’Neal, would not be able to control a 15 or possibly a 16-member board.

Short-Term Gain Versus Long-Term Value

The dissident slate is not seeking “short-term gain” to the detriment of the airline and its employees, as at least one of the unions has charged, the dissidents say. In fact, the two hedge funds “have a well-established record of making long-term, passive investments in several industries” and would not support board candidates “who advocate any short-term gains” such as paying special dividends “at the expense of long-term value.”

The hedge funds say they support United CEO Oscar Munoz and in fact Bethune counseled him on the need to repair relations with employee groups when Munoz was appointed CEO last November. The dissidents say they are not campaigning against Munoz but seek to improve his chances to succeed by enhancing the quality of the board.

The dissident slate says it supports improving the situation of employees who “have fallen victim to the Company’s chronic underperformance that has resulted from the Board’s poor composition, poor supervision, and poor leadership. This needs to change. With the election of the stockholder nominees to the Board, we believe that Mr. Munoz will have the proper support and guidance to continue building upon his early momentum in establishing a more positive Company relationship with employees.”

Bethune for Chairman

United recently appointed three additional board members as a way to dilute the dissidents’ slate of six. Two of the new members, James Whitehurst and Robert Milton have airline operating experience. Whitehurst is former COO of Delta Air Lines and Milton is former CEO of Air Canada.

The hedge funds asked the United board to immediately appoint either Whitehurst or Milton as chairman.

Following the new board election, the dissidents would support Bethune in becoming an independent board chairman as a better option than staying with current chairman Henry Meyer, who they claim “lacks any relevant operating expertise,” or handing over the chairman’s role to CEO Munoz, which many shareholder groups in various industries would perceive as a violation of sound governance.

If Bethune is elected to the board, the dissidents “hope the Board will fairly and openly evaluate the relative merits of all three qualified Chairman candidates, and then elect a Chairman who will be responsive to stockholders and independent of the CEO.”

Gerstner appeared on CNBC March 24 to state his slate’s case:

March 22, 2016

Board of Directors

c/o Chairman Henry L. Meyer III

United Continental Holdings, Inc.

233 South Wacker Drive

Chicago, IL 60606

Subject: Setting the Record Straight

Dear Chairman Meyer and Board Members:

We are writing to correct certain false and misleading narratives that the incumbent Board has promoted in defending itself against meaningful change, as represented by the six new Board candidates that Altimeter has nominated for stockholder election at the upcoming annual meeting:

· We Are Not Seeking Control: The stockholder nominees are a minority slate of six nominees – not a control slate. The Board consists of fifteen directors with a promised sixteenth director. Six out of fifteen (or sixteen) directors cannot possibly control the Board or the Company. Moreover, if elected, each of the stockholder nominees will be an independent director, with fiduciary duties to the Company and to all stockholders. Only one of the six minority-slate nominees has (or has ever had) an affiliation with Altimeter or PAR. If elected, that one stockholder-affiliated nominee surely will not “control” a board of fifteen or sixteen directors.

· We Are Not Seeking “Short-Term Gain”: Altimeter and PAR have a well-established record of making long-term, passive investments in several industries, including the airline industry, and of supporting and seeking long-term value creation for companies and their stakeholders. Altimeter and PAR are not short-term traders; nor are we activists looking to extract short-term gains. Altimeter has continuously owned United stock for over six years. Neither Altimeter nor PAR is advocating: (a) accelerated or increased stock repurchases; (b) incurring additional debt; (c) paying special or regular dividends; (d) selling major assets or selling the Company; (e) mindless or radical cost-cutting; or (f) any other tactics that would temporarily improve short-term financial results at the expense of long-term value. To be clear, neither Altimeter nor PAR will support any Board candidates – whether management-nominated or stockholder-nominated – who advocate for short-term gains at the expense of long-term value.

· We Are Supporting CEO Oscar Munoz: We strongly believe that Oscar Munoz should be given the opportunity to succeed in his new role as CEO. We have great interest in Mr. Munoz’s success, and, as he knows, we respect and admire him. Our campaign is not a campaign against Mr. Munoz. To the contrary, our campaign is aimed at maximizing Mr. Munoz’s probability of achieving success. The stockholder-nominated minority slate was designed with this objective in mind. With the addition of the stockholder-nominated candidates, Mr. Munoz will have Board-level support, experience, and expertise in critical areas – such as airline operations, industry and corporate best practices, revenue management, marketing, technology, turn-around experience, and stockholder perspectives – where, historically, the Board and the Company have had pronounced shortcomings.

