Skift Take

Funded, lean and focused, Hipmunk can take its sweet, little time honing its product to get ready for a larger profile. Whether it ever emerges from beautiful product to major player is a very open question. There is plenty of money to be made even as a relatively small company, but Hipmunk's ambitions are huge.

Hipmunk co-founder and CEO Adam Goldstein, 25, believes his flight and hotel metasearch company can one day be larger than Kayak, and with $20.2 million in funding and revenue that has trickled in from the moment Hipmunk debuted, he thinks he has the time to prove it.

“We think we can be bigger,” Goldstein says, referring to Kayak. “We think we can do it.”

With Priceline closing today on its $1.8 billion acquisition of Kayak, you can picture the Kayakers reading Goldstein’s boast, and breaking out in giggles as they pour their champagne (or whatever the favorite libation is over there).

After all, in the first quarter of 2013, nine-year-old Kayak reported more than 357 million user queries from desktops and mobile devices, 3 million app downloads, and $82.3 million in revenue. And, Kayak was in the black, wrangling net income of $2.1 million.

As a private company, founded in 2010, Hipmunk doesn’t break out a lot of numbers, although Goldstein says the overall business, including searches, bookings and revenue, has been “more than doubling every year since we started.”

Although these sorts of measures can be notoriously unreliable, Compete’s U.S. numbers peg Hipmunk’s monthly unique visitors at a fraction of Kayak’s, and even show Hipmunk trailing rival Room 77, which debuted its core hotel-comparison shopping product in late 2011, more than a year after Hipmunk burst on the scene.

Debatable

It’s hard to debate Goldstein’s premise that Hipmunk can one day beat Kayak because it is an open-ended goal, there are so many variables, and anything’s possible.

Then again, it is difficult to debate Goldstein about anything because he was the captain of the MIT debate team during part of his 2006-2010 stint at the school, although he doesn’t try to aggressively score points when recounting Hipmunk’s journey.

Goldstein was in charge of arranging the debate team’s national and international travel, and he found that it took so much time and was so frustrating that it led to what he calls an “aha moment” during his senior year about working on a travel startup.

The idea at first was to build a travel agency, one that would enable consumers to quickly make decisions based on a comprehensive array of choices, including flights, hotels, cars, trains and buses.

One of the first people Goldstein talked to about his ideas was Reddit founder Steve Huffman, whom Goldstein met during his high school years at what he describes as a “nerd conference,” Foo Camp.

Huffman, who would become Hipmunk’s co-founder, was experiencing his own frustrations about travel search as he was commuting across the country to visit his fiancé.

Goldstein says Huffman initially was skeptical, saying: “Why would we want to get in a fight with those guys?” referring to powerful, entrenched online travel agencies and existing metasearch players.

In retrospect, most people would think Huffman’s warning was on point when you consider that if Hipmunk were to aggressively engage in search engine marketing these days, it would face an uphill battle of competing for keyword real estate with hotels, other metasearch companies and online travel agencies, including Priceline, which spent $403.1 million in online and offline advertising during the first quarter.

“Suckage” and “Agony”

After graduation, in June 2010, Goldstein and Huffman were accepted into Y Combinator, and they had a three-month deadline to launch a product and pitch it to investors.

“We hadn’t written a single line of code yet,” Goldstein recalls. “We didn’t know what we were building yet, either.”

They decided to start with flight metasearch, and after a few weeks when no one would return their phone calls, they eventually struck a partnership with Orbitz as Hipmunk’s initial data source (ITA Software came later) and booking partner.

Huffman and Goldstein had come up with an attractive user interface, something that would get a lot of buzz and feature an Agony index, which would remove the pain of flight search by succinctly sorting flights based on price, duration and the number of stops.

They got Hipmunk online a week before Y Combinator’s demo day, and what was to become the Agony index was initially called Suckage.

But, the two entrepreneurs figured a lot of publications wouldn’t write about something with such a vulgar-sounding name so “literally the day before we launched at Y Combinator,” the co-founders ran a thesaurus search on “pain” and decided on “Agony” as the name for their now well-known sort option.

Approaching three years later, Hipmunk has raised $20.2 million in total funding, with a Series B round of $15 million, led by Institutional Venture Partners and with participation from Series A leader Ignition Partners, having been completed in June 2012.

Not in anyone’s pocket

With Kayak transitioning into the Priceline fold, Expedia taking a majority stake in German hotel-metasearch site Trivago, and Expedia also leading a $30.3 million Series C round for Room 77, Hipmunk finds itself as “one of the last independent metasearch companies” and “one of the fastest growing in the U.S.,” Goldstein says.

