Skift Take

Finally, an outcome for Northstar, which had been trying to sell in various phases over the last decade. And PhocusWright changes hand twice in a year. Read through Tom Kemp's remarks, he's just happy the deal happened, which means overall price is low.

Source: Skift

Author: Rafat Ali

After 11 years in holding, Boston Ventures, the parent private equity firm, has finally offloaded Northstar Travel Media, to Wicks Group, the PE firm that focused on B2B media/info sectors. No price was disclosed, but Northstar CEO Tom Kemp told Folio the EBITDA multiple as “mid-to-high single digits,” which is financialese for signaling that it may have been just enough that they made the decision to sell, considering the kind of business Northstar is and the lack of appetite for non-digital-heavy B2B media transactions.

Northstar has about $60 million topline revenues, some of which had been added to through the acquisition of PhoCusWright last year.

Wicks will retain the management team, including Northstar CEO Tom Kemp. Lots more info in the official press release.

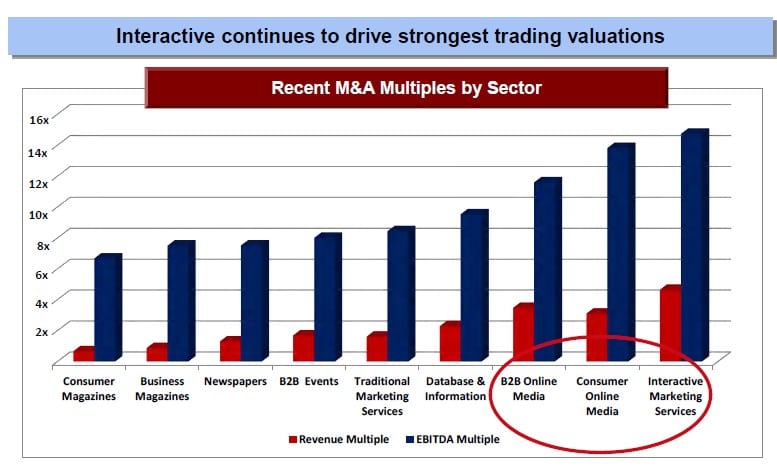

Updated: Clive Jacobs, travel industry vet and currently chairman of Travel Weekly Group Limited in UK (not related to Northstar) tweeted today that the sale price was in “ebitda multiple in excess of 6x.” Which is right about where 2012 legacy B2B media and info companies are selling at, at 4X to 8X multiple of EBITDA. The bank that sold Northstar, JEGI, in a presentation in September last year (PDF link) confirmed these B2B media multiples in a chart, pasted below.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: phocuswright