A plan to include the Empire State Building in a publicly traded company has cleared a critical investor hurdle that will allow the IPO to move forward.

Holders of more than 80 percent of the units that own the landmark skyscraper approved the plan to fold it into a newly created real estate investment trust called Empire State Realty Trust Inc. The green light came after more than a year of fighting between Malkin Holdings Plc, which has spearheaded the plan, and a small group of investors.

The vote was disclosed in a U.S. Securities and Exchange Commission filing on Wednesday.

The 80 percent figure is a critical threshold because it allows Malkin to use a forced buyout provision to get the full support of the investors. The provision, which a New York State judge recently upheld, requires holdouts to either sell their units back for $100 per unit or vote for the plan.

“We will terminate the solicitation in due course,” Malkin said in a statement. “The vote remains open and we urge all investors who have not yet voted in favor of the proposed consolidation and IPO to do so immediately.”

Malkin has estimated that each of the 3,300 units sold in the early 1960s at $10,000 a piece, could be worth more than $320,000, according to SEC filings. The ultimate value will be determined by the public market after the IPO.

At the end of last year, 2,824 investors held the units, according to SEC filings. The REIT is estimated to be valued at about $4.2 billion.

In November 2011, Malkin launched the plan to make the 102-story Empire State the centerpiece of a new REIT of more than 18 properties. While some investors welcome the plan, wishing to cash in on the more than 50-year-old investment, a small organized group of investors opposed it. Several lawsuits were filed, which prompted Malkin to change the structure of the ownership, providing them with a more tax-efficient way to convert their units into ownership of the REIT.

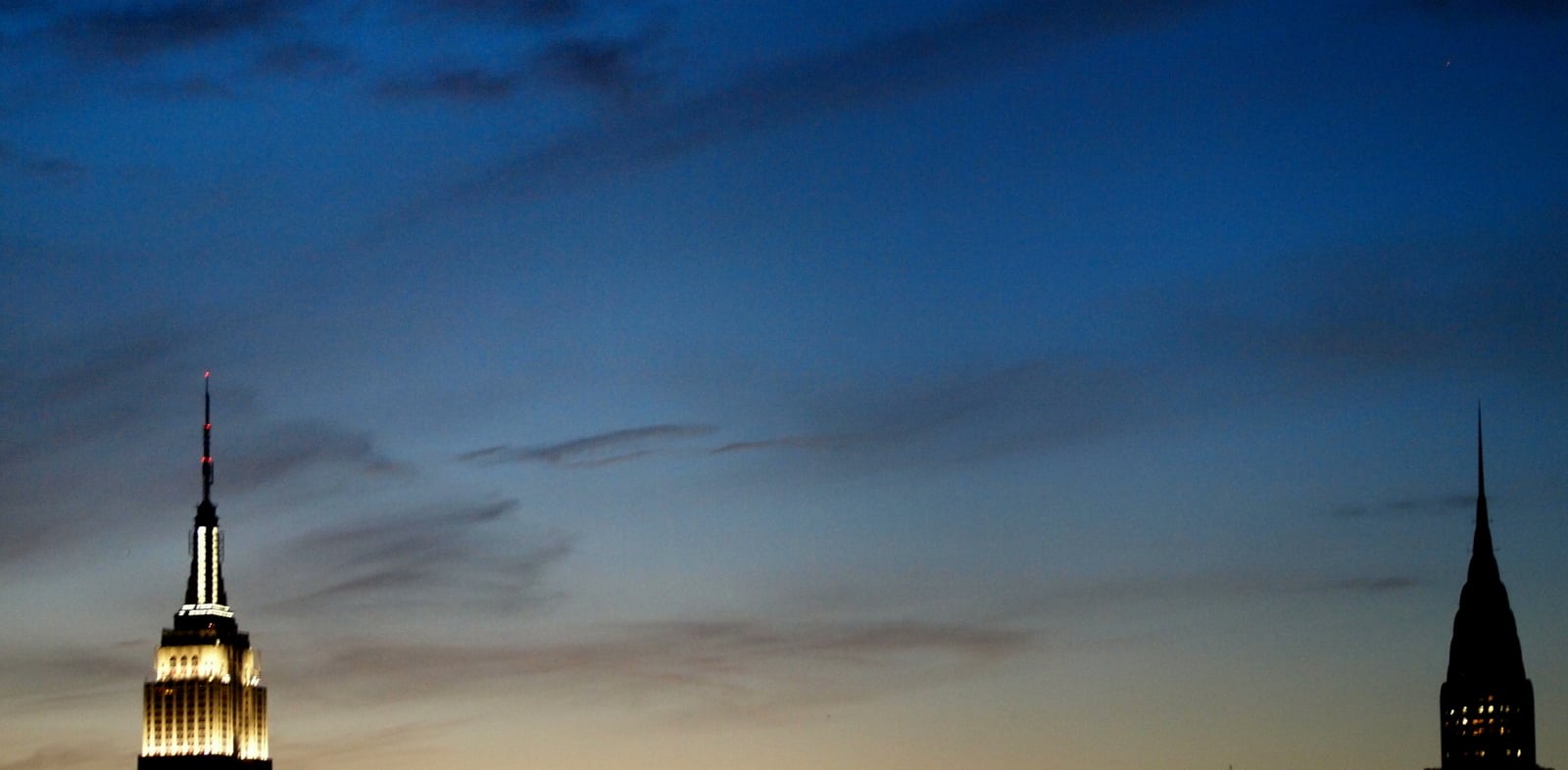

The Empire State Building, which ranked as the world’s tallest for four decades after its completion in 1931, is one of the most recognizable features of the New York City skyline. It is being renovated, and as of Sept. 30, was 68.5 percent leased.

For Malkin, which has ownership in all the properties proposed for the REIT, the plan would value its stake as much as $714 million after the REIT goes public.

The Leona Helmsley estate, a major investor in the company that sublets and manages several of the properties proposed for the REIT, could see its stake valued at about $1.03 billion, according to an SEC filing. It would reap about $672 million of the total in cash.

![]()

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: empire state building, ipo, nyc