Skift Take

The new American Airlines will have a formidable network, although it remains to be seen whether the merger transition will be characterized merely by a few bumps, or whether there will be significant turbulence.

Pan Am and TWA, two iconic airlines that were grounded for good in 1991 and 2001, respectively, got “out-competed” domestically by rivals such as United, American, Delta, Continental and Northwest, and that contributed to the duo’s demise.

To be sure, the reasons Pan Am and TWA went bust are complex, but US Airways president Scott Kirby, a key member of the US Airways-American Airlines transition-planning committee, seized on the weakness of the Pan Am and TWA domestic networks as the beginning of the end despite the fact that they were the “preeminent” carriers of their era.

The importance of domestic networks often gets short shrift, said Kirby during a presentation May 15 at the Bank of America Merrill Lynch 2013 Global Transportation Conference in Boston.

Kirby argued that domestic networks are “incredibly important” as a feeder to airlines’ global networks.

There is a punch line, of course.

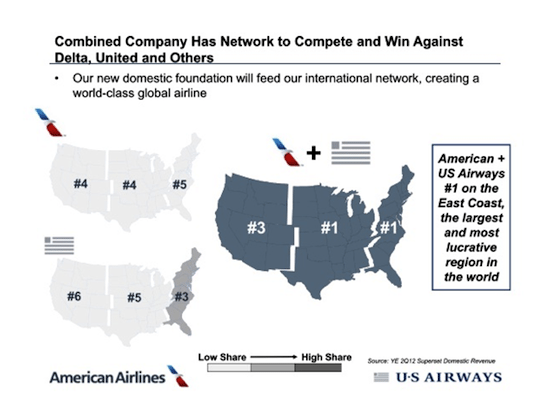

Kirby presented a slide showing that the combined US-Airways-American Airlines would be the #1 carrier on the East Coast, #1 in the central part of the country, and #3 in the West.

Pointing to the new American’s projected East Coast dominance, Kirby said the East Coast “is the largest, most lucrative travel region in the world.”

“This network,” he added, referring to the reach of the new American, “without question will be the strongest domestic network in the country.”

It’s not as if United and Delta are about to roll over and play dead, however.

United, for one, argues that it likes its competitive position in relation to the new American Airlines despite “overlaps” in Chicago, Dallas, Houston, Los Angeles and New York.

Nervousness subsiding

On other merger-related matters, Kirby conceded he had been “nervous” about how the transition would go with American executives “given how we got here.”

He was referring to American’s initial reluctance to consider a merger with US Airways.

“We are working [together] quite well so far,” Kirby said, confirming he believes the merger will get completed in the third quarter, pending Department of Justice approval.

Kirby said the merged airline would get off to a quick start in producing $1 billion in expected synergies, pointing to the brisk financial performance of the merged America West and US Airways in their maiden quarter together despite operational difficulties.

Shamelessly copying Delta

The new American looks at the success of the Delta-Northwest Airlines merger as a case study in a successful merger integration, said Kirby, without mentioning the disastrous United-Continental integration.

“We’ve tried and shamelessy copy some of the things that they’ve done,” Kirby said, referring to how Delta and Northwest opted to transition to Delta’s larger reservations system rather than the reverse.

He said the transition team is studying Delta’s steps and is implementing an “adopt and go” strategy.

“We know we won’t be flawless, but we think we will do pretty well, and we’ll minimize the bumps,” Kirby said.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: american airlines, us airways

Photo credit: The TWA system timetable from 1974 looks fine, but US Airways' Scott Kirby argues that TWA got "out-competed" in the territory on the map in the background. Jeremy Keith / flickr.com