Skift Take

"Reasonable and appropriate" is what $20 million buys you in severance.

AMR Corp. Chief Executive Officer Tom Horton will receive $19.9 million in compensation as the parent of American Airlines merges with US Airways Group Inc. and he steps aside.

Horton will receive the half-cash, half-stock payment when the deal closes, AMR said today in a regulatory filing. He will remain chairman until the combined airline’s first shareholder meeting and in that role will receive non-employee director compensation, according to the filing.

US Airways CEO Doug Parker, 51, will run the new airline as AMR leaves bankruptcy reorganization and merges with Tempe, Arizona-based US Airways. Horton, 51, became CEO in November 2011 after Fort Worth, Texas-based AMR filed for Chapter 11 protection.

AMR’s board agreed that Horton’s payment “is reasonable and appropriate given, among other things, Mr. Horton’s long service to the company, the success of the restructuring, and the value created for the company’s financial stakeholders,” Andy Backover, an airline spokesman, said by e-mail.

The merger should close in the third quarter, according to the airlines. AMR will seek bankruptcy court approval of the deal at a March hearing, a company lawyer, Stephen Karotkin, said today at a hearing in Manhattan.

The case is In re AMR Corp., 11-15463, U.S. Bankruptcy Court, Southern District of New York (Manhattan). –With assistance from Beth Jinks in New York. Editors: Ed Dufner, James Langford

![]()

From the SEC filing: Effective upon the closing of the Merger, Mr. Horton will receive a severance payment equal to $9,937,500 in cash and $ 9,937,500 in shares of New American Common Stock. In addition, Mr. Horton will continue to receive lifetime flight and other travel benefits commensurate with those to which he is currently entitled, an office and office support for a period of two years after the closing of the Merger.

Letter from AMR to Horton, filed with SEC, embedded below:

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: american airlines, tom horton, us airways

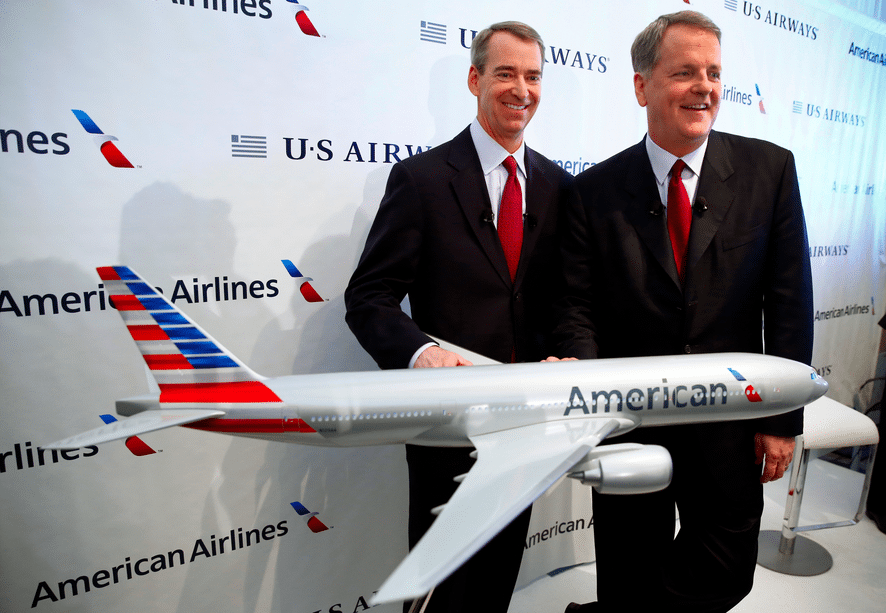

Photo credit: The $20 million Tom Horton smile, on the left, posing with US Airways CEO Doug Parker at the merger press conference. Tom Fox/Dallas Morning News/MCT