For the record, Room 77 CEO Drew Patterson says the company’s investors, which include Expedia, Concur, Sutter Hill Ventures, General Catalyst Partners, Felicis Ventures and a bunch of angels, are “passive investors,” and none sit on the Room 77 board.

But, Goldstein argues that Room 77’s investment path sends a signal, and that Hipmunk enjoys a competitive advantage as an independent force when it goes to striking hotel-partnership deals.

“The fact that we are not associated with their enemies is powerful,” Goldstein says.

Very positive reviews and loyal following

Hipmunk has garnered stellar reviews from the tech press and users for its attractive UI, ease of use, and its iOS and Android apps from their beginnings.

Recent initiatives include a revamp of Hipmunk’s mobile apps, and the option to book on Hipmunk (via Expedia in the background) instead of having to navigate away from Hipmunk and over to hotel and online travel agency sites. The mobile app for the first time features plenty of other online travel agency booking partners beyond Orbitz.

Almost everything Hipmunk does, from its flight and hotel search UIs, to its mobile apps, is pretty.

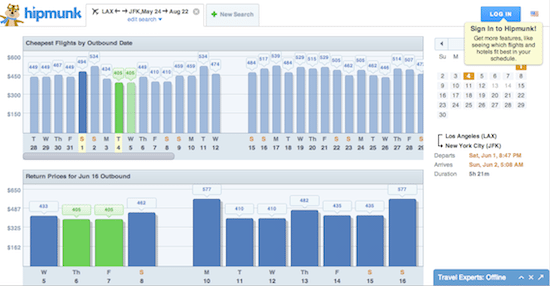

For example, take the Hipmunk Pricegraph, launched late last year and geared for consumers whose travel dates are totally flexible.

Pricegraph shows airfares over the next 90 days: Just view airfares and select departure and return dates from the graph, choose book this flight, and you can view a summation or full flight details before navigating over to United.com or some other airline or online travel agency site.

Goldstein says once people use Hipmunk, “they generally like it a lot,” and come back to use it again.

But how is Hipmunk going to get users to discover it and fight for eyeballs against larger players with much larger bank accounts?

Goldstein says Hipmunk still has much work to do in marketing, partnerships, and the product sides before it makes a decision on keyword marketing.

“While I think our product is the best in the marketplace already — and our users agree — I think we can still make it better, and we are going to do that, before we blow tens or hundreds of millions of dollars yelling it out to the world,” Goldstein says.

“It’s a little unoriginal to take that route that other travel sites have done in throwing money at it,” Goldstein adds, noting that Hipmunk may get creative in its eventual strategy.

Meanwhile, Goldstein acknowledges that Hipmunk erred in its initial focus on flights, and now most of its resources are directed toward improving its hotel and mobile products, with the latter being its “fastest growing piece of the business.”

Long-term outlook

Hipmunk can afford to hang around for a long time while it fine-tunes the user experience. It has $20.2 million in total funding, revenue coming in, and a relatively lean staff of 33 people. In contrast, Hotel Tonight, with some $35.7 million in funding, employs about 100 people.

Goldstein says Hipmunk’s financial situation is “great,” and while the company is now past its “early phase,” Hipmunk can afford to invest the “vast majority” of its resources into hotel search.

“We don’t have any need to raise money until we are ready to,” he says.

The problem, though, for Hipmunk, Room 77, Hotel Tonight, and other funded travel startups, is how do you achieve scale, and get into the position where your unit economics are so attractive that they spur even more growth.

“We are nowhere close to the size of Kayak,” Goldstein says, adding that he believes Hipmunk’s partnership deals are “competitive” with others in the industry. “There is tons of headroom and it’s going to take time to get there.”

Of course, being acquired by a larger company could always help a company keen on growth. (An acquisition can also totally screw things up.)

But, when asked what advice he would give to early-stage travel startups, Goldstein provides some hints about the preferred end-game, or at least the medium-term outlook.

He advises co-founders of travel startups to ensure they have “a common vision for what success looks like” as one co-founder may be wowed by an early acquisition offer, and the other may want to hold out for bigger and better things.

Says Goldstein, on the topic: “We have plenty of acquisition interest. But, we are interested in staying independent.”

This is the first of a three-part series on funded travel startups, looking at where they started and their strategies for breaking out of the pack.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: hipmunk, kayak, metasearch

Photo credit: Hipmunk CEO Adam Goldstein, left, and co-founder Steve Huffman. Hipmunk