Skift Take

As sharing economy services provide stronger data tools to corporate agencies, the role of Uber and Airbnb will expand in corporate travel policies.

For many business travelers, services like Airbnb and Uber offer more personalized service and flexibility than their current corporate travel policy offers.

This leads them to book outside their policy and leave their company’s travel managers to piece together their expenses.

The country’s biggest corporate travel agencies say better data from sharing economy services will soon lead large companies to adopt, and in many cases encourage, their use.

“It’s just become a part of the fabric of how people travel,” said April Bridgeman, managing director at Advito and senior vice president at BCD Travel.

Ride-sharing and accommodations are the sectors under the most scrutiny right now by travel managers, as employees embrace the services they use as consumers in their lives as business travelers.

Airbnb and Uber both launched dedicated business travel sections last year, with Airbnb reporting 700 percent growth from the more than 250 companies that signed up.

New data from Uber show that more than 50,000 companies enrolled in its business program, with rides taking place in 291 countries across 58 countries. Uber estimates companies saved $1,000 per employee over the last year by using Uber instead of taxis or traditional car services.

Corporate travel agencies echoed the claim that the sharing economy is taking on a new importance for business travelers.

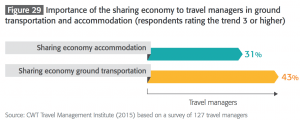

A recent report from Carlson Wagonlit Travel (CWT) found that travel managers are beginning to take the sharing economy more seriously.

About a third of travel managers polled rated transportation and accommodation sharing services as important overall.

“We’re still on the front-end of a larger sharing or on-demand economy, and just beginning to see some of this overlap of a very consumer-oriented offerings work its way into creating implication for managed travel,” said Nicholas Vournakis, senior vice president of global marketing for CWT.

Business travel executives told Skift they expect consolidation when it comes to opening up corporate travel policies to sharing economy services.

“Only certain providers are going to cross the chasm into mass-scale success,” said Evan Konwiser, vice president of digital traveler at American Express Global Business Travel. “That level of maturity is important to us in the corporate space, especially making sure there is responsiblity around data.”

Data

By looking at better data sets, travel managers can help create savings for their clients and better understand the needs of individual business travelers.

Bridgeman said the demand for data on sharing economy purchases is booming as travel managers look for more information. She said BCD Travel is now working with Airbnb to establish a feed to bring its data into BCD’s system.

“There’s a sizable percentage of hotel spend that is not being managed through the formal travel program,” said Bridgeman. “The first way to actually manage something is to be able to see it.”

Once TMCs are taking in reliable data on sharing economy spending, they can make more informed pitches to their clients about including sharing services in corporate travel policies.

“For a lot of corporate clients, solving the data issue makes them more eligible service for their clients,” said Konwiser. “In Airbnb’s early days, that would have been impossible.”

“Adoption is generally driven first by traveler demand,” said Konwiser. “When traveler demand picks up because of superior service, then it percolates up to the travel manager.”

Hotels

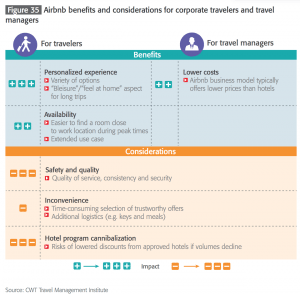

Accommodations are a trickier area for travel managers to justify adding to their travel policies for a variety of reasons.

Security of data and travelers are primary concerns due to the unreliable nature of Airbnb properties. In addition, the minutiae of a stay like picking up keys limits the value proposition of roomsharing.

“What we see from the data, the first use case is more along the lines of extended stay hotel, where the value proposition of an Airbnb is better from a cost-saving perspective and quality of house model,” said Konwiser.

“If someone is running from meeting to meeting, then maybe Airbnb isn’t the best option,” said Bridgeman. “Certainly if you’re going to be somewhere for a few days you can get a much nicer experience than a travel policy [selection].”

“Many business travelers out there are looking to act more like a local,” said Bridgeman.

Rebooking a client, however, is still an issue with the service.

“A traveler may need to call back to their agency of record for service, and booking any sharing economy provider doesn’t preclude a traveler from doing that,” said Vournakis. “But the likelihood that an agent would go back and rebook someone through Airbnb is low.”

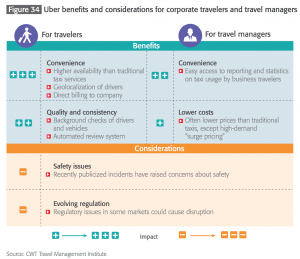

Rides

“Now we talk about taking a sharing economy provider like Uber, and not making it equivalent to other service provider,” said Konwiser. “Uber’s data are better than taxi and most black car data, due to geotracking, for both the expense and duty of care sides.”

Uber’s business program lets travel managers set policy limits and access ride or expensive information at will.

“[The data] is certainly enabling [corporate agents and travel managers] to gain some visibility into different practices and turns attention to the opportunity to shift travel behavior away from more expensive on-demand ground transportation,” said Bridgeman.

Saving money for corporations, and making ground transportation more seamless for travelers, makes ride sharing services a win-win for travel managers.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, american express, bcd travel, carlson wagonlit, uber

Photo credit: An Uber ride in Bogota, Colombia. Alexander Torrenegra / Wikimedia Commons