Skift Take

Car-hailing apps are the hot thing in ground transportation, but they'll need a big market to succeed. We see a few glimpses of that here, as well as a few things that could be speedbumps for the services.

If the tech blogs and venture capital activity is anything to go by then taxi- and car-hailing apps are the next big thing in ground transportation. The two leading services, Uber and Hailo, have collectively raised over $100 million to fuel their global expansion. Smaller players like TaxiMagic, Lyft, and Sidecar have also made headway into cities in the U.S. and North America.

Each service offers something slightly different, but they all share a basic premise: It’s better to connect with a cab, car service, or ride via a smartphone app, preferably one that also handles the fare and the tip, too. For drivers, the apps can be an easier way to connect with potential fares in disparate places during slow times, or make a killing thanks to surge pricing during peak hours or special events.

While the apps are fun to use, we wondered just how much people care about being able to command a car by smartphone.

Important: The survey is not done on Skift readers but the general U.S. internet adult population through Google Consumer Surveys. See previous Skift Asks here.

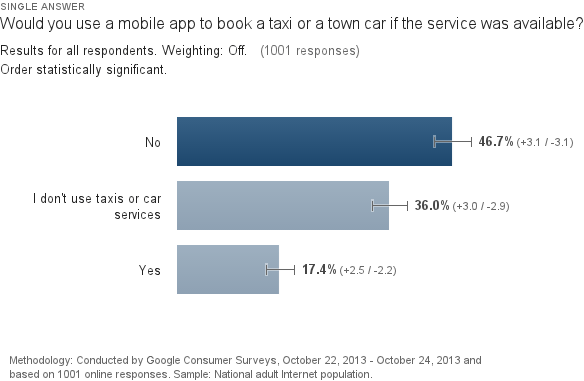

We asked users in our survey “Would you use a mobile app to book a taxi or a town car if the service was available?” The vast majority of respondents won’t be signing up any time soon. 47% said “no” and 36% said “I don’t use taxis or car services.” Just over 17% said “yes.”

This wasn’t a huge surprise. As we’ve noted before, the potential market for taxi-hailing apps is small, and cities such as New York, San Francisco, and Los Angeles represent over 50% of the traditional tax and car service revenues, and a larger portion of the app-driven ones. If the apps are going to succeed, they’ll need to nail California and the Northeast, and they’ll need to convert some people who don’t currently use taxis and car services.

This single-question survey was administered to the U.S. internet population from Oct. 22-24, 2013 through Google Consumer Surveys, with 1,001 responses. The methodology is explained here.

The headline takeaway: The U.S. is not crying out for taxi-hailing apps, but a there’s enough opportunity in that 17% that app companies don’t need to start planning their pivot.

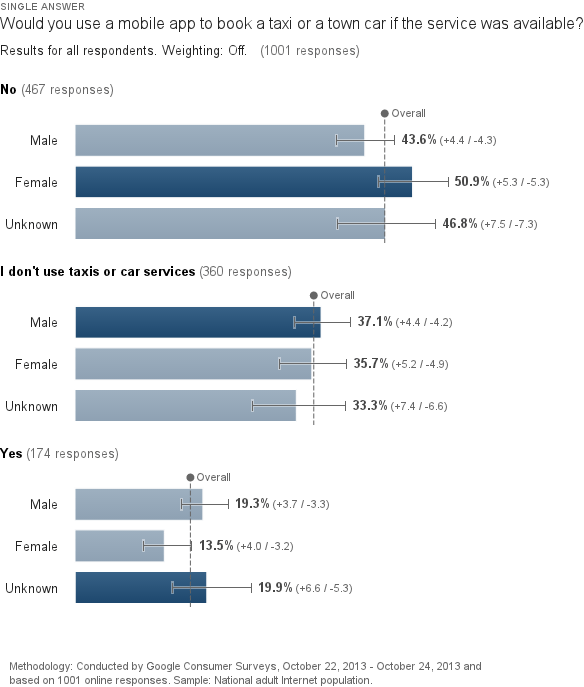

The takeaway: Even though it looks as if genders are evenly split here, the large number of ‘unknown’s in the survey results throws the gender answer.

