Skift Take

Greek Tourism and Athens International Airport have done their part for the Greek economy. We hope the momentum will continue over the summer.

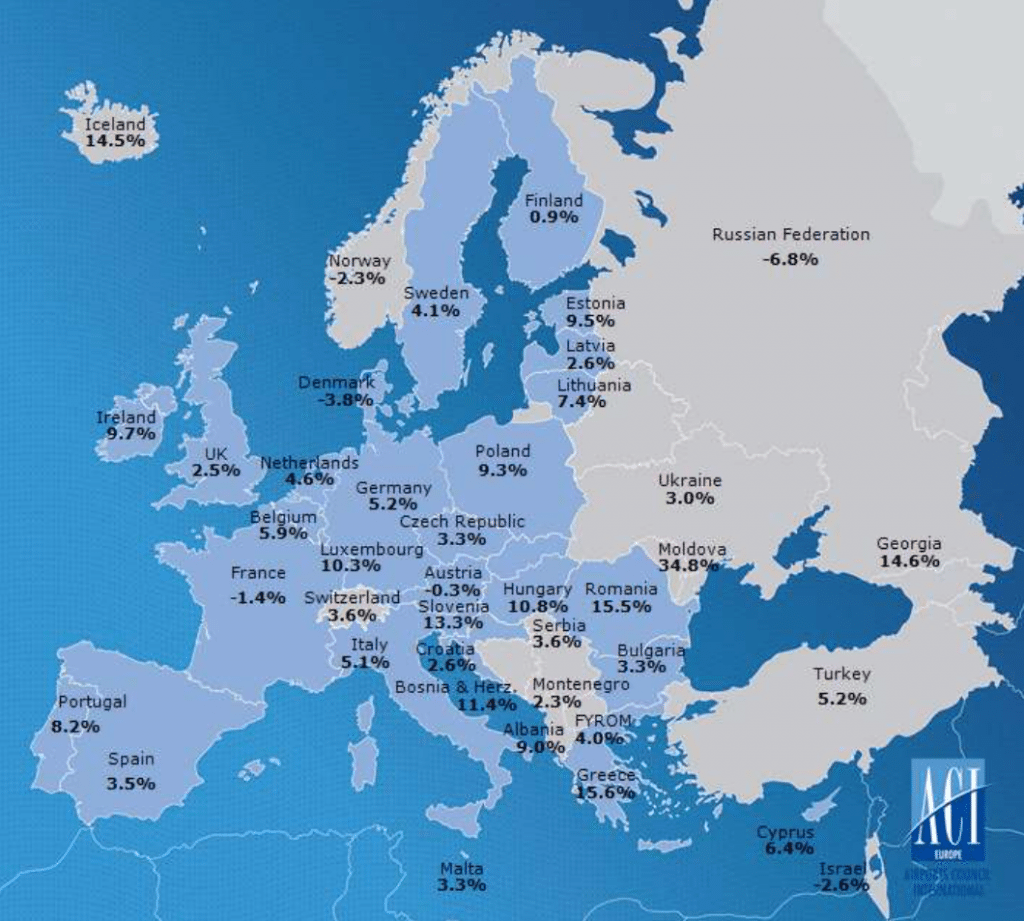

Athens International Airport has outperformed many of its peers in Europe, showing the highest figures of passenger growth in April among airports its size, and a percentage of growth superior to any of the EU’s largest airports.

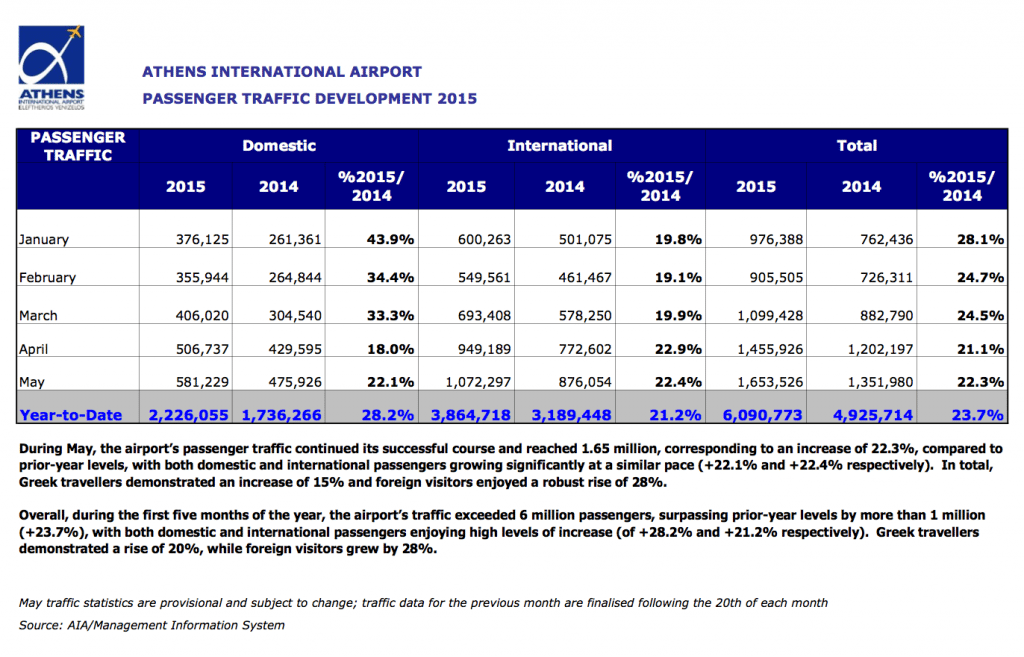

With passenger growth of 21.2% in April, and passenger numbers of 1,454,833, as recently reported by Airports Council International Europe, Athens International Airport, outperformed its peers in the region, reflecting Greece’s recent tourism recovery.

