Skift Take

The generation that came of age indebted may aspire to ownership, but it is willing to settle for access to such things instead.

Last month we released our latest trend report, “What the Sharing Economy Means to the Future of Travel“, the most definitive report ever done about the effect of sharing economy in the travel industry, and learnings for incumbent players in the travel industry to avoid disintermediation. Below is an extract from the report. Get the full report here.

In their 2011 book “What’s Mine Is Yours: The Rise of Collaborative Consumption“, Rachel Botsman and Roo Rogers identified technology, cost consciousness, environmental concerns, and a resurgence of community as the main drivers of the sharing economy. Dutch academic Pieter van de Glind confirmed this in a survey.

“Practical need, financial gains and receiving praise from others are the main extrinsic motives. The main intrinsic motives are social and environmental. Besides motivational factors, networks, (social) media and recommendation prove to be explanatory factors for the willingness to take part in collaborative consumption,” he writes.

Several major economic, social and technological changes that came about in the later part of the last decade made the sharing economy grow into a significant part of the travel industry.

Economic Factors

Americans and Europeans know that relatives who lived through the Great Depression had a skill for thrift. People who deal with lean times tend to waste as little as possible, and reuse disposable items that others may throw away without a thought. This current generation of travelers who experienced the late 2000s economic collapse and subsequent fiscal austerity are similarly price and efficiency-conscious — but they have the tools to connect owners of transportation and space to those who need it.

“Renting and sharing allow us to live the life we want without spending beyond our means. Not all of it is intentional, mind you: low cash flow (or none at all) is most certainly driving many customers to rent rather than buy,” says Sarah Millar at Convergex Group, a brokerage. “Many of the sharing and rental services you can find on the Internet, for example, were founded between 2008 and 2010 – that’s not a coincidence.”

Academic studies of attitudes and motivations for participating in collaborative consumption point to economic benefits as the main driver. Juho Hamari and Antti Ukkonen of the Helsinki Institute for Information Technology found that money-saving is more prevalent for motivating people to participate.

“[Collaborative consumption] has been regarded as a mode of consumption that engages especially environmentally and ecologically conscious consumers. Our results, however, suggest that these aspirations might not translate so much into behavior as they do into attitudes,” they write.

Even those who aren’t directly affected by the rise in unemployment in rich countries since 2007 are eager to find ways to save on travel. While incomes stagnated, households had extra pressures such as mortgage debt, while the younger population in America struggles to pay off student debt. Meanwhile, gas prices, and therefore, airfare increased and hotel rates stayed the same. The growth of the sharing economy took place alongside declining rates of home and car ownership in the United States and Europe. The generation that came of age indebted may aspire to ownership, but it is willing to settle for access to such things instead.

Such travelers are more aware of idle or excess assets. Sharing allows owners to make money from their idle cars, reducing the cost of ownership, and gives potential car renters another option that is usually cheaper than a mainstream car rental. Thus, sharing expands options and helps people save money. A study sponsored by Airbnb found that 60 percent of adults agree that “being able to borrow or rent someone’s property or belongings online is a great way to save money.”

Another economic trend that contributed to the growth of the sharing economy is the prevalence of venture capital to fund the startups that champion the concept. According to a study of 200 collaborative consumption startups by Jerimiah Owyang at Altimeter Group found that they have enjoyed a collective $2 billion influx of funding. The average funding per company was $29 million. This enabled these new companies with novel business models reach a wide audience and grow very quickly.

For more analysis, get the full report here.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: sharing economy, Travel Trends

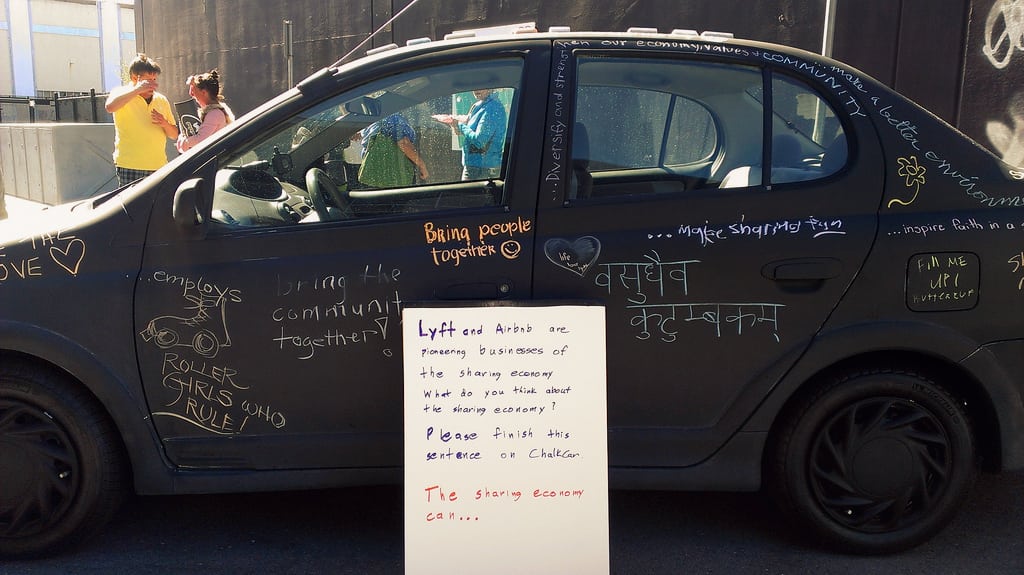

Photo credit: What sharing economy means for the future of travel. Citymaus / Flickr