Skift Take

Booking.com wants to change the narrative: Its growth, and especially its girth, compare favorably with Airbnb's on the apartment rental front. And Booking.com can show some digital one-up-manship too because all of its 21 million rooms are instantly confirmable.

Feeling the heat because of all the buzz about Airbnb’s global growth trajectory with its more than 2 million listings, Booking.com for the first time has released its own room tallies: 21 million bookable rooms.

Until now, Booking.com merely reported its number of properties, currently 824,231, and not the number of bookable rooms. The company hadn’t talked much about apartment and condo rentals but Skift pointed out last month that Airbnb Needs to Watch Out for Booking.com’s Apartment Ambitions.

Here’s the room breakdown: Booking.com’s numbers-crunchers identified on the site 14.4 million bookable hotel rooms, 1.8 million vacation rental rooms and 4.8 million rooms in other types of lodging, including apartments, villas, chalets, bed & breakfasts, guest houses, boats, igloos, tree houses and farm stays.

While Silicon Valley and others rave about the expansion and mainstreaming of Airbnb, with its purported 2 million listings in 190 countries, and 60 million guests, Booking.com reports that its own “unique accommodations properties” (everything beyond its hotels and vacation rentals) increased 32 percent and accommodated 137 million guests over the last 12 months.

Booking.com states the number of vacation rentals on its site increased 66 percent to 1.8 million in the last 12 months.

That would make Booking.com, which is the growth-driver in the Priceline Group, a much larger lodging provider than Airbnb by just about every measure.

However, Booking.com, which was founded in 1996, is a senior citizen compared with 7-year-old Airbnb.

Still, on the growth front, there were some momentum questions in the Priceline Group’s third quarter of 2015 results. Room night growth decelerated in third quarter of 2015 to 22 percent, down from 26.7 percent in the third quarter of 2014 and 26.2 percent in the second quarter of 2015.

Apples to Apples?

Apples to apples comparisons when assessing the girth of lodging sites are really tough.

Booking.com believes that 4.8 million bookable rooms in “unique categories of places to stay,” albeit everything beyond hotels and vacation rentals, is the closest comparison that can be made to Airbnb’s 2 million-plus listings.

But there are still lots of differences in inventory types and geographies between Booking.com, Airbnb and HomeAway. For example, Booking.com is more Europe-focused while Airbnb’s and HomeAway’s strengths are still in the U.S.

Sites such as Expedia and HomeAway, which announced last week that they will merge, don’t detail room numbers. Neither does Airbnb, which is trying to expand beyond apartments and into vacation rentals.

In a Skift interview last week, HomeAway CEO Brian Sharples said comparing HomeAway’s and Airbnb’s property numbers are “meaningless in a way.”

“Yes, I mean, it’s meaningless in a way because it’s tough to compare one number to another,” Sharples said. “For example, in the case of Airbnb, 90-plus percent of their supply is primary homes that people live in that they’re sharing with others, and in the case of HomeAway, 95 percent of what we have are second homes that are set up for vacation rental travelers so the fact that one has more than the other is about as relevant as trying to compare Wal-Mart and Nordstrom based on the number of SKUs they have. They’re completely different SKUs.”

The combined Expedia-HomeAway would have considerably more properties than Booking.com: 1.5 million versus 824,000. HomeAway counts 1.2 million properties on its sites and most are “whole homes” so its unknown how Expedia-HomeAway would stack up against Booking.com in room counts.

TripAdvisor’s FlipKey states it “features 300,000 vacation homes and rooms located in over 11,000 cities throughout the world.”

Why Are Room and Property Numbers Important?

From a consumer perspective, in any given destination travelers want comprehensiveness in types of properties, lots of choice and availability, and a competitive rate environment.

From an industry perspective, online booking sites need to show momentum and please investors, seek large numbers of properties to drive consumer demand for lodging partners, and the sites can generate marketing power and efficiencies by getting larger.

As the Priceline Group stated in its 10-K report on February 19: “We believe that the increase in the number of accommodation providers that participate on our websites, and the corresponding access to accommodation room nights, has been a key driver of the growth of our accommodation reservation business. The growth in our accommodation bookings typically makes us an attractive source of consumer demand for our accommodation providers.”

Instantly Confirmable

If Booking.com’s growth numbers in vacation rentals and apartment-like inventory are robust, the company is also differentiating itself from Airbnb, HomeAway and TripAdvisor/FlipKey on several fronts.

Unlike its competitors, Booking.com states it doesn’t charge guests a booking fee. Starting in the second quarter of 2016, HomeAway will for the first time will start charging guests a 6 percent booking fee on average. Airbnb charges 6 to 12 percent and TripAdvisor/FlipKey charges guests 5 to 15 percent.

While HomeAway and other sites give hosts 24 hours to confirm a reservation, Booking.com states “all rooms on Booking.com are instantly confirmable at the moment of booking.”

Booking.com wants to change the narrative: Its growth, and especially its girth, compare favorably with Airbnb’s on the apartment rental front. And Booking.com can show some digital one-up-manship too because all of its 21 million rooms are instantly confirmable.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, booking.com, expedia, homeaway, priceline, tripadvisor

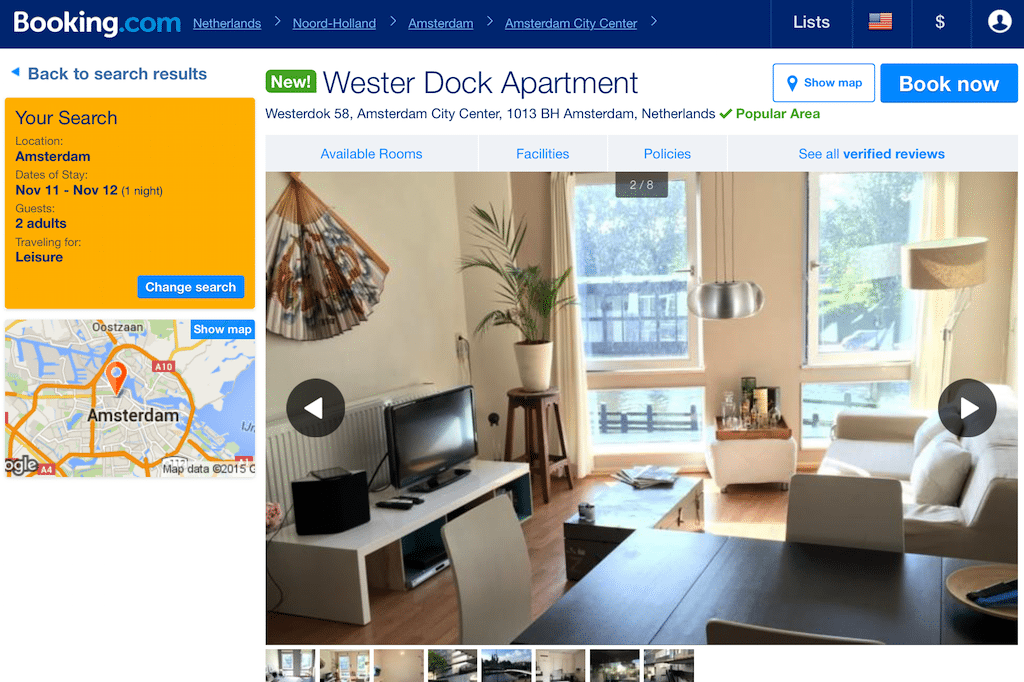

Photo credit: The Wester Dock Apartment in Amsterdam is one of 21 million rooms offered on Booking.com. Booking.com