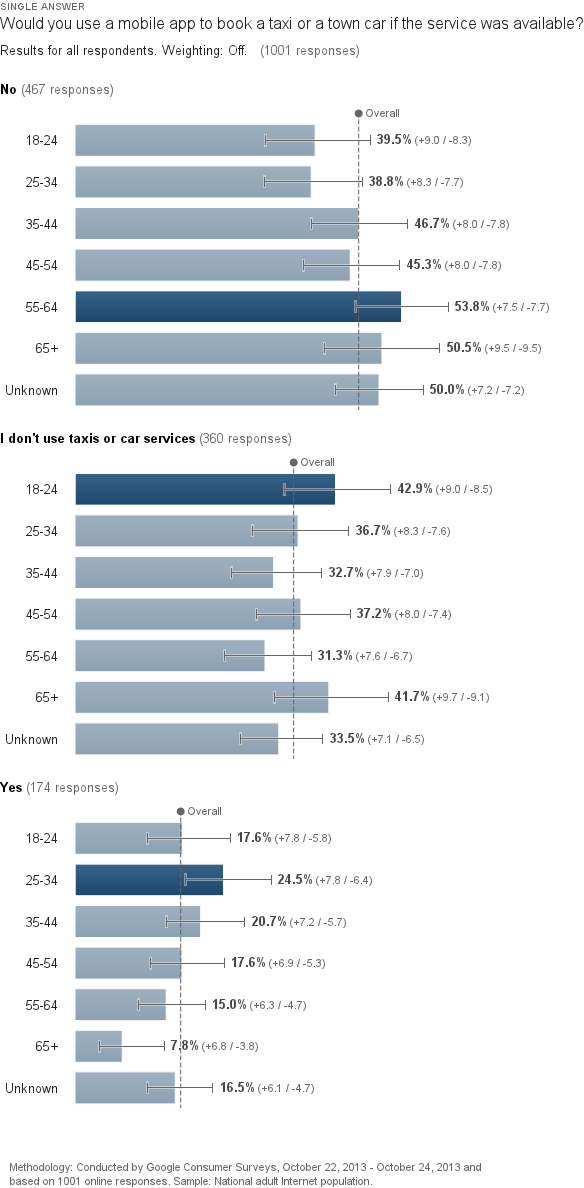

The takeaway: The biggest demographic opportunity for these services is exactly where the apps would want it to be, the always-connected 25-34 demo.

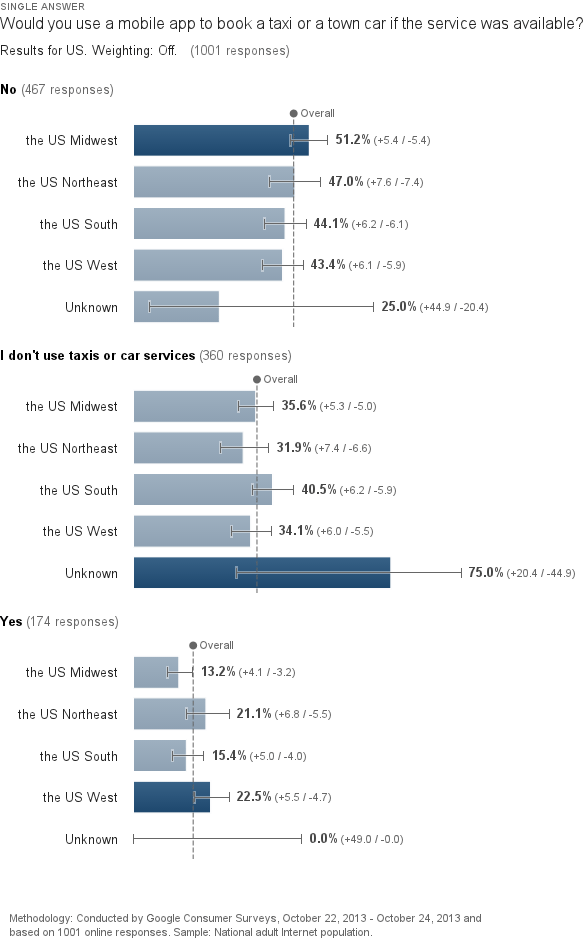

The takeaway: Good news for the apps here. The Northeast and the U.S. West are the markets they need to own if they’re going to grow, and they’re the two most likely regions where our respondents would use the apps.

