Skift Take

Some travel companies took compare tools like Booking Buddy's and pre-checked several windows, driving up their own click revenue and exasperating consumers who unknowingly found their computer screens flush with pop-under windows when they started to search. CPC rates charged to advertisers became subject to a downward spiral, and although the model is still widely used, metasearch stole some of its thunder.

You’ve heard about game-changing travel companies such as Travelocity in its early days as a Travel 1.0 online travel agency, Expedia and Hotels.com as they developed the hotel merchant model, and Kayak with all of its sliders and filtering gadgets en route to refining flight and hotel metasearch.

But, one company that has never gotten its due — until now — for the manner in which it transformed the way people book travel online, and the method in which airlines, hotels and online travel agencies advertise on the Web, is BookingBuddy.

To this day, almost a decade after BookingBuddy introduced a flight-comparison tool that changed the online travel landscape, you can see the company’s influence across the globe.

Sites deploying BookingBuddy’s own search widget or, more commonly, others taking their inspiration from it and offering their own flight- or hotel-comparison widgets, include Travelocity, Expedia, TripAdvisor, Travelzoo, Wego in Singapore, and so many more. Participating advertisers include Priceline, Booking.com, Marriott, Expedia, Hotwire, Skyscanner, Orbitz, Cheaptickets, Hawaiian Airlines, Webjet, Air Canada, Accor Hotels, Asia Travel, Agoda and hundreds of others.

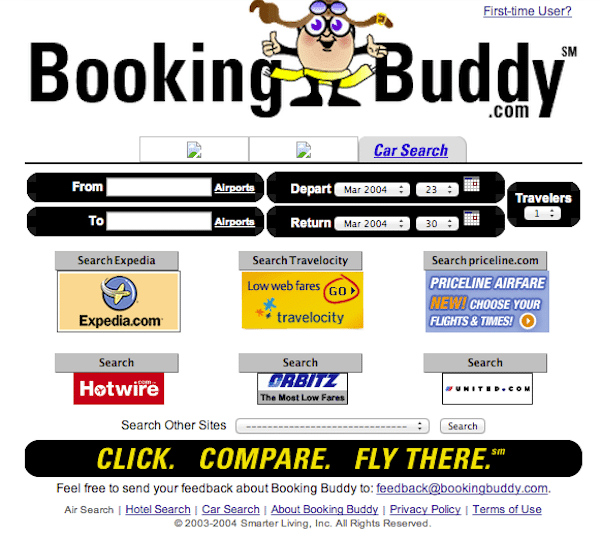

Booking Buddy launched its flight-comparison tool in September 2003 and a standalone website, BookingBuddy.com, which was part of Smarter Living, in January 2004. Hotel- and cruise-comparison tools soon followed. Here’s a screenshot from March 2004 (courtesy of Wayback Machine), showing the BookingBuddy flight-comparison tool and website in one of their first iterations:

The tool enabled travelers to enter origination and return airports, travel dates, and number of travelers on BookingBuddy.com, and then users chose one to six advertiser websites, in this example Expedia, Travelocity, Priceline, Hotwire, Orbitz, and/or Priceline, for continued searching and to check airfares.

Deep links would open in separate, pop-under windows on the respective advertiser websites so travelers could continue with their flight searches, and shop.

Three years later, in 2007, Smarter Living, which by then had changed its name to Smarter Travel, and its BookingBuddy unit were generating roughly $26 million in revenue, enough to entice TripAdvisor to acquire them.

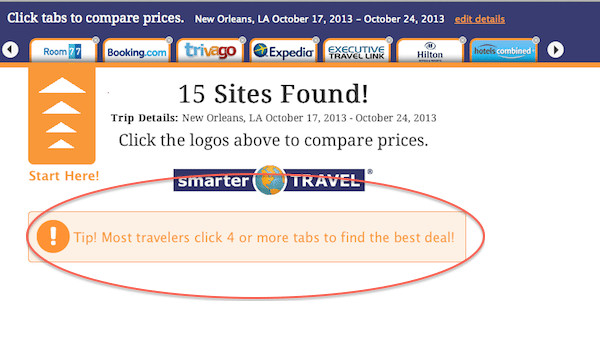

In 2013, the BookingBuddy pop-under search tool, and its legion of copycats, survive and, in some respects, thrive.

Arbitrage Back Then

In the early 2000s, flight search on travel media sites mostly amounted to a classic search box and indvidual text links to various flight or hotel deals.

