Skift Take

As investors consider the looming Sabre IPO, they'll have to consider how adverse the impact would be if Expedia opts to terminate its Travelocity agreement with Sabre during the course of its 9-year term.

Sabre announced that it plans to price its IPO on or around April 16 as it aims to raise $895 million or so to pay down debt, and its roadshow presentation highlights how the ultimate fate of Travelocity looms as a lingering issue that investors would have to factor in.

Under a strategic marketing agreement signed last year and quietly amended in March 2014, Expedia agreed to power Sabre’s Travelocity sites in the U.S. and Canada, and provide access to its hotel supply and customer service capabilities. The amendment changed the commercial terms and extended the pact a year so that it now runs nine years.

Under the terms of the agreement, Expedia has the right to terminate the pact if the deal doesn’t meet certain revenue thresholds, and Sabre states that any early termination by Expedia could “result in a significant impact on earnings.”

Sabre CFO Rick Simonson explains in the roadshow presentation that Expedia also has a call option to acquire Travelocity at fair market value, and if Expedia exercises it then that would provide cash to further help Sabre pay down debt.

It is abundantly clear that resolving the problem of Travelocity, which had been wracking up losses, was key to progress in Sabre’s IPO try, and Travelocity’s disposition still hangs over the process.

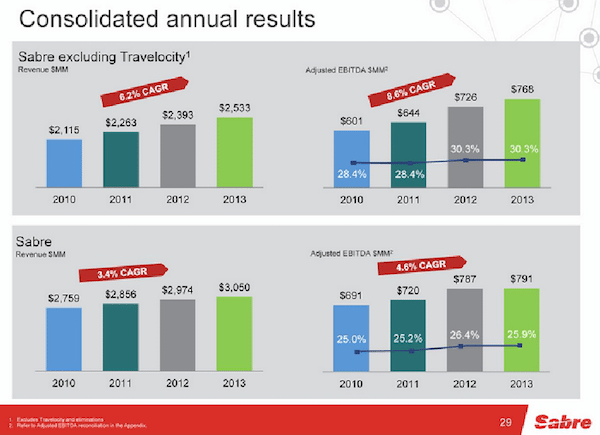

Sabre prefers that would-be investors consider what would be its respectable 6.2% compound annual growth rate from 2010 to 2013 if Travelocity’s performance wouldn’t have been there to drag things down.

Put Travelocity into the mix and Sabre’s CAGR during that period falls to 3.4%.

By rough comparison, when Hilton Worldwide filed its IPO registration statement last year, the hotel chain reported that its CAGR from January 2000 to June 2013 was 6%.

The majority of Travelocity’s air and hotel product has been migrated over to the Expedia technology platform, and Sabre officials say it has been going well, with volumes and conversions increasing.

“The result is an asset light, people light, investment light business model,” CFO Simonson said.

During the term of the agreement with Expedia, Sabre’s revenue from Travelocity would decline, but its EBITDA from Travelocity should be more predictable, Simonson says.

Meanwhile, Sabre is presumably having meetings with investors over the next week in the run-up to the April 16 IPO try, arguing that its business “fosters a vibrant culture of invention” for airlines, hotels, travel agencies, corporations and travelers.

While competitors provide some of the solutions during the travel cycle, “Sabre uniquely sees the entire puzzle,” said Sabre CEO Tom Klein.

Investors will have to calculate how Travelocity fits into the entire Sabre puzzle, as well.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: ipo, sabre, travelocity

Photo credit: Expedia is now powering the air and hotel products on Travelocity.com and Travelocity.ca. 109792