The airport also reported strong passenger numbers in May, hosted a total of 1,653,526 passengers, which represents a 22.4% increase over May 2014.

So far this year, Athens International Airport is recording the strongest year in its history.

Athens has seen passenger numbers rise to more than 6 million in the first five months of the year, which is more than one million more passengers than last year, with an increase of 23.7%. Domestic passengers increased by 28.2% and International passengers increased by 21.2%. Greek traveller numbers grew by 20% of all passengers and foreign visitors grew by 28%.

This strong performance comes at a difficult time for many of Europe’s airports, which Olivier Jankovec, Director General of ACI Europe, attributes to key economic and labor factors.

“Passenger traffic growth slowed in April compared to previous months with non-EU markets especially affected by the weakness of the Russian economy and the strikes of French air traffic controllers also taking a toll on EU traffic. As a result, 42% of Europe’s airports reported decreases in passenger traffic, up from 23% in March,” he says.

“Nevertheless, the outlook remains positive, with economic growth picking up in the Eurozone and the positive impact of the ECB’s (European Central Bank’s) stimulus program becoming more apparent. Airlines have added more capacity for this summer season compared to last year and barring a dramatic twist in debt negotiations with Greece, the coming months should see continued passenger growth and hopefully some improvement in freight figures.”

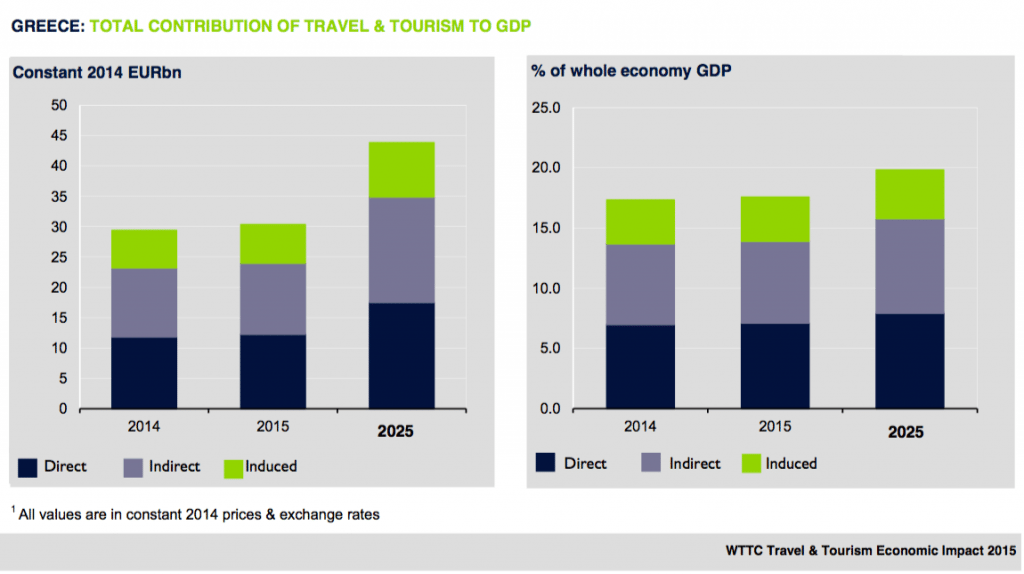

The World Travel & Tourism Council (WTTC) predicts a continued strengthening of Greece’s tourism economy and increased contributions to the nation’s economy from the tourism sector over the next ten years. In its Travel & Tourism Economic Impact 2015 report for Greece, the WTTC states:

”The direct contribution of travel & tourism to GDP in 2014 was €11.8 billion (7.0% of GDP). This is forecast to rise by 3.6% to €12.3 billion in 2015. This primarily reflects the economic activity generated by industries such as hotels, travel agents, airlines and other passenger transportation services (excluding commuter services).

“But it also includes, for example, the activities of the restaurant and leisure industries directly supported. The direct contribution of travel & tourism to GDP is expected to grow by 3.6% per annum to €17.5 billion (7.9% of GDP) by 2025.”

Signs of Decline

Some claim that government policy issues could result in a reversal of this strong performance.

In a recent report, Deutsche Welle quotes the head of the Greek Tourism Confederation, Andreas Andreadis, expressing concern over a decline in bookings.

“We’ve been receiving reports of a decline in bookings, especially from Germany,” he says.

Andreadis references statistics from the German Society for Consumer Research, which show a 2% decline year over year for bookings for Greek holidays booked in Germany. British tourists are still keen to visit the islands, however, which Andreadis attributes to “favorable exchange rates.”

Rumors of a government proposal to increase the VAT on the luxury travel market on the Greek Islands, and a possible higher sales tax for luxury accommodations also contribute to concerns.

“Italy, Spain and France have a tourist VAT of 10 percent; Turkey and Cyprus even less –not to mention the Canary Islands where there is no VAT. If we increase the VAT to 13 or 14 per cent, then we would practically go out of business,” says Andreadis.

The Greek Exit

Ongoing questions over Greek repayment of debt, loom over the markets and cast a shadow on the Greek summer. According to the Financial Times, “One-third of large investors expect a Greek exit from the Eurozone as negotiations between Athens and its creditors over a desperately needed €7.2bn bailout package deteriorate.”

“A Grexit would not alleviate the crisis; quite the contrary, it would be a hard blow for us,” Andreadis says.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Photo credit: Oia is a well-known tourist area in Santorini, Greece. Harvey Barrison / Wikipedia