Skift Take

Hotels and the sharing economy don't compete as much as they complement one another. Understanding what makes the innovators work, though, can improve the operations of hotel chains and properties.

Last week we released our latest report, “What the Sharing Economy Means to the Future of Travel“, looking at the economic, social, and technological changes that are driving customers toward the sharing economy and how it is affecting the incumbent players in the travel industry. It is the most definitive state-of-the-market report on this big growth sector in travel. We’re extracting a portion on its effects on the hotel industry below. Get the full picture, buy the report.

The sharing economy should not be viewed as a threat to the hotel industry. The fast rise of sharing startups notwithstanding, they still make up just a small fraction of the one billion yearly U.S. room nights.

“The meteoric rise of Airbnb.com, booking more than 10 million nights since its inception in 2007, should not cause the hotel industry to worry about the vacation rental market. Both business models have co-existed for a significant amount of time without infringing on each other’s growth,” says Michelle Grant, Travel and Tourism Manager at Euromonitor International. “There may be a bit of a substitution effect with leisure travelers seeking out less expensive accommodation options during times of economic distress — which may be something hotels need to keep an eye on.

The much older vacation rental market is less of a competitor than a completely different service. IT is an example to learn from, not a threat. Grant points out that self-catering and private accommodation, the bulk of vacation rentals, accounted for $77 billion in revenue in 2011, up 98 percent since 1999. Total global hotel room revenue was $429 billion in 2011, up 83 percent over the same period.

Also, sharing sites work best in cities with already high hotel occupancy rates. For the most part, business travelers that adhere to corporate travel policies aren’t likely to have the choice of using a stranger’s guest bedroom.

Amenities

One place to start is to reconsider ancillary fees for Internet use and telephone calls. Guests are increasingly expecting connection free of charge. An obviously high markup for essentials like Internet use feel like even more of a ripoff after enjoying them for free on your last peer-to-peer rental stay.

Some hotels are coming around, says Gonzalo, the Internet marketing expert. He points to Kimpton Hotels’ loyalty program as a fine example. It gives you a minibar allowance, fee WiFi, and complimentary use of items such as hairdryers and computer chargers and complimentary toiletries such as toothbrushes.

Another perk that could make hotels more attractive, especially for families, is a kitchen. Gonzalo says that the Hilton Garden Inn’s suites with kitchen amenities are more consistently booked, and guests tend to stay longer.

Unique Local Experience

Staying in a hotel isn’t quite the same as living like a local and sharing their bathrooms, but hotels can still deliver a unique experience. Many hotels such as the Park Hyatt are offering one-of-a-kind local tours to guests. Some higher-end hotels such as the Ace are seeing success in attracting guests and locals to their lobby and restaurant. Inviting local musical acts to play in the lobby is one way to make the hotel stand out. Another possibility is inviting local chefs to give guests cooking classes.

In the past few years, there has been an explosion of sharing startups that allow residents in a destination to act as tour guides. If hotels partner with them hotel visitors could get a taste of the sharing economy and meet locals. Sharing startups such as Cookening, Bienvenue a Ma Table, and EatWithALocal that could give tourists an authentic experience that they might have with an Airbnb host.

Above all, hotels with a cookie-cutter experience will have a harder time appealing to the customers most likely to try sharing.

Personal Connections

Not everyone wants a single-serve friend, but community is a strength of the sharing economy that could also work for hotels.

Extensive training for staff is more necessary than ever. Most guests come equipped with devices with access to almost all human knowledge. Staff should be at least as helpful with local knowledge. Boutique hotels have a huge advantage here. Joie de Vivre Hotels, one of the biggest boutique chains in the United States, is a fine example. Each JDV is unlike the others, and the concierge staff have detailed profiles and are encouraged to give guests personal advice. JDV’s founder and former CEO, Chip Conley, recently joined Airbnb as its head of global hospitality.

Hotels Have Inherent Advantages

Hotels offer standardized service that make it appear safer than the sharing competition. Peer-to-peer accommodation rarely offers reliable instant booking. Many potential guests are put off by negative publicity about services like Airbnb, and don’t want to run the risk of having a bad experience with a property owner. In some cases, peer-to-peer accommodation is technically illegal. Older travelers are coming around to sharing, but are especially leery of interacting with strangers met over the Internet. With a hotel, there is an expectation of predictably good service and there is a clear answer for who can fix problems. Hotels must continue to leverage loyalty programs and branding while they incorporate some of the economic and social advantages of the sharing economy.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, homeaway, kimpton, sharing, strategy

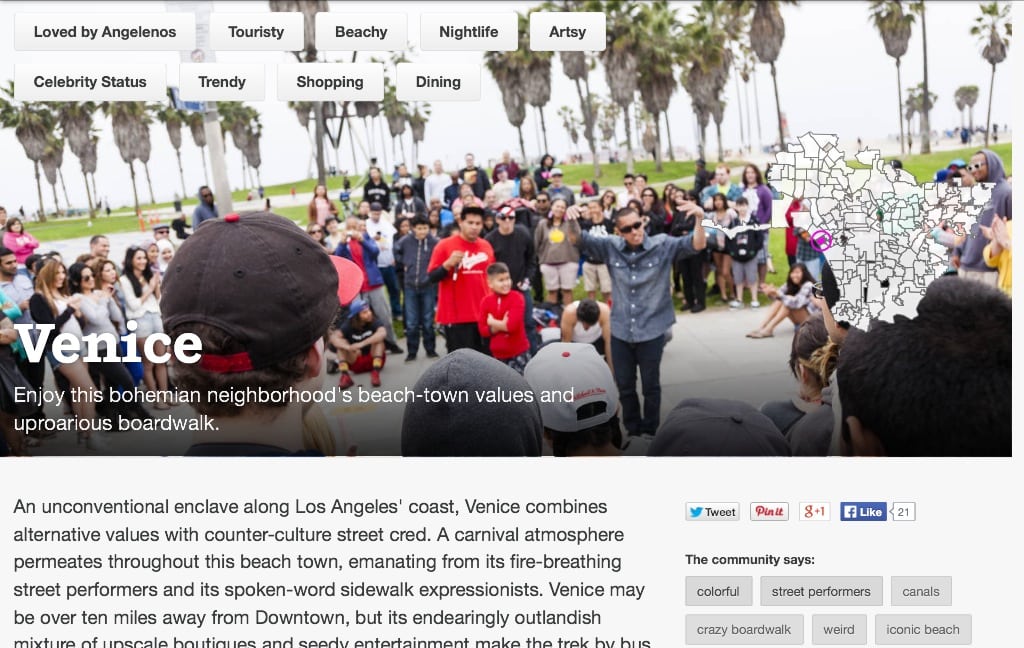

Photo credit: Airbnb has neighborhood guides for multiple destinations where it has listings. Airbnb