Skift Take

Expense reporting is still the bane of many business travelers' existences even though it doesn't have to be. Travelers are far ahead of their companies and it's time for mangers to adopt smarter tools like these to help their policies catch-up with the times.

As loyalty slowly erodes among some travelers, combined with many who want to go outside their companies’ policies to book travel, expense reporting is at a crossroads.

Many companies still use paper expense reporting while traveler receipts are increasingly digital and many purchases are made through mobile. This week’s five startups introduce expense reporting solutions meant to better reflect the twenty-first century business traveler — one who’s opened-minded about spending and willing to try new tools if it gets them their money back faster.

>>Captio integrates its expense management solution with a company’s existing systems and processes. It also helps automate the supervision process of expense reporting to make sure receipts comply with company policy and approve or reject claims.

SkiftTake: Business travelers need to do their part in ensuring receipts comply with company policies, but employers also need to make the supervision and approvals process for receipts easier for themselves.

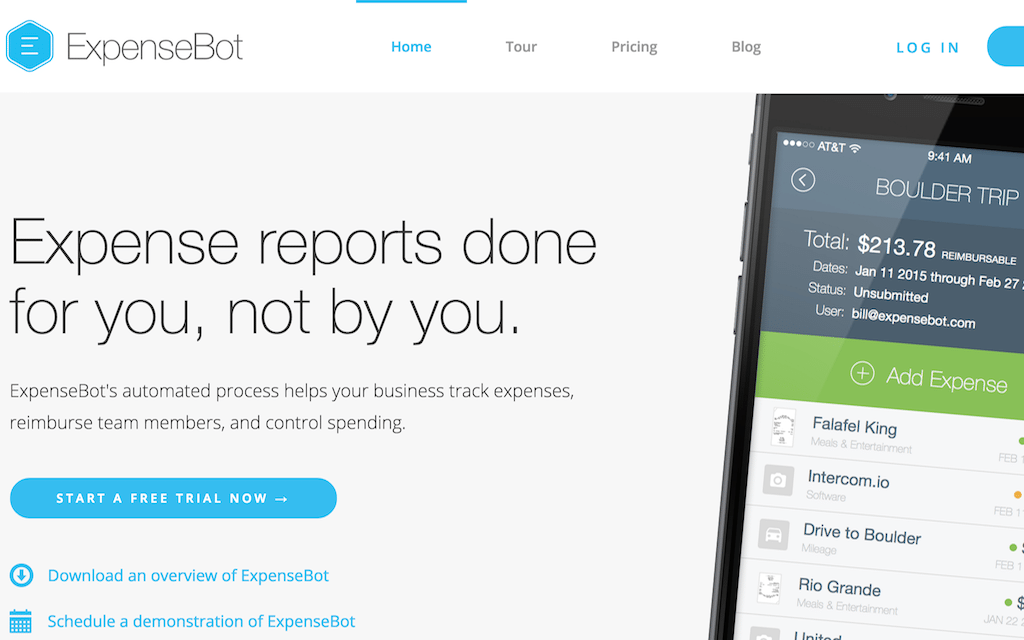

>>ExpenseBot automatically collects business travelers’ credit card transactions and lets them take photos of receipts on a mobile app. ExpensBot reads receipts, matches them to credit card charges and identifies what’s reimbursable.

SkiftTake: A solution that’s building the expense report as purchases are made and receipts come in makes for a less overwhelming process.

>>AppZen automates the research and reasoning that human auditors do and checks for the legitimacy of every business travel expense item and assigns a risk score to it using its algorithms. This is done through connecting social data to the actual place, person, attendees, merchants and customers along with using signals from various sources.

SkiftTake: Risk scores help to identify trouble spots faster but humans should be the ones with the final say of whether or not a particular receipt gets approval.

>>Abacus is a real-time expense reporting solution. It leverages the data collected as expenses are submitted and managers get instant visibility into employee spend. Abacus processes next-day reimbursements, enforces expense policies and syncs with accounting softwares.

SkiftTake: Business travelers want to get reimbursed as soon as possible but they also want to make sure that receipts will actually get reimbursed and comply with policies. A tool that could tell travelers in real-time whether some kind of purchase can be expensed will help the traveler make the right spending decision.

>>TravelPerk is a company creating a custom algorithm for budgets for every individual business trip that an employee takes, be it for flights, hotels or rental cars. This algorithm computes budgets each time based on real-time market pricing data. Once a budget is set, the employee then has the opportunity to “beat the budget.” If the business traveler chooses a lower-priced travel option than the budget that is created, they’re rewarded with 50% of the savings.

SkiftTake: If given a certain budget, we’re doubtful that most business travelers will take pride in “beating it.” If a company will pay anyways, a budget is a budget. Still, some want a feel-good relationship with their work, but it will of course take a lot of funding to keep the rewards component sustainable long-term.

For all of our SkiftSeedlings coverage, check out our archives here.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: skiftseedlings, startups