Skift Take

Economic growth or lack of it is mirrored in air travel, and the "Asia Rising" story may be turning around, while Europe comes out of recession and U.S. business confidence increases.

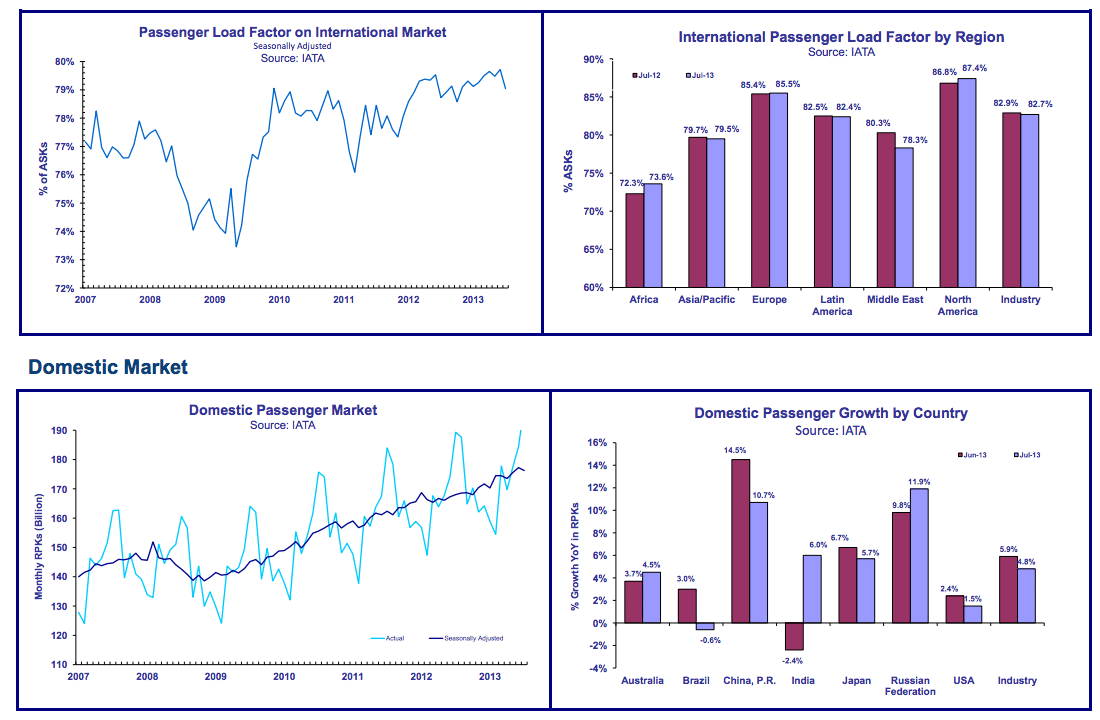

Not that there was any doubt that economic growth and connectivity go hand in hand, but the latest July air travel numbers from IATA outline them even more clearly: even as global air travel overall revenues were up about 5.0 percent in July this year compared to last year, the regional economies are turning and so is air travel. The big story of emerging markets driving growth over the last few years as developed economies stagnate could be shifting, the numbers for July show.

China’s economic growth is slowing as it is air travel, and India’s in negative territory, with its near term growth prospects looking bleak, according to IATA numbers.

“The emergence of the Eurozone from an 18-month recession provided the biggest boost to traffic over recent months. In contrast, the deceleration of the Chinese economy has been a dampener on air travel, with weakness showing up throughout emerging Asian markets. The price of oil, a huge cost item for airlines, is tracking political tensions in the Middle East. Along with the global cost impact of this, at the regional level there is the potential for disruption for one of aviation’s strongest and most consistent growth markets,” said Tony Tyler, IATA’s Director General and CEO.

Region-wise numbers from IATA:

- Asia-Pac: The region’s largest economy—China—continued to decelerate in the second quarter. With trade volumes in emerging Asian markets shrinking by almost 5% over the first half of the year, the softness is not isolated to China. In particular, India’s near term growth prospects are looking bleak. For the year, IATA expects performance to even-out around the 4.1% growth achieved year-to-date.

- Europe: European carriers recorded a 3.7% increase in demand compared to July 2012, in line with year-to-date growth although a significant decline compared to June results (5.3%). The Eurozone emerged from its 18-month recession during the second quarter, giving grounds for cautious optimism for the region’s performance in the second half tempered by significant variations by country. Capacity rose 3.6% and load factor improved marginally to 85.5%.

As for domestic numbers, bad news for China and India:

- China’s domestic traffic climbed 10.7% compared to July 2012. Although this was second best, it reflected a slowdown from the 14.5% year-over-year growth recorded in June and suggests China’s air travel market may be showing its first signs of weakness. Capacity rose 14.3%, and load factor fell 2.6 percentage points to 80.9%.

- Indian domestic traffic was up 6.0% in July year-on-year, reversing the 2.4% decline in June. Continuing volatility over recent months has made it difficult to establish a clear growth trend. Capacity rose 4.9%, and load factor climbed 0.7 percentage points to 69.3%

More details in the PDF embedded below:

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: iata

Photo credit: China Airlines planes are seen on the tarmac of Beijing Capital International Airport. 95676 / 95676