Skift Take

After lots of experimentation, Google realized it didn't need a hotel metasearch site like Google Hotel Finder because it has the Google search engine. That is a formidable asset, to say the least, and it will be a challenge over the years to the powers that be in hotel booking.

When the U.S. Department of Justice decided a week ago not to stand in the way of Expedia’s acquisition of Orbitz Worldwide, the DOJ cited Google’s hotel and flight products as a sign that new players are emerging to ensure a competitive market.

Right on cue, Google announced a series of moves this week to ramp up its hotel advertising and booking features.

And you can bet that similar initiatives to enhance booking flights on Google can’t be far behind.

On the hotel front, Google killed its Hotel Finder site, launched in 2011, in favor of offering hotels from hotel websites and online travel agencies right in Google search. Google had been offering hotels both in its Google Hotel Finder site and in Google search but has decided the latter is the sleeker and more attractive experience.

While sites such as Trivago, Booking.com, Expedia and Accor Hotels are buying ads atop and to the right of Google search results to buy traffic for their sites, Google is saving consumers a step and offering it all in Google search through its Hotel Ads program. Many of the aforementioned booking sites participate in both programs.

At the same time, Google is changing the business model of its Hotel Ads program and enabling independent hotels, which have many complaints about their treatment from online travel agencies, to offer their hotels in Google search by paying commissions instead of compensating Google on a cost-per-click basis.

Hoteliers will have to decide where they get the better return on investment and must decide all of that in the context of less control of the customer through a Book on Google model.

Google states it is bringing these independent hotels on board through partnerships with hotel aggregators Sabre Hospitality Solutions, Trust International, DerbySoft, Fastbooking, Seekda and TravelClick, and is talking to other providers, including DHISCO (formerly Pegasus Solutions), among others.

In its infancy, but perhaps what will turn out to be the most impactful move is that Google is expanding its Book on Google program for hotels from mobile, where it started in 2013, to desktops and tablets in the U.S.

Through this program, consumers can book hotels in Google search while Google handles the payment through Google Wallet. Similar in some respects to TripAdvisor’s Instant Booking, the hotel or online travel agency then handles the confirmations and customer service, and therefore owns the customer.

Expedia is on record as saying it will consider participating in Book on Google even as it boycotts TripAdvisor Instant Booking. Expedia doesn’t like the relative lack of branding it would get in TripAdvisor Instant Booking and isn’t anxious to build up what could be a formidable hotel-booking challenger.

Google also is planning to add amenity information, such as the availability of Wi-Fi, free breakfast or a pool, to its hotel offerings in 24 countries.

Google has taken its time about scaling up its hotel search and booking business but now things are shaping up at a quicker pace.

When it gets around to combining these hotel offerings with its flight business, then we’ll really have something to talk about.

Have a confidential tip for Skift? Get in touch

Tags: advertising, google, tripadvisor

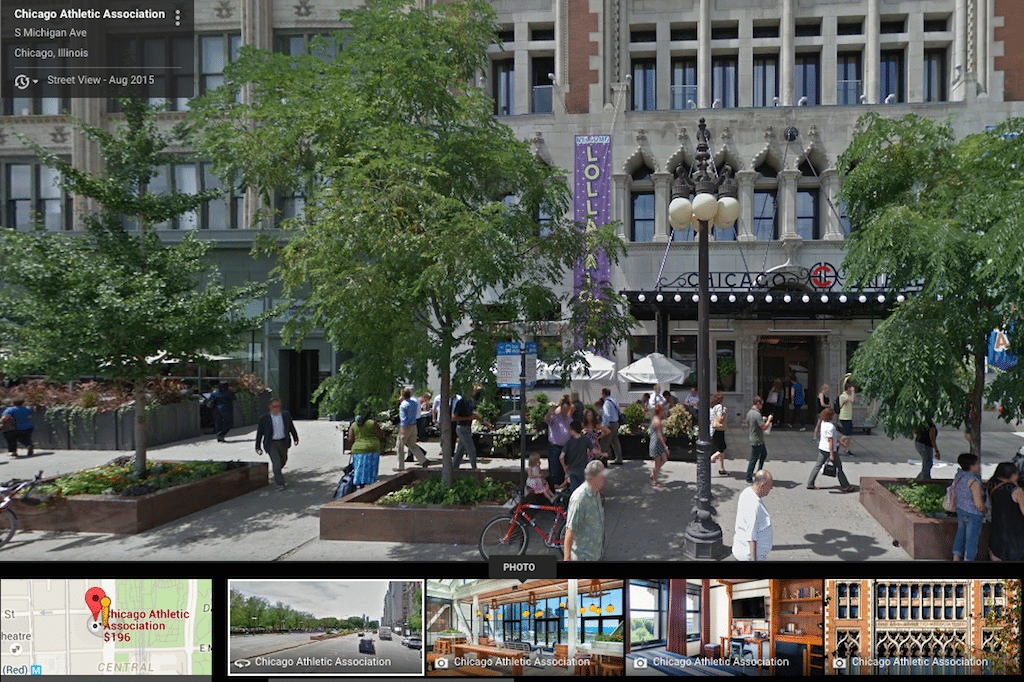

Photo credit: Images in Google Hotel Ads of the Chicago Athletic Association property. Google