Skift Take

If online travel agencies are heading toward becoming a hybrid of transactions and metasearch advertising, it is ironic that Kayak, Room 77 and Hipmunk have already become hybrids, having begun to take direct booking themselves in recent years.

Now that Priceline and Expedia acquired their respective travel metasearch playthings, U.S.-based Kayak and Germany’s Trivago, when are these online travel agencies going to take the seeming logical next steps?

In other words, when are the transaction-focused online travel agencies, Priceline and Expedia, going to integrate cost-per-click-based Kayak and Trivago into the OTAs’ respective flight or hotel search results?

There is a strong argument to be made that such a hybridization of the booking sites, turning them into a blend of transactions and metasearch advertising, makes a lot of sense financially and from the perspective of providing a much better and more comprehensive customer experience than is the norm today.

As one advertising wonk puts it, this could be the ultimate loyalty play in online/mobile travel.

Here’s Why:

Expedia and Priceline are already fairly comprehensive, but price-conscious travelers are fickle in their bargain-hunting and they’ll wander off to tons of other travel websites, looking for a lower fare or rate, more often than not.

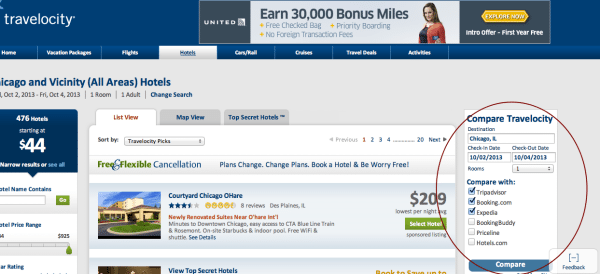

Some online travel agencies, such as Travelocity, for example, have long supplemented their own search results with a “compare” advertisement, earning perhaps $0.20 to $0.50 per click when users check one of the boxes and continue their hotel search as separate windows open to compare Travelocity’s results with those of TripAdvisor, Booking.com, Expedia, BookingBuddy, Priceline or Hotels.com.

Travelocity, or any other site employing this strategy, might only earn the $0.20 to $0.50 per click through this “compare” advertising. Leads generated from this compare feature are considered fairly high quality because they’ve already narrowed down there search to a hotel and have selected dates.

But, hotel metasearch, as practiced by Kayak, Trivago, TripAdvisor, Hipmunk and Room77, for instance, is a different animal, and advertisers are often willing to pay 10 times more per click than they might with the “compare” feature because the leads are of an exponentially higher quality. And this is one of the chief reasons TripAdvisor recently transitioned from pop-under windows to hotel metasearch.

When TripAdvisor’s new hotel metasearch displays the Trump International Hotel & Tower Chicago for an October 2 to 4 stay, it shows the Expedia rate ($836 per night), the Hotels.com’s rate ($836), the Travelocity price ($925), and users can also click “see all 10” and view the rates on a bunch of other sites.

Because TripAdvisor’s metasearch display includes the dates of the stay and the rates when a user clicks on one of the OTA booking options, that click is worth a lot more money to TripAdvisor than the less-defined “compare” advertising on Travelocity. The metasearch user is a lot more likely to book than the customer using the “compare” feature as it comes a bit earlier in the travel-research cycle when users have not narrowed their choices based on price.

In fact, while Travelocity in theory may have earning $0.40 for a click in the “compare” advertising, TripAdvisor generated $2.37 to $2.61 per click on its metasearch results in the second quarter, according to research from the Susquehanna Financial Group.

Enter Priceline-Kayak and Expedia-Trivago. Instead of using Travelocity-like “compare” advertising to supplement OTA results, Priceline and Expedia could –and eventually may — integrate Kayak’s and Trivago’s metasearch results into their flight or hotel search results.

In this way, these online travel agencies would evolve into much more of a hybrid transaction-advertising play than they already are, generating much higher CPCs, and providing a better user experience to customers while becoming much more comprehensive.

It is a more satisfying user experience for the customer to click off to a single metasearch advertiser when the hotel rate is already known rather than dealing with opening multiple, separate windows on several websites using the “compare” feature and without having price parameters narrowed down.

In addition to providing higher CPCs, greater comprehensiveness and an enhanced user experience, the integration of metasearch could in theory engender more customer loyalty. It could diminish the need for customers to navigate away, and around to a dozen travel sites if the OTA can provide a wide array of options right from its own site.

In a similar vein, Amazon began employing a similar strategy around 2008 with its Product Ads From External Websites, which offers windows to book products on other sites if users can’t find what they want on Amazon.com.

Not A Done Deal

There are reasons, of course, that Expedia and Priceline might be reluctant to fully integrate their newly acquired metasearch prizes, Trivago and Kayak, respectively.

They will have to test the hell out of the proposition to ensure that integrating Kayak or Trivago wouldn’t wreak havoc with their conversion rates on transactions.

And too much distraction might not be healthy.

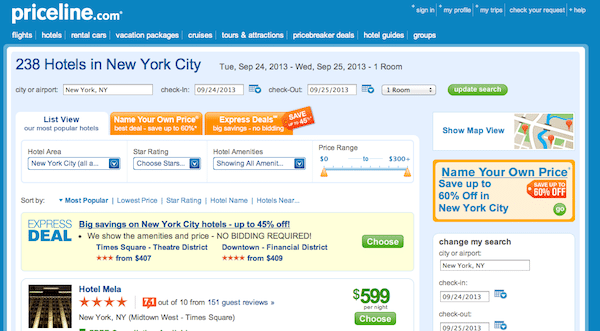

Priceline, for one, already has a hodgepodge of stuff going on in its hotel search results pages as they show standard retail rates, Express Deals (no bidding for for discounts up to 45%) and Name Your Own Price (bidding with discounts up to 60%).

Adding metasearch to the mix might make things even more complicated for Priceline, but it would be smart over the long term to at least test the proposition.

There are some keen observers who believe this is where the Expedias and Pricelines are heading, spearheaded by their respective acquisitions of Trivago and Kayak.

Such a transition, though, isn’t inevitable, and there are doubters even among major metasearch players. As one put it:

“To some extent you already see this kind of integration, with the ‘compare on other sites’ options on the sidebars of OTAs. But metasearch has been around for a long time, and so far OTAs have made meta acquisitions, but not integrated them directly. I think that tells you something: that the OTAs believe their brands stand for ‘book here,’ whereas metasearch sites’ brands stand for ‘search here.'”

The travel metasearch official adds: “Could it happen? Sure. But I don’t think it will; it would be an admission of failure. And while the flight business is harder than ever, the hotel OTA business is pretty darn good. At the scale of the OTAs, I think it makes pretty good sense to control the inventory and user experience from end to end.”

All of the online travel agencies are already involved in the advertising business to varying degrees. They once looked at metasearch skeptically, and now have embraced it. Taking the next leap to integrate their metasearch subsidiaries is undoubtedly under discussion, and could be the next big thing.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: advertising, expedia, kayak, metasearch, priceline