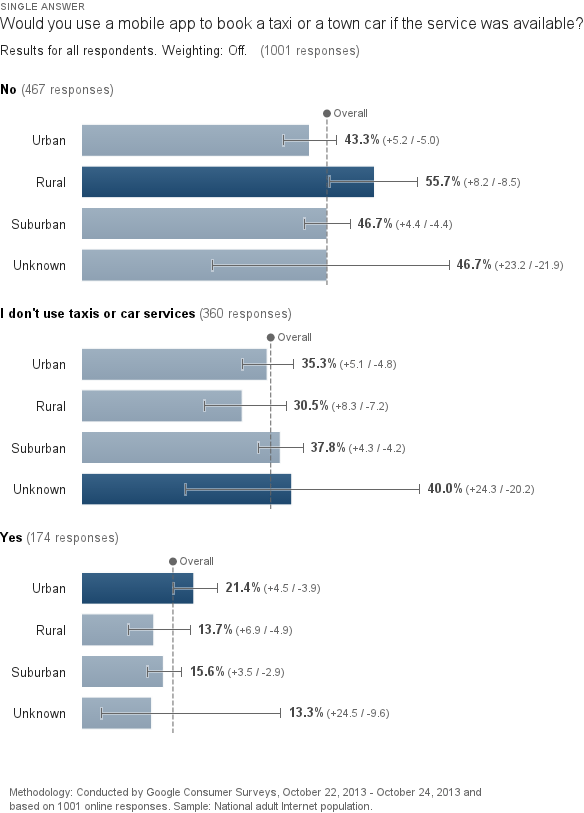

The takeaway: No surprise here, as urban areas are the heart of the taxi business.

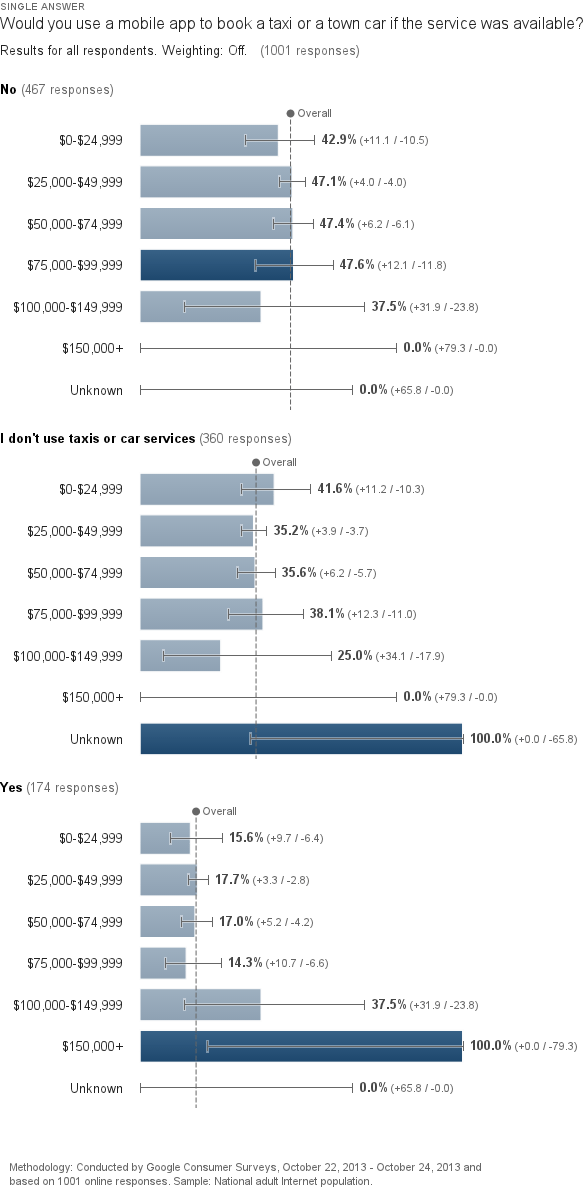

The takeaway: The lower your income, the less likely you are to use an app to hail a car. But if you’re making north of $100K, it’s a much more attractive idea. The services only need to worry when the luxury of a car becomes one expense too much.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: hailo, lyft, sidecar, skiftasks, uber

Photo credit: Limousine driver Florian Bucea checks his Uber service in Chicago, Illinois, on March 25, 2013. 93219 / 93219