Skift Take

The process of privatization in aviation, including that of airport infrastructure, has been a difficult one over the past two decades, but as it continues it promises to bring greater efficiencies and competitive advantages.

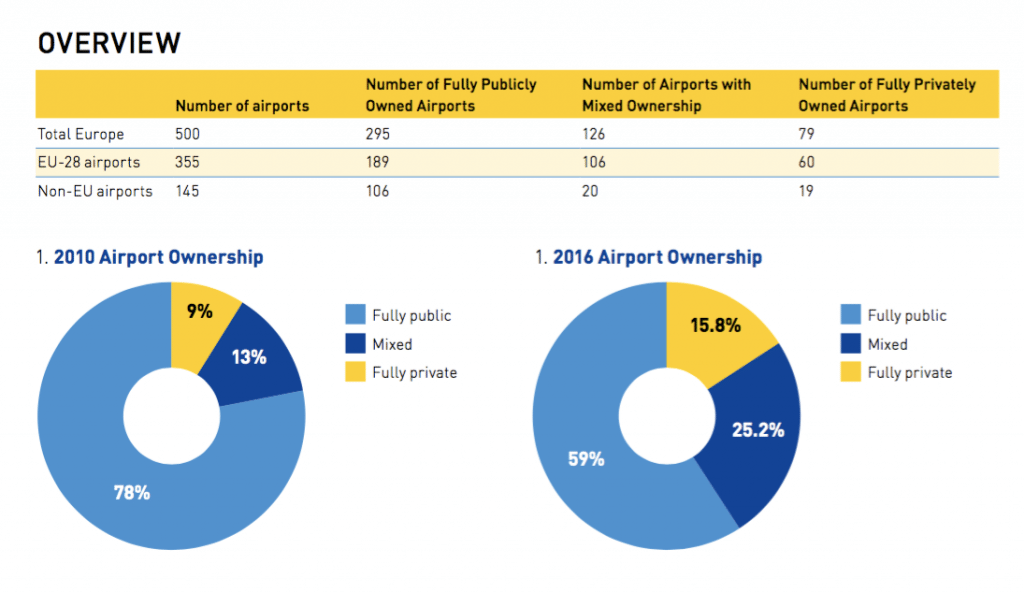

The Airports Council International Europe (ACI-Europe) has updated a 2010 report on the share of private ownership at EU’s airports revealing a dramatic rise in private investment over the past six years.

Today, 41% of European airports — 205 in all — have private shareholders, up from 22% in 2010.

It is a process of commercialisation which the airports association’s Director General, Oliver Jankovec, believes is essential to global competition, with benefits reaped by running airports as businesses rather than public infrastructure.

“This wider process of ‘commercialization’ of the European airport industry has had far reaching consequences—not least in the domain of airport competition,” says Jankovec. “Indeed, the process of change has if anything turned full circle. Increased competitive forces have pushed airports of all sizes to fight for route development and traffic growth, to become leaner and more efficient, to boost service quality and to find the optimal means of financing investments.”

Privatization of airport infrastructure initially met with some resistance in Europe. Jankovec says many were “taken aback” by the airport association’s 2010 report revealing the level of private investment at the time.

“Despite the business transformation that our industry had undergone since the liberalization of the aviation sector in the 1990s, older perceptions continued to linger,” he says. “To many, airports were still considered as government departments only responsible for basic infrastructure management.”

The privatization of AENA in Spain, the world’s largest airports operator in passenger numbers, met public resistance. But keeping up with global competition, Jankovec says, has made this type of privatization necessary.

Jankovec points out that even 78% of fully public airports in Europe have been ‘corporatized,’ that is to say that they function as independent commercial entities more than public utilities.

“Ultimately market pressures are blind to whether an airport is publicly or privately owned,” Jankovec says. “Indeed, the distinction between public and private airports is perhaps beginning to blur and lose significance with some of the most active investors in airports actually being themselves airport operators with some degree of public ownership.”

The increase in private investment at Europe’s airports over the past six years has been significant.

Since 2010, 100 new airports have had some level of private investment, more than doubling the total number of European airports with private shareholders so that three out of every four passengers in Europe today travel through an airport which are now traveling through an airport with private shareholders.

“Almost all fully publicly owned airports are now corporatized and managed on a purely commercial basis. These are not anecdotal changes to our industry—they are truly transformative changes. They underline the fact that airports are now run as businesses focused on air connectivity development, operational efficiency, service quality, revenue diversification and sustainable investments,” Jancovek says.

“Our airports — be they public or private — are to be run as businesses in their own right, strongly incentivised to continuously improve and underpinned by the principle that users pay a reasonable price to cover the cost of providing the facilities and services that they benefit from. There is no denying the tangible benefits that this approach has brought the EU significant volumes of investment in necessary infrastructure, higher service quality levels, and a commercial acumen which allows airport operators to diversify revenue streams and minimise the costs that users have to pay – all of which are fundamental requirements to boost air connectivity.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: gulf carriers

Photo credit: heck-in area at Terminal 4 in Madrid's Barajas airport. Iberia Airlines / Flickr