BookingBuddy’s ingenuity in 2003 and 2004 is that it figured out a way to monetize a consumer’s flight search effectively — and multiple times.

Travel metasearch sites, which compared flights or hotel deals side by side on a single site, such as FareChase, SideStep, Qixo and Kayak, were emerging, but the technology was expensive to develop.

BookingBuddy eschewed the tech-intesive metasearch path and started buying flight and hotel keywords on Google for perhaps 10 cents per click, and got good at playing the search engine marketing “arbitrage” game.

In those days, flight and hotel keywords were still relatively cheap, and companies could even poach other companies’ trademarks and buy the Marriott or American Airlines keywords from Google.

So BookingBuddy would drive a traveler from Google to BookingBuddy.com for a relatively low 10-cent click, and then BookingBuddy would charge participating advertisers perhaps 35 cents per click for each pop-under window search that the traveler selected.

But, that 25 cent differential was just the beginning.

Travelers often selected three or four sites to search, which meant that BookingBuddy might generate $1.40 in cost-per-click revenue, all by just paying 10 cents for that Google search term.

Soon, BookingBuddy and others who developed similar tools, which expanded from flights and into hotels, were displaying six advertisers, showing even more partners in drop-down menus, and charging extra for premium placements.

The model has proven very beneficial to travel publishers, and is still in vogue, although cpc advertising rates have fallen as the model has proliferated.

In the above Smarter Travel hotel-compare tool, seven advertisers are displayed on this page, and notice the tip: “Most travelers click 4 or more tabs to find the best deal!”

That would mean click revenue times four for Smarter Travel.

Says David Krauter, general manager of Smarter Travel Media, referring to the compare tool: “We continue to invest in running the business.”

Have a confidential tip for Skift? Get in touch

Tags: advertising, kayak, metasearch, travelocity, tripadvisor

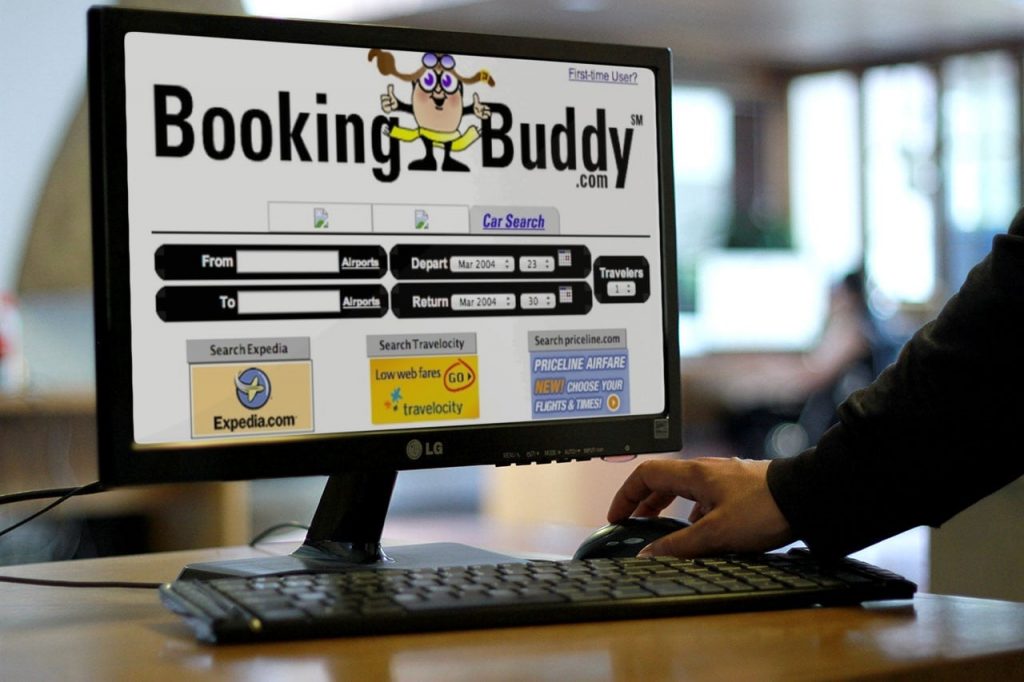

Photo credit: This November 2004 screenshot shows Booking Buddy's hotel compare tool. The company figured out how to deliver a traveler from Google to a travel site, and then monetize that visit over and over. PlaceIt by Breezi