In-flight wi-fi provider Gogo has dusted off plans for its IPO again, after initially filing in end of 2011 and not going through with it back then. It filed again with SEC this morning, and now intends sell up to 11 million shares at $15 to $17 per share, which would bring in anywhere from $165 million to $187 million at top of the range. It will be listed on Nasdaq under, what else, GOGO.

Gogo first filed in Dec 2011 and then expected to raise $100 million.

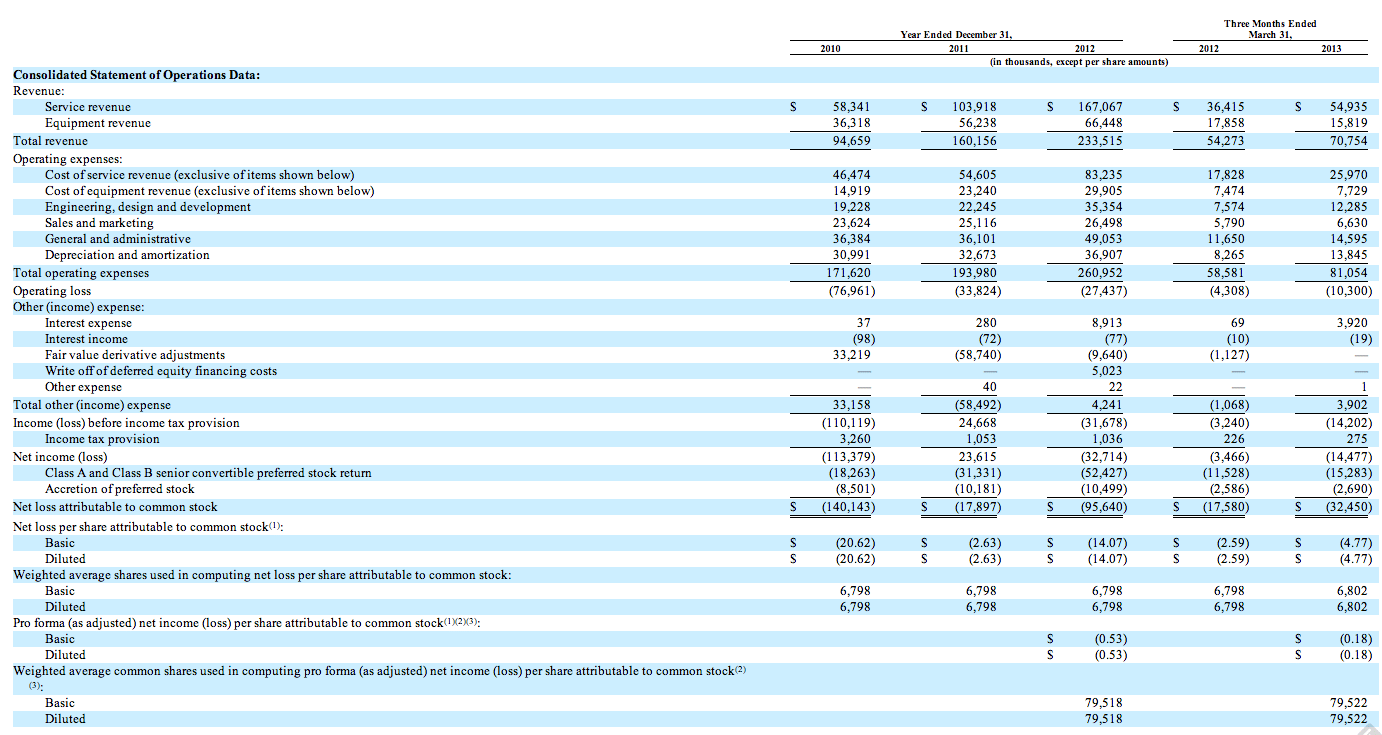

Some numbers of note from its amended filing:

- Airlines Gogo is installed on: Delta, American, US Airways and Alaska.

- As of April 30, it had 1,908 commercial aircraft online, and adding 390 more.

- From Aug 2008 to April 30, 2013, passengers used Gogo’s service about 37.0 million times.

- Its video on demand product, Gogo Vision, is currently installed on more than 650 aircraft, and plans to install about 900 additional commercial aircraft by the end of 2013.

- International expansion: In March 2013, it tied up with Delta to provide Ku-band satellite connectivity services on its international fleet, which currently consists of 170 aircraft. In Feb 2013, Gogo became available on four aircrafts of Asian carrier Scoot.

- Revenues increased 46% from $160.2 million in 2011 to $233.5 million in 2012 and net income decreased from $23.6 million to net losses of $32.7 million.

- For Q1 of 2013, revenues increased 30.4% from $54.3 million in Q1, 2012 to $70.8 million, net losses increased from $3.5 million to $14.5 million.

Gogo’s financials, click for bigger chart:

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch