Skift Take

Given the headlines, while Rome2Rio, Captain Train and Loco2 are trying to get the message out that they are just as hot as travel-startup peer GoEuro, in contrast Hot Hotels is getting the word out that it will avoid some of the business model pitfalls of HotelTonight.

When the Priceline Group announced in 2012 it would acquire Kayak for $1.8 billion that had to be welcome news for rival Trivago, which saw Expedia Inc. take a controlling stake in it a few months later.

Editor’s Note: In our Skift Startup Stories series, we document travel startup issues, solutions, and lessons from a variety of angles, hoping to shed light on what separates the winners from the losers. You can read all the stories here.

Likewise, when Airbnb raises another $1.5 billion in funding that becomes an endorsement of the sector and the raise could have a trickle-down effect on competitors’ money-raising efforts.

So it goes in the travel startup sector —any startup sector for that matter: A big partnership or lucrative funding deal for the category leader or major player has a ripple effect.

But the converse may hold true when developments are negative.

Such were the potential reverberations over the last month with news that multi-modal transportation startup GoEuro landed $45 million in funding and conversely when Skift broke the news that same-day hotel-booking app HotelTonight is up for sale following layoffs of 20 percent of its staff.

Even before the GoEuro funding news was official some of its competitors had received word of it and were viewing the development as lifting all ferries and pangas.

“Great news for the multi-modal sector and probably a little overdue,” said Rod Cuthbert, CEO of Rome2Rio. “This will help the major players wake up to the fact that more people take the train or bus to their destination in Europe than fly, and these people are still booking hotels, activities and so forth. As a form of customer acquisition, multi-modal makes so much more sense than air-only search, and only a few companies have relevant technology in this area. GoEuro’s funding is good news for Rome2rio, Loco2 and Captain Train.”

While GoEuro has now raised $76 million in venture funding, Rome2Rio has picked up $2.73 million, Loco2 $1.63 million and Captain Train $11.9 million, according to Crunchbase. Startup and fundraising strategies vary widely, though, and the dollars raised aren’t an ultimate indicator of success.

On the Other Hand …

On the flip side, when news broke that first-mover and category leader HotelTonight, which has raised more than $80 million, was downsizing, with the brunt of the layoffs occurring among sales staff/account managers, the CEO of a competitor, Hot Hotels, sought to distance his travel startup’s business model from that of HotelTonight.

Conor O’Connor, founder and CEO of last-minute app Hot Hotels, says he wasn’t surprised about the layoffs at HotelTonight because its direct model of forging relationships with hotels is “unsustainable.”

“The cost of contracting is massive,” O’Connor says, adding that in addition to winning the initial contract the account manager then has to ensure that the hotel partner is serviced and is constantly providing the app with the best rates and availabilities.

Drawing distinctions between HotelTonight and Hot Hotels, which admittedly does a fraction of the business of the category leader, O’Connor says “early on” the two-year-old Hot Hotels opted for a hybrid direct/indirect model of obtaining hotel inventory and “pushes more indirect.”

For example, Hot Hotels establishes ties with hotel aggregators, bed banks and wholesalers, rather than hiring staff to win direct relationships with hoteliers, and markets itself through metasearch players, O’Connor says.

Founded in Spain, Hot Hotels, which now has 15 employees, became part of Techstars Boston over the Summer of 2015 and relocated most of its operations to that city, although it still has some staff in Europe.

As it seeks to expand its hotel product beyond Europe, the Middle East, Africa and Latin America and into North America, Hot Hotels has attracted a total of $2.5 million from existing investors and is in the process of raising additional venture funding from new investors, O’Connor says.

Given developments, while Rome2Rio, Captain Train and Loco2 are trying to get the message out that they are just as hot as travel-startup peer GoEuro, in contrast Hot Hotels is getting the word out that it will avoid some of the business model pitfalls of HotelTonight.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: goeuro, hot hotels, hoteltonight, rome2rio, sss

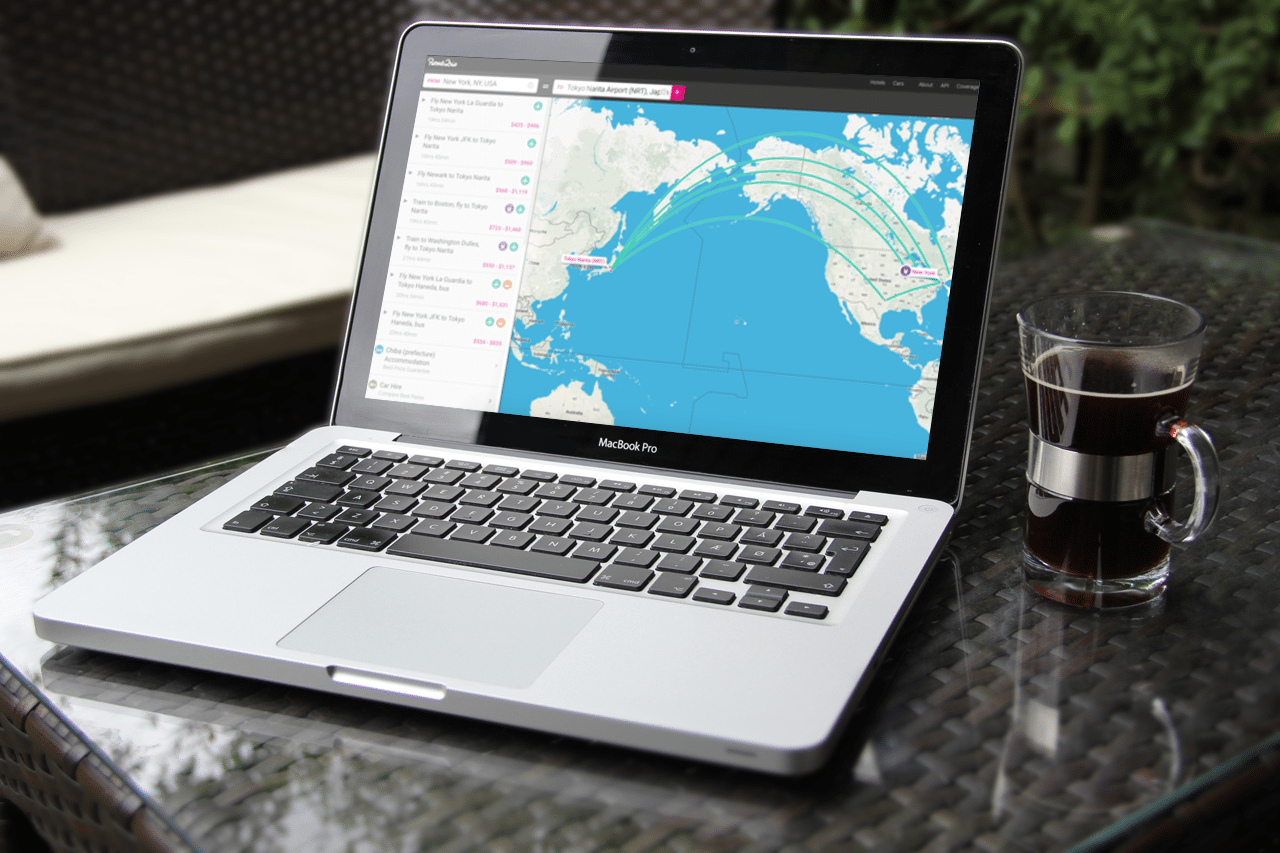

Photo credit: Rome2Rio sees benefits from its competitor's multi-million dollar raise. Frame