Skift Take

Oyster has great content, but will potential buyers, such as media companies or hotel sites, really be brave enough to accommodate a business that bills itself as "The Hotel Tell-All?" Many will shy away from this candor because they don't want to offend hotel partners. That being said, critics said from day one that the Oyster's premise of professional reviews was unsustainable, and so far that is turning out to be true.

Hotel review site Oyster, funded with more than $18 million by backers such as Bain and the Travel Channel, is shopping for a banker so it can put itself up for sale, Skift has learned.

The search is in its final stages and Oyster, which offers professional hotel reviews from journalists on staff and from freelancers, has already been discussing its status with potential buyers, we have confirmed.

Oyster co-founder and CEO Elie Seidman declined to comment on the issue.

Lots of funding but not enough traction

Founded in 2008 and having raised more $18.4 million in funding from the Travel Channel, Bain Capital Ventures and Accelerator Ventures, Oyster has a decent product, but has long struggled with developing a sustainable business model. Our understanding is Travel Channel owns the largest share in Oyster, post the $7.5 million funding it put in, as part of the $10 million Series C round in April 2011.

More stories:

- FlightCar and airports argue over what’s innovation and what’s just cheating

- Airbnb gears up for big legal and legislative battles in New York

- Is Airbnb illegal in New York? Definitely not, but many of its hosts break the law

Oyster is the Travel Channel’s hotel partner, but that relationship likely hasn’t given Oyster the big push it needs, considering TravelChannel’s own digital efforts have been going in fits and starts over the years.

On the Travel Channel homepage today at the very bottom, is a tiny link to the Oyster homepage reading, “Find Las Vegas Hotels, New York Hotels and more on Oyster.com.”

Fakeout photos

You can probably eliminate Orbitz Worldwide as a potential buyer as Oyster has long irked Orbitz by contrasting Oyster’s realistic photos of hotel properties with the often-unrealistic and always-marketing-tinged hotel photos from Orbitz and other online travel agencies.

Oyster labels the disparity “Oyster’s Photo Fakeouts” (see image above).

A photo fakeout currently on the Oyster homepage contrasts Oyster’s realistic hotel photos with those from the hotels themselves.

Oyster pledges that its professional journalists visit each property before they review it, and the company, with its tagline, “The Hotel Tell-All,” further differentiates itself by publishing a list of the pros and cons at each hotel. There aren’t a lot of hotel sites that do that.

For example, Oyster’s review about the Essex Inn, South Loop, Chicago, notes that the rooms are comfortable “with floor-to-ceiling windows,” although the “rooms are on the small side,” and the “decor is generic and slightly dated.”

Sending journalists to hotels can be costly

Oyster says its reviewers have visited thousands of hotels in more than 200 cities, but the problem is how do you afford these expenses when reviews also entail revisiting properties to make sure the reviews are up to date.

Jetsetter, which recently was acquired by TripAdvisor and also put an editorial twist on the upscale properties it featured, likewise struggled with the editorial costs issue.

Oyster has been wrangling for years with finding a way to monetize its hotel content. In 2010, it enabled site visitors to book hotels through a third-party partner, and in 2011 that gave way as Oyster developed its own hotel booking engine instead. But that plan, which was potentially more lucrative than splitting revenue with third-parties, was scrapped in early 2012.

Today, Oyster enables its users to book hotels by navigating over to Booking.com, HotelClub, Priceline.com, EasyToBook, Getaroom and others. That’s not a very lucrative option for Oyster because of the revenue split, and many sites around the world offer similar options.

It isn’t a viable answer considering the hyper-competition in the hotel space these days from everyone from Booking.com and Expedia to travel metasearch companies such as Kayak and Trivago.

Oyster’s latest hotel-booking scheme really doesn’t have a prayer for success given the larger and more sophisticated players giving it a go in the marketplace.

Potential acquirers?

With all of its hotel content, Oyster could be a good fit for USA Today, which is a joint venture partner in HotelMe, a site that features hotel reviews from guests that the hotels have verified actually stayed at the property. And USA Today has been on a buying binge of late, scooping up Web properties way past their prime and on the cheap

Other hotel-oriented media or travel companies, from online travel agencies to hotel metasearch sites, could be doing their due diligence on acquiring Oyster.

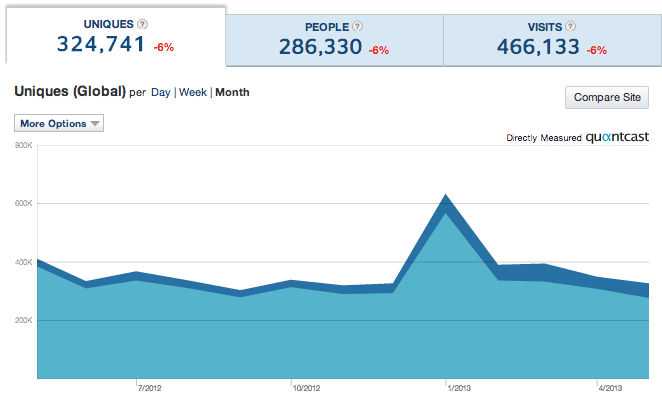

Another big problem for Oyster is that its brand hasn’t grown organically to a great degree, and it just isn’t that well-known. Quantcast (where Oyster is verified) shows that Oyster had only 286,000 unique visitors globally for May, and the growth chart is slow growing, at best, and in fact has fallen for most part of this year.

Oyster is hoping it can consummate a marriage with a much bigger player who can take advantage of its hotel content, and get it front of a lot more travelers.

Have a confidential tip for Skift? Get in touch

Photo credit: The photos, part of the Oyster photo takeout series, contrasts Gran Bahia Principe Punta Cana's pristine photo of its idyllic beach with a more realistic photo from Oyster. Oyster.com