Skift Take

Is the quality of Gogobot's user generated content really enough to make a difference as it launches hotel metasearch and brings itself into conflict with more well-heeled rivals? Gogobot thinks so, but it really has a lot to prove.

If the U.S. hotel metasearch field was already crowded with players such as Kayak, Trivago, Hipmunk, Room77, and others, there’s a new kid entering the competition, namely Gogobot.

Founded essentially as a social travel site in 2010, Gogobot has been earning revenue over the last 15 months from advertising and by linking off mostly to Booking.com for hotel transactions, but Gogobot was losing bookers as travelers shopped around elsewhere to ensure they were getting the best rates.

With the launch of hotel metasearch, Gogobot hopes to close that gap and to reduce the number of sites that people need to shop by combining comparison shopping for hotels from numerous online travel agencies with its ratings, reviews, filters and community, which it divides by special interests into “tribes.”

“Our goal is to bring that number down and to be the go-to place when people are planning their travels,” says Travis Katz, Gogobot co-founder and CEO. Katz cites Google statistics that travelers may visit 32 sites in the trip research process before making a booking.

Gogobot brings some assets to its entry into metasearch that in the big picture have parallels, albeit on a more modest scale, to TripAdvisor’s. Gogobot has some 650,000 ratings and reviews, and 4 million photos so travelers can do research to supplement their bargain-hunting.

Gogobot doesn’t have the depth of TripAdvisor’s content, of course, but it has more trip-planning information, with professional and curated guides, as well as user ratings and reviews, than do most of its transaction-focused competitors.

Gogobot is indeed starting with a base of traffic, which Katz says is 93% organic.

SimilarWeb statistics from February 2014 show Gogobot ranking third among Hipmunk (1), Trivago (2) and Room77 (4) in traffic. Kayak trumps them all in the U.S.

And, comScore statistics from January 2014 portray Gogobot as second in traffic behind Trivago and ahead of Hipmunk and Room77.

Katz says Gogobot has attracted 15 million visitors in the last 12 months, citing its Google Analytics tracking.

Gogobot’s hotel metasearch is now the default type of search on its homepage, and on the first hotel search results page users can view a property’s photos, reviews, and recommendations from Gogobot’s “tribes” such as those in Luxury, History and Business.

Katz views this community content as a differentiator, and a competitive advantage. As with TripAdvisor, travelers won’t necessarily navigate directly to Gogobot’s hotel metasearch, but may end up there after researching a destination or viewing other users’ recommendations.

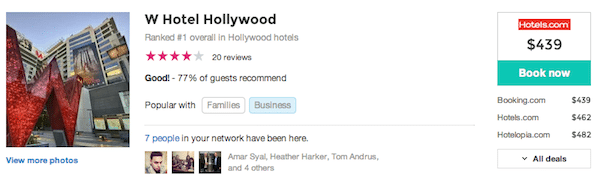

Gogobot metasearch, which will be hotel only and is just on desktops for now, prominently features the low rate from the online travel agency that won an auction to get there. Rates from other online travel agencies, including Booking.com, Hotels.com, Venere and Hotelopia might appear lower in a smaller font.

When users select “all deals” they may see results from well over a dozen online travel agencies to get a full view of the market.

Katz doesn’t believe Gogobot metasearch should be considered a “me-too” product because of the site’s other content, but he doesn’t underestimate the challenge of working out the glitches, kinks and business challenges.

He’s well aware that TripAdvisor took almost a year to transition to a “revenue neutral” environment when comparing the monetization of its former pop-up model and the hotel metasearch feature that TripAdvisor launched in 2013. Unlike just about all other metasearch players, Katz says Gogobot doesn’t intend to supplement its income with pop-ups.

You can expect that Gogobot, with some $19 million in total funding and revenue growth of about 50% per quarter over the last five quarters, according to Katz, will be ramping up search engine marketing spend to some degree.

“We have been doing testing on where we will deploy our money once we feel like the new funnel is tuned on the metasearch side,” Katz says.

Katz doesn’t see this next phase in Gogobot’s growth as some big pivot or rejection of the social aspects of trip-planning.

Critics will say there never was much money in social travel, as startup after startup withered and died.

“We don’t see it as a pivot, but a natural and logical evolution of what we are doing,” Katz says.

Gogobot tilted toward the hotel side of the business for monetization around 15 months ago to supplement its advertising revenue, but was losing too many transactions as travelers searched elsewhere for pricing.

Now Gogobot will have to prove that its social content is truly a meaningful differentiator from its new hotel metasearch rivals.

Either that or it will have to spend a lot of marketing money to break out of the pack.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: gogobot, hotels, metasearch, ugc

Photo credit: Gogobot debuted hotel metasearch and in so doing confronts competition from a whole new set of more well-established rivals. Gogobot