Skift Take

There's something to remaining a private travel company, not to mention one of the world's largest, like The Travel Corporation. The company is private and profitable and gets more freedom and flexibility than public companies that have to answer to shareholders every quarter.

The Travel Corporation, with its portfolio of more than 25 brands, takes nearly two million travelers around the world annually on guided holidays, luxury river cruising, and youth travel.

Despite being a specialist in guided holidays with fairly prominent brands, including Trafalgar, Insight Vacations, Brendan Vacations, Uniworld Boutique River Cruise Collection, Contiki Holidays, Evan Evans Tours, and the luxury Red Carnation Collection of boutique hotels, the Travel Corporation historically has had trouble getting the major online travel agencies to promote its wide variety of tours.

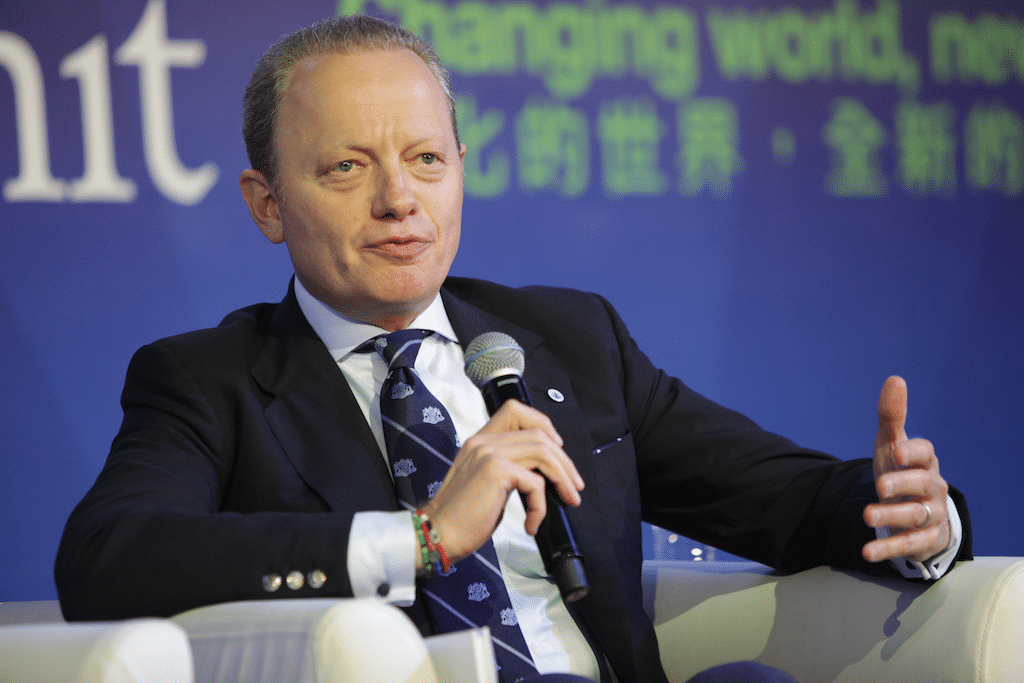

CEO Brett Tollman brings more than 30 years’ experience as a travel and hotel executive to the role, as well as four generations worth of leadership in the privately held company.

Skift recently sat down with Tollman to talk about his views on the uphill battle to get online travel agencies to sell his tours, recent merger and acquisition as well as he has a skeptical view on the wisdom of consumer advertising.

An edited version of the interview follows:

Skift: You’ve said before you wish Expedia and Priceline would sell more of your tours. Where are you with that?

Brett Tollman: I’ve had conversations ongoing now for several years, it started with Dara [Khosrowshahi] at Expedia about four years ago. That didn’t get anywhere because at that time they were consolidating their [technology] environment onto one platform, I think the U.S. one, and since then I haven’t been able to gain any traction with them.

I met with Darren [Huston] at Priceline last year and we had a great conversation and apparently they’re putting a [request for proposal] together or doing something to see how they can bring on some of our niche products, what we call guided vacations and escorted journeys. Trafalgar uses guided vacations and escorted journeys is what Insight Vacations still uses. I’m hoping to hear from the folks at Priceline soon.

We’re a niche product so I completely understand and respect why they haven’t engaged with us to date. Their core business is obviously hotel, car, flights and then ocean cruising. Those are obviously huge volumes for them and the priority and focus of their IT is all around its integration with APIs, white labels and whatever it is they’re doing.

We did do some work with Expedia about five years ago in Canada and that dropped off for a number of reasons. It was really us and G Adventures that started it and we’ve never really been able to resuscitate it since then. Again, we perfectly recognize that the OTAs are an incredibly powerful and important channel and a dominant one in certain sectors and we embrace that.

I hear some people in the industry talk about the “ultimate evil empire” and that we have to do different things to combat and fight against it. I don’t think you can really stop the power and influence of Expedia and Priceline today and we certainly want to work with them rather than find ways to work against them.

We are live with Priceline with river cruising but that comes through a third party. [Priceline] hasn’t started incorporating river cruising yet into their API as they continue focusing on ocean cruising so it looks like we’re still on the back burner there as well. We’ll just keep being the squeaky wheel and try to get there and the commissions OTAs could make are substantial.

