Skift Take

Seems like a small amount of buying anything substantial, if you see startup valuations these days. It may need a lot more if it wants to make a difference against tough competition.

The Momondo Group, which includes the Momondo and Cheapflights brands, is in an acquisitive mood.

Momondo Group has secured an $8.3 million (actually GBP 5 million) revolving credit facility from Barclays to fund Momondo Group’s “global expansion and enable the business to move quickly to secure future acquisitions.”

London-headquartered Cheapflights Media acquired Copenhagen-based Momondo in 2011, and a year later rebranded as Momondo Group.

As the Cheapflights brand transforms itself from a deal-publisher into a metasearch company, like Momondo, the Group currently has a presence in more than 25 countries, and is looking to expand.

Hugo Burge, Momondo Group CEO, says the company is in the initial phase of looking at potential acquisition targets, and he declined to provide any details.

The company had borrowed $32 million in 2011 to acquire Momondo, and now that the debt has been paid down sufficiently, Momondo Group is ready for its next growth phase, officials said.

The $8.3 million revolving credit facility follows an announcement late last month that Momondo Group had hired Yannick Roux as head of corporate development.

Roux, who was part of the investment team in his prior role at Forward Internet Group, is charged with vetting “potential acquisitions, strategic investments and partnerships” for Momondo.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: cheapflights, metasearch, momondo

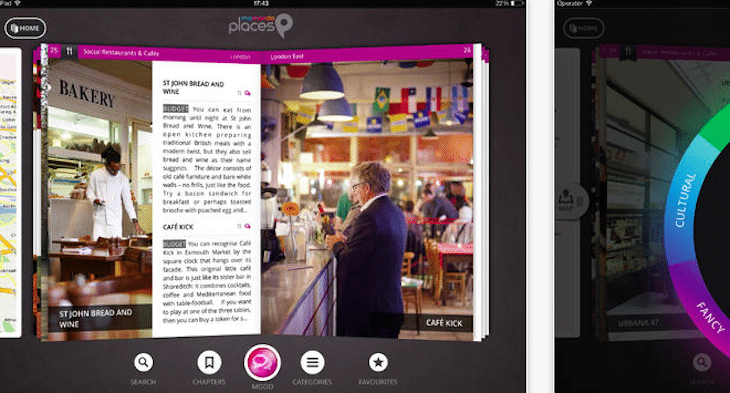

Photo credit: The Momondo Group is mulling acquisitions. Pictured is the Momondo Places iPad app.