Skift Take

Venture capitalists are increasingly making bets that vacation homes and timeshares are a tremendous growth opportunity as an alternative to hotels.

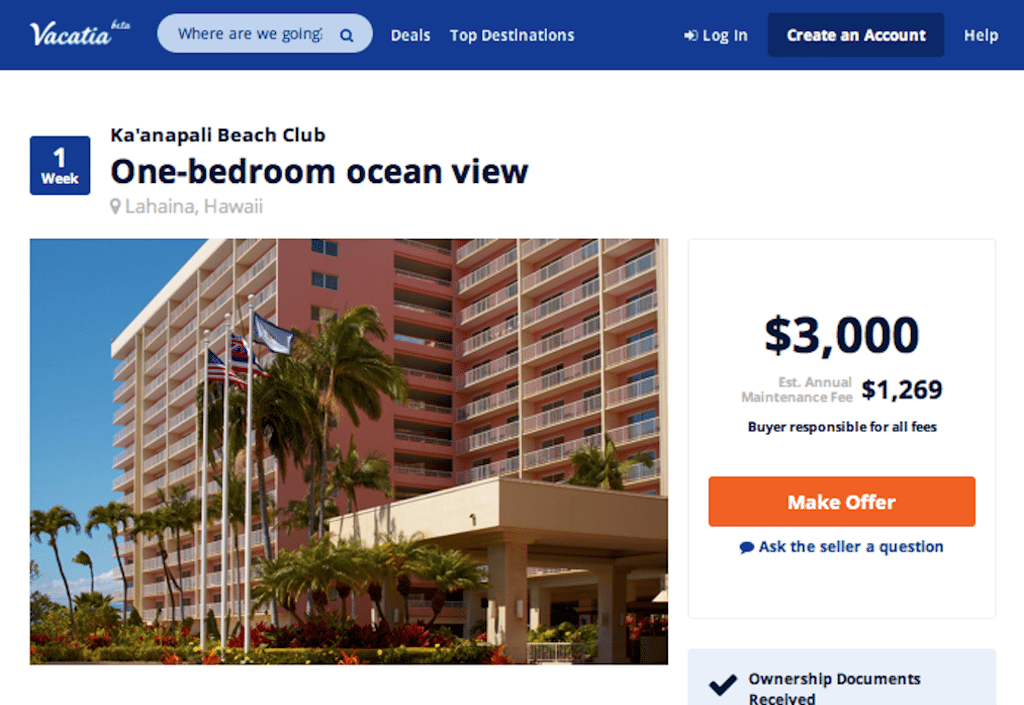

Vacatia, a marketplace for timeshares and fractional-ownership properties, attracted $5 million in seed finding from hotel industry and online travel veterans.

The investment, geared to take Vacatia from beta to an official launch, occurs as the vacation rental industry continues to garner much interest from investors.

The seed investors include online travel, and hotel and vacation rental industry veterans, such as Spencer Rascoff (Zillow, Expedia, Hotwire), Erik Blachford (Expedia), Robert Spottswood (Hyatt Vacation Ownership), Raymond L. “Rip” Gallein Jr. (Starwood Vacation Ownership and Marriott Vacations Worldwide), and Barry Sternlicht and Steve Hankin (Starwood Capital).

Also participating on a personal basis in the round were Egon Durban of SilverLake and Gene Frantz of Google Capital. Bee Partners, Peterson Ventures and Meyer Ventures contributed, too.

Vacatia’s parent company is Vacation Listing Services.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: investors, vacation rentals

Photo credit: Vacatia, a timeshare and fractional ownership marketplace, just received $5 million in funding. Vacatia