Skift Take

What can dislodge Priceline's growth path over the next few years? How much of a dent can a large number two play? Are there any startups that would come up to change the equation completely? Seems unlikely on all fronts.

With a market cap of about $61 billion, Priceline Group is the world’s most valued travel company, surpassing Las Vegas Sands’ market cap of $59.85 billion.

Despite that, the company’s stock has been down about 15 percent over the last month, and no one really knows why. What are the big growth opportunities left for the company going ahead? The analysts at investment bank Piper Jaffray took a crack — in an analyst briefing to clients yesterday — at why they think there is still a lot of runway to grow for the company. And it all boils down to one word: global.

It sees two major global trends in online travel, and says that Priceline is set up well for them: 1) the increasing penetration of online bookings internationally, and 2) the shift of travel ad dollars to online. 85% of Priceline bookings are international (outside of U.S.) and its Kayak acquisition provides exposure to online ad growth.

Here is how is justifies its growth projections, and the reasoning looks solid:

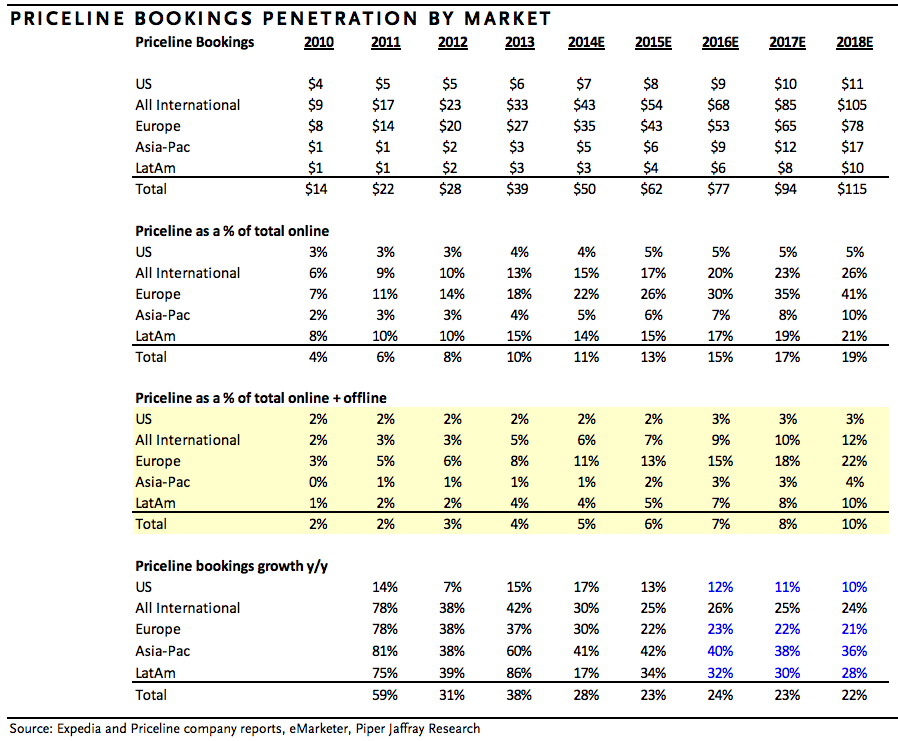

We believe Priceline’s share within the broader global travel market is just 4%. Priceline’s Asia-Pac (Agoda) and Latin America (Booking.com) businesses are growing quickly off of

small bases and, we think, driving Priceline’s international travel bookings growth above 25% during the next two years.The Asia-Pac and Latin America travel markets, when combined, are larger than the U.S. market at approximately $380B vs. $310B according to Expedia and Priceline company reports and growing significantly faster. We also note that Priceline’s Europe business is far from mature and also likely growing above 20% today driven by Booking.com. The European travel market is worth approximately $325B according to Expedia and Priceline company reports, suggesting that Priceline’s European share is just 8% according to our estimates. In short, we believe there is plenty of ceiling room for growth during the next 10 to 20 years.

The chart below by PJC shows current Priceline business as part of overall travel booking business, and the growth left in it, both as booking becomes online, and as the company builds its global business.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: agoda, booking.com, priceline

Photo credit: The growth of Priceline Group is all international, and the engines are Agoda and Booking.com.