Skift Take

The Priceline Group won't admit it but its management is feeling the heat from Expedia Inc.'s moves. Adding Orbitz Worldwide to Expedia Inc. will only increase Expedia's inorganic growth, which is growth nonetheless.

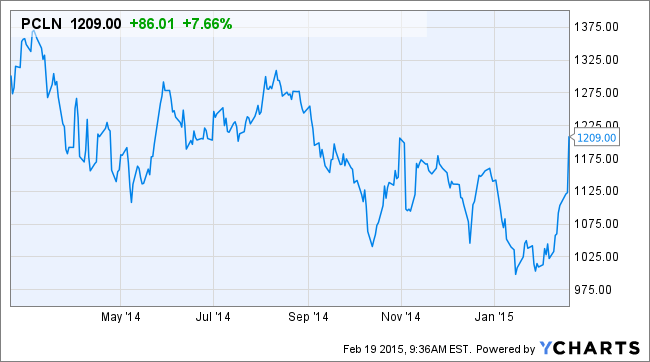

After years of setting the pace, the Priceline Group is feeling the heat from a rejuvenated and acquisition-happy Expedia Inc. and Priceline Group CEO Darren Huston has taken a shot at Expedia’s growth strategy.

Asked during today’s fourth quarter earnings call about Expedia Inc.’s suddenly faster growth than the Priceline Group’s, Huston said the Priceline Group prides itself on highly profitable growth, adding that his company’s 24 percent room night growth in the fourth quarter was “100 percent organic.”

The Priceline Group is focused on premium brands and “on organic growth and execution,” Huston said.

The implication is that Expedia Inc., with its acquisition of Travelocity and pending acquisition of Orbitz Worldwide, is not focusing on premium brands.

Referring to Expedia Inc., which saw its hotel room nights grow at a faster clip, 28 percent, during the fourth quarter, Huston said Expedia’s growth has come from “doubling and tripling down on existing brands.”

Expedia declined to comment.

Different Strategies

Expedia Inc. acquired Trivago in 2013, acquired Wotif in 2014, partnered with Travelocity in 2013 and acquired it in January 2015, acquired a majority stake in Expedia’s joint venture with AirAsia this week, and last week announced its intent to acquire Orbitz Worldwide for $1.6 billion.

Huston said he gives credit to Expedia Inc. but pointed to the Priceline Group’s “different philosophy” about building the company profitably and for long-term growth.

In the fourth quarter, Expedia Inc. saw its gross bookings increase 24 percent to $10.6 billion while the Priceline Group experienced 17 percent growth in gross bookings (23 percent on a local currency basis) to $10.7 billion.

While Expedia Inc. and the Priceline Group fought to a dead heat in the size of their respective gross bookings in the fourth quarter, Expedia Inc.’s grew faster.

Hotel Room Nights

On the room night front, Travelocity and Wotif contributed 5 percentage points to Expedia Inc.’s 28 percent growth in the fourth quarter. Thus the organic growth of around 23 percent would have been very similar to the Priceline Group’s.

Expedia Inc.’s Trivago hotel metasearch company, the fastest-growing weapon in the Expedia Inc. arsenal, experienced 68 percent revenue growth in 2014 to $410 million while squeezing out a relatively small $4 million in EBITDA.

Expedia’s strategy for Trivago is top-line growth at the expense of profits while the Priceline Group’s strategy for both Kayak and OpenTable is slower top-line growth with profits built in.

Let’s Be Perfectly Clear

Huston said he doesn’t see Expedia Inc.’s acquisition flurry “overall as negative,” adding that it helps to define the competition more clearly.

He said the Priceline Group has plenty of room to grow.

“If you look at the U.S. specifically, for us it is all upside,” Huston said.

Built on an aggressive TV advertising campaign, the Priceline Group’s Booking.com has been growing at a fast clip in the U.S., and likely has been taking some share from Expedia Inc.’s roster of brands.

Hotel B2B

In other news, Huston said the Priceline Group has rebranded its fledgling hotel B2B product as Booking Suite and the Buuteeq and Hotel Ninjas teams, brought on with 2014 acquisitions, have been integrated into Booking.com.

He said Booking Suite is in the marketplace now building the business and it has the side benefit of “bringing us closer to our hotel partners.”

Airbnb

Huston contrasted the high-friction in booking rooms through Airbnb and some vacation rental sites with the Priceline Group’s tack of having instantly bookable vacation rental properties.

He said the Priceline Group’s hotel business is not feeling a negative impact from Airbnb and other sharing economy companies, although this could change in the future.

Airbnb is helping the Priceline Group by getting laws changed or at least defined in cities that Airbnb enters, he says. Noting that the rules in the sharing economy sector have always been “foggy and gray,” Huston said “we are always going to play on the white side of the rules.”

Huston said the Priceline Group’s room night growth has been propelled by increased supply, especially from vacation rentals.

He said the next phase in vacation rentals for the Priceline Group would be increasing supply in the vacation rental by owner segment as opposed to the property management sector.

HomeAway anyone?

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, earnings, expedia, hotels, priceline, vacation rentals