Skift Take

Proceeds from the IPO -- the size of which is still to be determined -- would go toward paying down debt. Unlike many other private equity acquisitions where the acquired companies have been hamstrung and loaded down with debt, Blackstone has really rationalized and improved Hilton's global operations.

With Blackstone-owned Hilton Worldwide filing its long-awaited IPO papers earlier today, the curtain has been lifted behind their private-company doings.

On the financial front, Hilton, which was acquired in 2007, has been profitable in the lead-up to today’s S-1 statement. Here are some numbers:

- For the 12 months ending June 30, 2013, Hilton posted $427 million in net income on $4.03 billion in revenue.

- For full-year 2012, Hilton’s net income jumped 39.1% to $32 million as revenue increased just 2% to nearly $4 billion.

Hilton states: “Net income attributable to Hilton stockholder increased by 68% on average from the year ended December 31, 2010 through the year ended December 31, 2012, and for the six months ended June 30, 2013 net income attributable to Hilton stockholder increased 66% as compared to the six months ended June 30, 2012.”

Outside the U.S.

In the half-dozen years that Hilton has been under Blackstone ownership, one of its key accomplishments has been to enhance its growth outside the U.S. as its 10 brands had been under-represented globally, the company says.

In fact, revenue from international operations accounted for 27% of total revenue in the 12 months ending June 30, 2013.

With 665,667 rooms in 90 countries, Hilton says it has another 170,000 rooms in the pipeline, and that’s the most of any major hotel brand.

Another accomplishment, Hilton says, is that from December 31, 2007, to June 30, 2013, the company has increased its EBITDA from its management and franchise operations by 30%.

Owned Hotels Like the Waldorf Astoria New York

Since 2007 Hilton has invested $1.8 billion in its iconic owned and leased hotels, including The Waldorf Astoria New York, the Hilton Hawaiian Village, and the London Hilton on Park Lane.

“… We believe the iconic nature of many of these properties creates significant value for our entire system of properties by reinforcing the world-class nature of our brands,” Hilton states.

Hilton says it is considering selling some of these properties, or using all or parts of them for “retail, residential or timeshare uses.”

Defending Lawsuits Could Be Heavy-Lifting

In other news, Hilton offers a cautionary note about recent class-action lawsuits against hotels, including Hilton, and online travel agencies challenging the nature of their rate-parity contracts.

“Our fees and expenses associated with this litigation, even if we ultimately prevail, could be material,” Hilton states. “Any adverse outcome could require us to alter our business arrangements with these intermediaries, and consequently could have a negative impact on our financial condition and results of operations.”

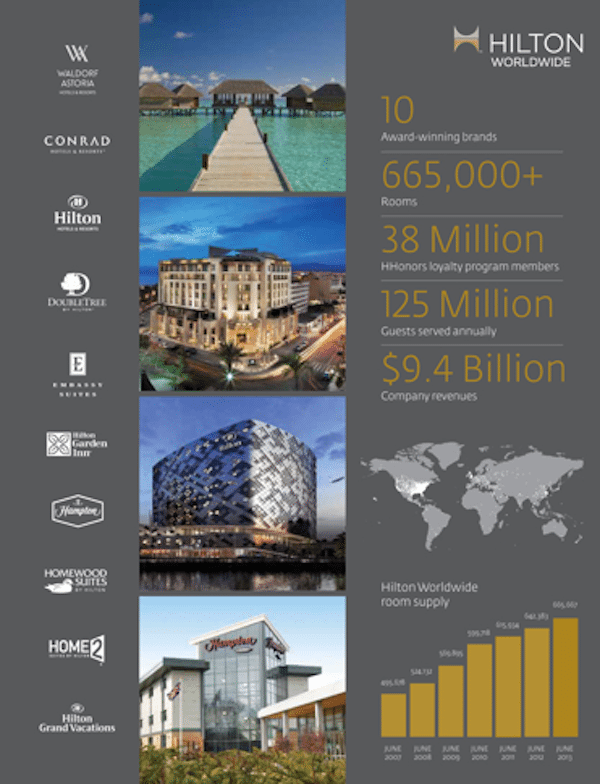

Here are some Hilton metrics as captured in a graphic in its S-1 statement:

Have a confidential tip for Skift? Get in touch

Tags: blackstone, hilton, ipo, private equity