Skift Take

These are early days, but when a major hotel provider such as Booking.com diversifies into vacation rentals, everyone should take notice.

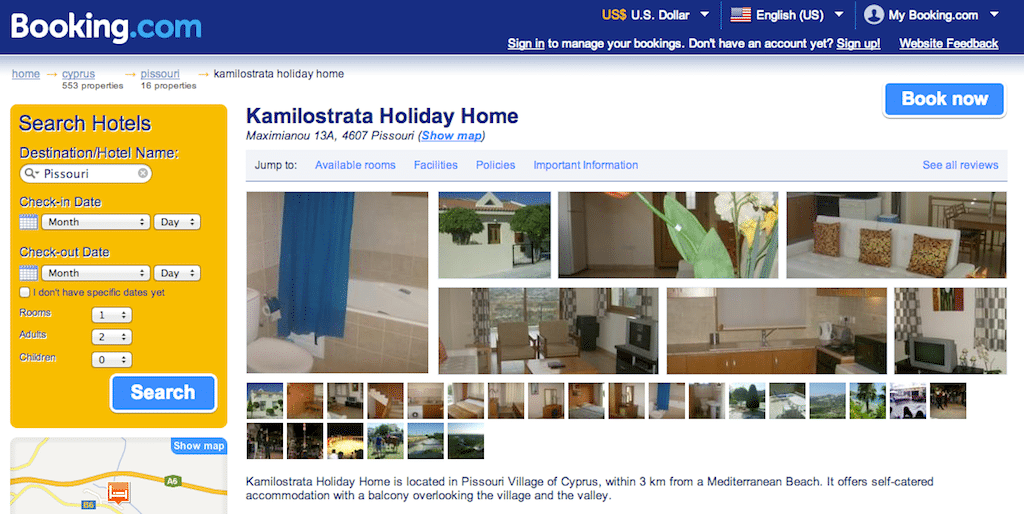

There’s a new vacation-rental seller, Booking.com, in the market as the world’s largest lodging provider has added hundreds, if not several thousand, vacation homes and apartment hotels to its portfolio of nearly 262,000 properties over the last few months.

Vacation-rental kingpin HomeAway has long argued that apartment-share maven Airbnb is not a competitor because it attracts different customers.

But HomeAway and other vacation-home companies should watch out for Priceline’s Booking.com creeping up on them in the wings.

Booking.com, without fanfare and almost clandestinely, has been slipping vacation rentals, including professionally managed properties, into its lodging results.

For example, the following is a screenshot of a Booking.com listing for the Interhome Holiday House Carlo, a 2-bedroom villa, just outside Villasimius, Italy.

Interhome, which professionally manages some 32,000 apartment hotels and vacation homes worldwide, seems to have hundreds of apartment and holiday home listings available on Booking.com these days.

There are plenty of other such properties now on Booking.com, although many of them don’t appear to come from chains, such as Interhome.

Hotels versus vacation rentals

Booking.com has long been adept at turning website lookers into bookers, but one issue hanging over its vacation-rental push is how to integrate vacation rentals without detracting from its core hotel sales.

The issue takes center stage because there are significant differences on Booking.com between the way customers reserve hotels and how they can now rent a vacation home.

Unlike most rentals on Booking.com, with these vacation home and apartment rentals you have to prepay a portion of the rental — perhaps 30% at the time of booking — and some of them require security deposits upon arrival, as well.

In the case of Interhome Holiday House Carlo, the listing says that Interhome charges the customers’ credit cards for a prepayment of a portion of the rent.

Changing cancellation policies

In addition, Booking.com is known for its flexible cancellation policies with the words “free cancellation” plastered throughout its hotel listings.

But, many of the vacation home rentals have more stringent cancellation policies. For example, some would charge the full payment if the reservation were cancelled within 42 days of the stay.

Unlike a hotel booking, with a vacation rental the owner or professional management company emails the Booking.com customer instructions on the policies covering the rental and where to pick up the keys.

On Booking.com’s U.S. language site, listing rates for the vacation rentals are shown in dollars, but need to be paid in local currencies.

Booking.com has long offered apartments, condo hotels, and guesthouses, but they usually were rented like a standard hotel rental on the site. But some of the influx of apartment rental listings tend to skew toward the vacation-rental model with 30% charged at the time of the booking, and the total amount due 42 days before arrival, for example.

This is big

Booking.com’s quiet — and still small — integration of vacation rentals is potentially a major development in the vacation-rental industry because of Booking.com’s power, acumen, and global reach.

While many vacation rental listings sites force customers to deal one-on-one with owners, often over the phone, Booking.com is making the online process smooth and easy.

Parent company Priceline has a lot on its hands with its pending $1.8 billion acquisition of travel-metasearch company Kayak.

With companies such as HomeAway and Airbnb slowly disrupting the traditional hotel industry, you can envision Priceline one day acquiring a HomeAway or one of its smaller competitors to scale up Booking.com’s fledgling vacation-home offering.

HomeAway CEO Brian Sharples is a member of Kayak’s board of directors, and advised Kayak on the IPO process. Perhaps that portends some further cozying up between HomeAway and Priceline.

And Booking.com’s getting into the vacation-rental business gives it another advantage over Expedia in the global hotel competition.

Booking.com didn’t immediately respond to a request for comment on the development.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: booking.com, homeaway, vacation rentals

Photo credit: Booking.com is blending vacation rentals such as the Kamilostrata Holiday Home in Cyprus into its hotel listings. Booking.com