Skift Take

As banks develop new instruments to pitch credits cards and travel writers become more experienced in marketing them, it's likely that the industry will see an uptick in well-written, cleverly crafted ads. It's up to the reader to carefully figure out the difference.

Take a stroll through any raft of content in the business travel blog community and one trend will routinely present itself: credit card advice.

Over the past several years, content built around travel credit cards has been steadily increasing, so dramatically, in fact, that sites have popped up solely to discuss and promote the industry.

On the surface, the uptick in credit card content appears to be directly a function of new instruments invented in the space. Airlines and hotels all now have their own branded credit cards, using their points as an incentive to drive extra spending. Banks like Chase and Capital One have gotten into the game by offering broad credit card programs with multiple travel partners, allowing customers to store up masses of points and disperse them to airline or hotel programs as needed. With so many travel providers, so many banks and so many cards, it was natural that a cottage industry to sort through the best and worst deals would form.

That growth has also also been bolstered — perhaps artificially — by aggressive advertising and sponsorships. Banner ads, long forgotten as a viable revenue source, are slowly being replaced by credit card referrals and affiliate links that can earn $100 or more from each successful applicant — an amount that drastically outpaces revenue from advertisements.

Banks feed writers with updated content and promotions, and writers are incentivized to write about each update meticulously because of the high potential payout dangling in front of them.

Defining the Relationships

Broadly, the relationship between banks and writers is par for the course in the publishing industry. Airlines, for example, know the best and smartest reporters, work with them to create the best, proper content is built. It’s media relations by the books.

Where that relationship gets murky is in how that content is being presented to the consumer. In many cases, writers are being fed content from the banks and then turning around and profiting from the credit card referrals that they generate through the story. And while it’s reasonable to expect writers to profile any new credit card instrument or promotion, it’s also important that readers understand the source and purpose of the content. To that end, the government has stepped up to make those relationships more clear, now requiring that most content has a disclosure about affiliate links.

A perusal through BoardingArea.com, a popular points and travel portal, will often yield numerous articles about financial instruments and their headlining disclosures therein.

Further clouding the issue, however, is any editorial bias when a bank pays for ads or affiliate links directly on a consumer website. As highlighted in this Mr. Money Moustache post, advertisers like Chase aren’t above nudging the editorial in a direction of their choice — and when bloggers don’t step in line they risk losing their revenue stream.

Even on established sites, it’s not always clear who’s in charge. The Points Guy, which is home to Brian Kelly, is one such example. In 2012, Mr. Kelly sold The Points Guy to Bankrate, a publicly traded company that publishes and promotes financial content. While he retains editorial control, Bankrate provides organizational support and some affiliate links. But outside of two email addresses in the site’s terms and conditions, there’s no mention of the relationship with Bankrate.

“I still have a vested ownership interest in TPG and I retain 100% editorial control,” he tells Skift. “I leverage Bankrate resources as needed, but everything — from marketing, advertising and our SEM/SEO strategy is all internally managed and separate from Bankrate and any of their other owned and operated sites.”

Needless to say, there will always be some bias as long as advertisers are involved in editorial, and even The Points Guy admits to having blind spots, saying on its website:

Opinions presented on the site are those of Brian Kelly – The Points Guy, or our team of writers who at times may post their own opinions. While we do our best to report on recent and lucrative offers, the site does not include all available credit card offers.

In addition to the warning above, TPG has disclaimers about its relationships with card providers at the beginning of each post, even if it’s not directly related to card offers.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: points

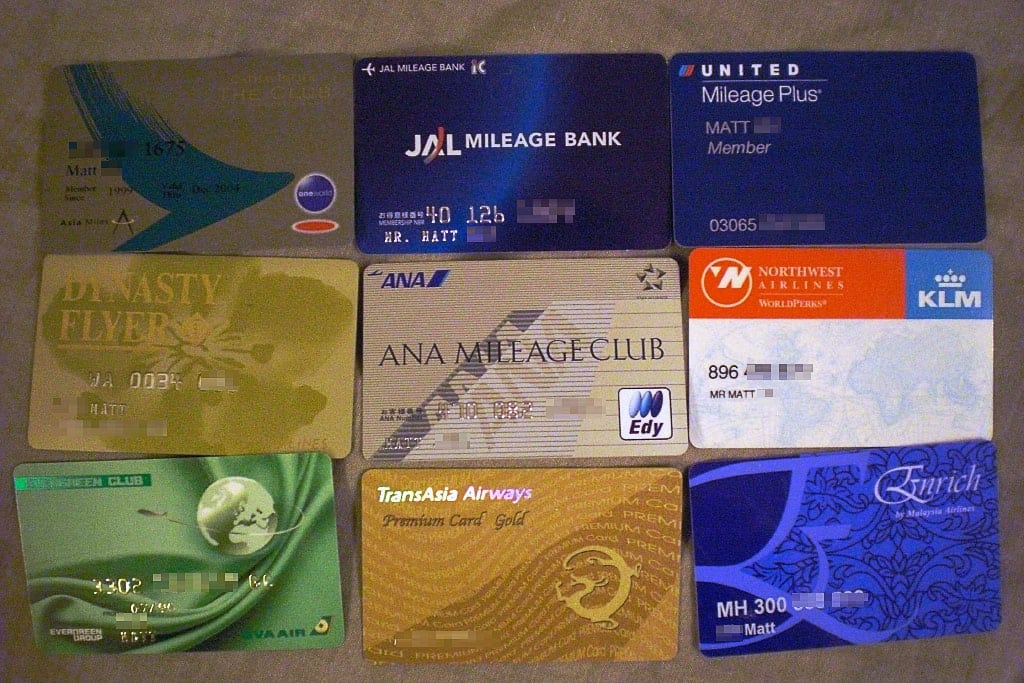

Photo credit: Loyalty cards spread out. Matt_Weibo / Flickr