Skift: You’ve also said you consider your brands “channel agnostic” and don’t care where guests book. So if Expedia and Priceline don’t work out for you, it’s not the end of the world, right?

Tollman: Absolutely, our businesses are very successful today. As a privately run, family run business we have no debt. Being private we have none of the public market pressures like what are the next quarter’s requirements or standards from a profitability standpoint. We certainly see OTAs as a potentially significant game-changer but it’s not the end of the world.

At the end of the day it comes down to the consumer. If a customer wants to book through a brick and mortar travel agent, we want them to be able to do that. We just want the business.

Skift: Say Expedia and Priceline do start selling more of your tours someday. How does this change the definition of who your customer is and how you think of the customer?

Tollman: We don’t see it changing. Some of our travel trade partners globally look at the customer as their customer so to speak and they’re very weary of letting us do co-branded communications with them. In Australia, for example, a customer will typically book with us potentially nine months in advance of travel. In the U.S. it’s about four to five months and these booking windows continue to get smaller. In China they do it on their mobile devices on the way to the airport.

That period between when someone books and pays and travels is a fantastic opportunity to really nurture that relationship and send them information about their trip. And we very much respect if a customer booked with a travel agent as we will never try to get them to book directly with us next time.

No one owns a customer. The customer is king per-say as the old adage goes and a brand is being short-sighted if it thinks that it owns the customer. No one owns an individual and that individual has so many options for how they can book a holiday today. For us it’s about trying to broaden the ways they can find us, whether it’s going to an OTA or if they walk into a AAA office.

Our challenge is similar to what brands face in supermarkets: How do you get your products on the shelf? Because if it’s not on the shelf, they’re not going to buy it obviously. And I also don’t think we should expect a traveler to always buy from travel agent x or OTA y, whoever they get the best service and experience from is who they’ll want to repeat with.

Skift: With Expedia and Priceline in mind, there’s been a lot of mergers and acquisitions activity lately in travel and the tours and activities segment has experienced it too in the past year with TripAdvisor’s acquisition of Viator, for example. Thinking about all of these mergers and acquisitions who do you think is best positioned for growth moving forward?

Tollman: They obviously all have very different strategies, from Expedia and Priceline to the Chinese companies looking to buy hotel assets. I just read that the Westin Sydney was sold for 1.2 million Australian dollars per room and this is a fairly tired, 20-plus year hotel and the most money paid for a hotel in the southern hemisphere and that was bought by a Chinese company. I just find it mind-boggling some of the prices that these companies will pay.

Skift: So knowing this, what should travel startups, either in tours and activities or elsewhere in travel, focus on that are seeking merger or acquisition opportunities?

Tollman: I can’t say I’m an expert in that space but what seems to really be appealing today is volume of traffic and consumers. This is no different than what Facebook paid for WhatsApp with 350 million users at the time and no profitability. That seems to be the key appeal today. I think you worry less about profitability and more about your transactional or member usage volume and that it’s a really sexy new tool and is something that makes a lot of sense.

Skift: Let’s talk about how you market your different brands. You’re a huge company and obviously marketing strategies differ from brand to brand. What are some new things you’re doing in marketing?

Tollman: We’ve used a lot more drones recently across our brands for our video and always looking to try different things. We’ve just recently hired a luxury lifestyle speciality consultant who’s based in New York who works with a lot of luxury brands in the food and beverage space who’s working with us on Uniworld. We’re looking to grow our LGBT market for Uniworld and looking to focus more on that market for that brand since we haven’t previously.

Skift: Historically The Travel Corporation brands aren’t heavy with consumer advertising. Why is that?

Tollman: You’re in business to make a profit and if you spend too much on advertising it’s very hard to make a profit. I can’t imagine what [Viking River Cruises] spends a year on advertising, they must spend $100 million a year on all their aspects of marketing and they’re everywhere but I don’t know how they make a profit because they finance a lot of their ships.

That’s just not a model we believe in. We believe a sustainable, well-balanced business is one where you need to make a profit and we don’t believe in financing if we can help it.

Skift: In between making a profit and keeping guests central, what are some surprises you’ve learned from your guests so far in your career?

Tollman: There are many. When people choose where they’ll go on holiday they typically choose the destination first and then decide whether it will be an ocean cruise or if they’ll fly there or whatever. The thing we find most interesting from a marketing perspective is that people want to see an image of a destination but they don’t necessarily need to see that destination photo of Florence or Rome with people actually in it. That’s always an important reminder of the power of people’s minds and creativity to visualize themselves in the destination.

From an experience standpoint, how much people appreciate great service. Great service being warm and friendly, not too solicitous and not too arrogant. You also can’t say that you understand your customer because every customer is different since everybody isn’t homogenous.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: ceo interviews, expedia, priceline

Photo credit: Brett Tollman, the CEO of the Travel Corporation at a World Travel & Tourism Council event on April 25, 2015. World Travel & Tourism Council / Flickr.com