· We Support Improved Employee Relations: As Mr. Munoz has acknowledged in various public settings, upon his appointment as CEO, he sought advice from Gordon Bethune, a stockholder nominee who has a 10-year record of superior labor relations while at Continental Airlines. In response, Mr. Bethune advised Mr. Munoz that his highest priority should be to regain the trust of the Company’s long-suffering labor unions and employees by visiting with employees in the field, by involving them in important decisions, by affirmatively recognizing and appreciating their essential value to the Company, and by working to conclude mutually acceptable collective bargaining agreements. Like Mr. Bethune, we also recognize and value the critical contribution that the Company’s employees make to United’s ultimate success. Unfortunately, the employees – along with stockholders – have fallen victim to the Company’s chronic underperformance that has resulted from the Board’s poor composition, poor supervision, and poor leadership. This needs to change. With the election of the stockholder nominees to the Board, we believe that Mr. Munoz will have the proper support and guidance to continue building upon his early momentum in establishing a more positive Company relationship with employees.

· Board Responsibilities Are Distinct From Management Responsibilities: Questions have been raised about how the stockholder nominees would operate the Company differently. The premise behind this question is wrong. The executives manage the Company’s day-to-day operations. The Board governs. Our focus in supporting this minority slate of Board candidates is to improve corporate governance – not to operate the Company. By improving the Board’s quality, we expect to see enhancements in areas that are Board responsibilities, such as (a) supporting and supervising overall corporate-strategy development; (b) properly hiring, advising, supervising, and incentivizing management; (c) setting appropriate corporate goals and holding management accountable for relative performance against peers; (d) generally aligning Board and management interests with stockholder interests; (e) ensuring adequate focus on succession and contingency planning; and (f) ensuring quality corporate governance, transparency, process, and risk management.

· We Support A Qualified And Independent Board Chairman: Apparently based on the Board’s anonymous media leaks, the press has reported that we demanded the appointment of Mr. Bethune as non-executive Chairman of the Board. As a matter of good corporate governance, we do believe that United should have an independent Chairman with sufficient expertise in the airline industry to set the Board’s agenda and to supervise strategy and execution. The current Chairman, who has served on the Board (including the pre-merger Board) since 2003, lacks any relevant operating expertise. Moreover, the incumbent Board has committed to combine the Chairman and CEO roles by next year, which will violate well-established principles of good corporate governance by leaving United without an independent Chairman. We believe that anyone considering the best interests of the Company and its stockholders would conclude that Mr. Bethune is a far better Chairman choice than either the current Chairman (a former commercial banker with zero airline operating experience) or the sitting United CEO. However, the Board has very recently appointed two new members with airline experience, which is a welcome development. In fact, we encourage the Board to immediately appoint as Chairman one of these two new members – either James Whitehurst or Robert Milton. Both of these individuals are more qualified and more independent than either the current Chairman or the sitting CEO. Following the upcoming annual stockholder meeting, we expect that Mr. Bethune also will be joining the Board. At that point, we hope the Board will fairly and openly evaluate the relative merits of all three qualified Chairman candidates, and then elect a Chairman who will be responsive to stockholders and independent of the CEO.

Fundamentally, our objective is to position United toward long-term success for the benefit of all United stockholders, employees, and customers. The Board should have the same objective.

As always, we welcome to the opportunity to engage in further discussions focused on this shared objective.

Sincerely,

Brad Gerstner, Paul A. Reeder

Chief Executive Officer, Chief Executive Officer

Altimeter Capital Management, LP PAR Capital Management, Inc.

For more information, United stockholders with questions about the United Annual Meeting can contact Okapi Partners, the stockholders’ proxy solicitor, toll-free at (855) 305-0857.

About Altimeter Capital

Altimeter is a global investment firm managing both public and private funds focused on the airline, travel, technology, internet, software, and consumer sectors. Altimeter was founded in 2008 by Brad Gerstner and has offices in Boston, Massachusetts and Menlo Park, California.

About PAR Capital Management

PAR Capital Management manages a private investment fund. The firm was founded in 1990 and is located in Boston, Massachusetts. PAR’s philosophy is based on the belief that long term investment success can be achieved through narrowly focused and rigorous fundamental research, disciplined portfolio management and the alignment of incentives between manager and client.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: munoz, united airlines

Photo credit: Gordon Bethune, former chairman of the Board and CEO, Continental Airlines, is running on a dissident slated for a director position on the board of United Continental Holdings. Pablo Martinez Monsivais / Associated Press